Vietnam’s economy sustained its robust growth momentum in July, according to Dragon Capital’s July 2025 market report, building on the positive performance in the first half of the year. The government has raised its 2025 GDP growth target to 8.3-8.5%, reflecting confidence in the economic outlook for the second half.

Manufacturing activity improved, with the Purchasing Managers’ Index (PMI) rising to 52.4 – the highest in almost a year – driven by increases in new orders and output, despite persistently low export orders. Credit disbursement as of the end of July grew by 10.2% year-to-date, the highest in over a decade. The State Bank of Vietnam (SBV) maintained its loose monetary policy, injecting record liquidity through open market operations to keep interest rates low as credit demand increased. Inflation was well-controlled despite a strong surge, with the Consumer Price Index (CPI) rising 3.1% year-on-year in July; meanwhile, public investment disbursement in the first seven months increased by 25.5%.

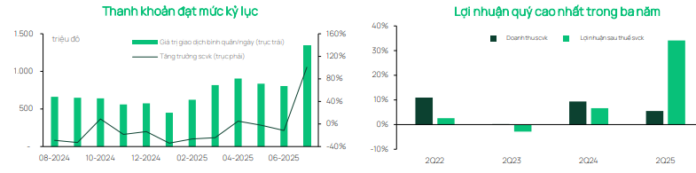

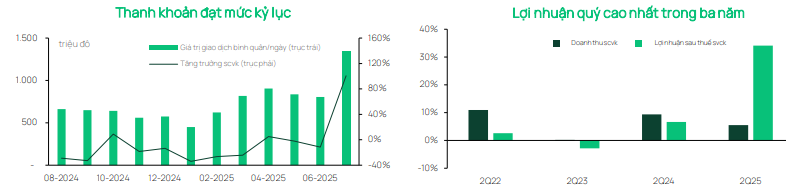

Foreign direct investment (FDI) disbursement reached US$13.6 billion in the seven-month period, up 8.3% year-on-year, indicating strong and sustained investor confidence. The stock market surged in July, with the VN-Index climbing 8.9% month-on-month in USD terms to close at 1,502 points – the highest in three years. Liquidity was robust, with average trading value exceeding US$2.1 billion per day and peaking at US$3 billion per day in early August. Mid-cap stocks outperformed, supported by active participation from individual investors, alongside record margin lending balances at securities companies.

As of early August, about 97% of listed companies on the VN-Index had released their Q2 2025 financial results, with the market’s after-tax profit surging 34.1% year-on-year, marking the strongest quarterly growth since Q1 2022.

Among the 80 stocks tracked by Dragon Capital, 39% of companies outperformed and 40% met profit forecasts, the highest beat-to-miss ratio in three years. By sector, Finance posted a 16.9% profit increase, led by banks benefiting from credit growth and improved asset quality, along with securities firms profiting from robust margin lending and proprietary trading activities.

Notably, the Real Estate sector saw a 69% profit surge, supported by improved earnings and asset revaluation for residential developers, as well as positive results from large industrial real estate enterprises. The Manufacturing and Services sectors both recorded net profit growth of over 45% year-on-year. While profit growth was broad-based, 36% of Q2 profit came from non-recurring income, whereas revenue growth remained modest at 6.1%.

Given the favorable H1 results, Dragon Capital upwardly revised its 2025 net profit growth forecast for the Top 80 companies from 13.8% to 20.1%. Of the adjustment, 52% stemmed from core profit, and the remainder from one-off items, including bad debt recoveries by banks and real estate transfer deals.

Legal reforms continued to be implemented. The SBV issued Circular 14/2025, stipulating a roadmap for gradually removing credit growth limits and adjusting capital adequacy requirements in line with Basel III standards. In parallel, the draft amendment to the Land Law proposed adjustments to certain provisions issued in 2024 to improve operating conditions for real estate developers. These proposals include applying state-regulated land prices instead of market prices, potentially reducing land use costs, along with greater flexibility in project approval, land revocation, and land use fee payment.

Overall, the outlook remains positive. Despite external challenges such as US tariffs, Vietnam’s economy remains resilient, underpinned by stable credit growth, controlled inflation, robust public investment, and positive FDI inflows. Investor sentiment can stay optimistic if macro conditions and corporate earnings continue their current trajectory. However, given the market has witnessed one of the strongest rallies in three years, sensitivity to global negative factors related to trade wars and economic prospects may increase.

– 10:20 14/08/2025

The Art of Monetary Policy: Navigating Interest Rates and Exchange Rates with Agile Governance.

The government has requested that the State Bank of Vietnam proactively undertake research, evaluation, and forecasting within the scope of its functions, tasks, and authority. This includes developing monetary policy scenarios and orientations from now until the end of 2025 and for 2026. A report is to be submitted to the Government’s Standing Committee for consideration and feedback no later than August 20, 2025.

The Billion-Dollar Fund’s Big Win with Banks and Brokerages: Unveiling the Reason Behind the $2 Billion VIX Stock Holding

As of the beginning of this year, this billion-dollar foreign fund has doubled down on its equity stock holdings, bringing the total allocation to a substantial 14%. This strategic move was executed by adding VIX and SHS to its portfolio, showcasing a confident and bold approach to investing.

The Power of Persuasion: Crafting Compelling Headlines

“Unleashing the Potential: PYN Elite’s Stellar Performance with Two Stock Codes”

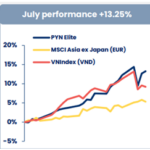

In July 2025, PYN Elite Fund, a foreign-owned investment fund, boasted an impressive 13.25% return, the highest it has seen in 55 months since January 2021. This remarkable performance surpasses the VN-Index’s 9.2% gain, which peaked at a historic high of 1,557 points on July 28.