The US Dollar Index (DXY), a measure of the greenback’s strength against a basket of major currencies, rose by 0.38 points to 100.42 at the close on May 9, marking its third consecutive weekly gain and reaching a four-week high.

Earlier, the Fed decided to keep the reference interest rate unchanged at 4.25-4.50% at the conclusion of its two-day policy meeting on May 7, in line with market expectations. However, the Fed also warned about the risks of rising inflation and unemployment, indicating that it remains cautious and is not yet ready to loosen monetary policy.

On May 8, the US and the UK reached a bilateral trade agreement, wherein the US maintained a 10% basic tariff on UK goods and granted a quota of 100,000 cars per year to be exported to the US with a preferential tariff of 10%, instead of the previous general rate of 25%. In return, the UK reduced import tariffs from 5.1% to 1.8% and provided greater market access for US goods. This agreement eased concerns in the financial markets about global trade tensions, causing capital to flow out of safe-haven assets and into the USD.

As a result, the US dollar strengthened against major currencies such as the Japanese yen and Swiss franc, while the pound weakened after the Bank of England cut interest rates.

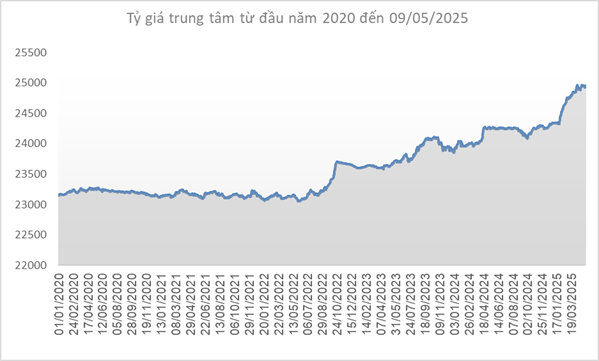

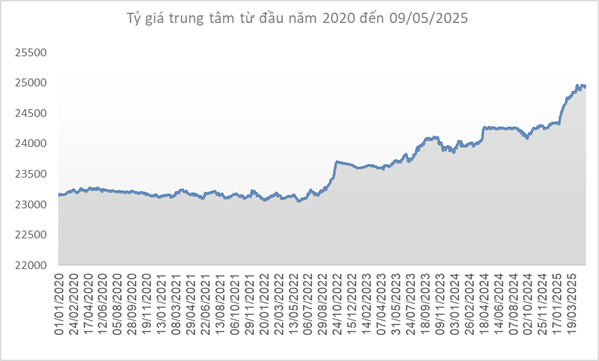

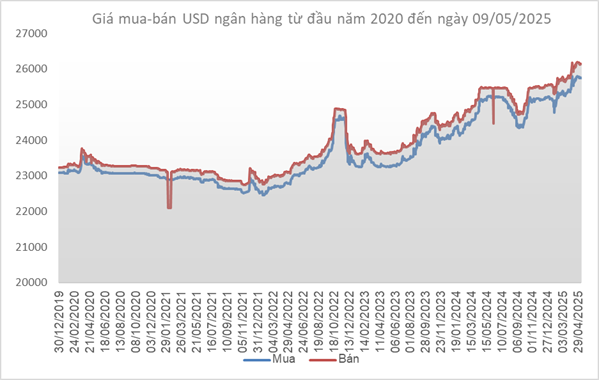

Source: SBV

|

Domestically, the central exchange rate announced by the State Bank of Vietnam on May 9 decreased slightly by 5 VND compared to the previous week, standing at 24,951 VND/USD.

With a trading band of 5%, the USD/VND exchange rates at commercial banks are allowed to fluctuate within the range of 23,703-26,199 VND/USD.

The USD/VND reference exchange rates at the State Bank of Vietnam – Exchange Management Department are 23,754-26,148 VND/USD (buying-selling), both decreasing by 5 VND compared to the previous week.

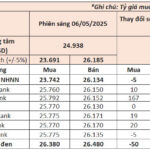

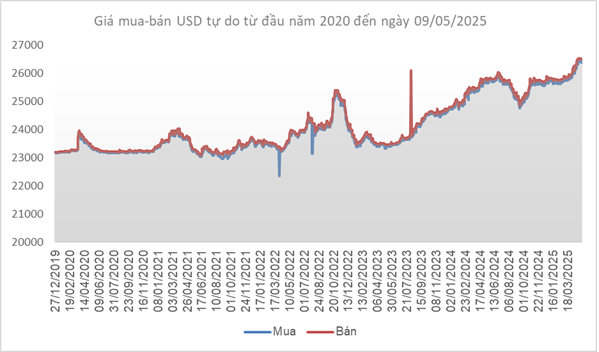

Source: VCB

|

At Vietcombank, the buying and selling rates of USD/VND on May 9 were quoted at 25,750 and 26,140 VND/USD, respectively, both decreasing by 40 VND compared to the previous week.

Source: VietstockFinance

|

In the free market, the USD/VND exchange rates decreased by 35 VND, trading at 26,375-26,475 VND/USD (buying-selling).

– 18:00 11/05/2025

The US Retaliates with a 46% Tariff: What Does This Mean for Vietnam’s Inflation, Exchange Rates, Interest Rates, and Banking Sector?

I predict that inflation will remain within the government’s target and that it will be manageable. This provides a solid foundation and opportunity for the State Bank to harmonize its control tools.