Hanoi Stock Exchange (HNX)-listed real estate company Dragon Village has released an update on its bond principal and interest payments.

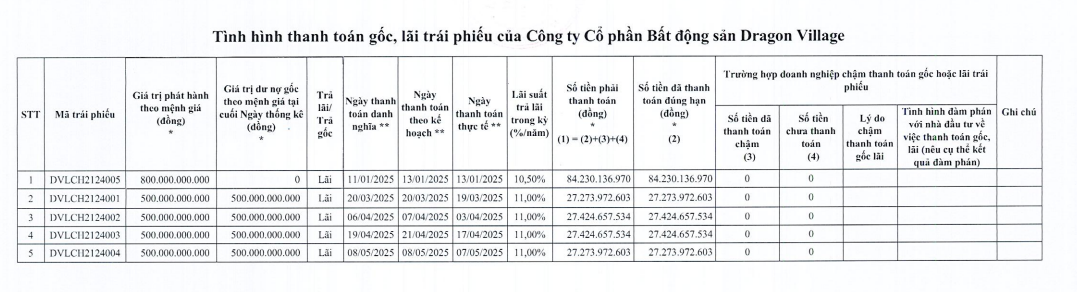

During the first half of 2025, Dragon Village made interest payments totaling over VND 190 billion for five bond series, with codes ranging from DVLCH2124001 to DVLCH2124005.

Source: HNX

It is known that these five bond series were all issued by Dragon Village in 2021, with an initial term of 36 months. The stated purpose of issuing the first four series, from DVLCH2124001 to DVLCH2124004, was to supplement investment capital for the Rose Valley Urban Area project (75.4 hectares) in Me Linh, Hanoi.

According to Decision No. 1310/2023/QD-HQT dated October 13, 2023, Dragon Village approved a change in the term of the DVLCH2124005 bond series from 36 months to 60 months.

On the same day, October 13, 2023, Dragon Village also issued Decision No. 1310-1/2023/QD-HQT, approving the extension of the term for the other four bond series from 36 months to 60 months. Following this change, these bond series are expected to mature in September, October, and November 2026.

On May 30, 2025, Dragon Village repurchased 8,000 bonds with the code DVLCH2124005 at a price of over VND 104 million per bond, totaling more than VND 832 billion. The repurchase was completed on June 4, 2025.

As of June 30, 2025, the face value of the first four bond series, from DVLCH2124001 to DVLCH2124004, was VND 500 billion per series.

Dragon Village, established in May 2014, was initially named Phu An Khang Real Estate Joint Stock Company. According to a registration change in February 2015, Phu An Khang had a capital of VND 6 billion, with three shareholders: Pham Thi Van Ha (40%), Nguyen Thi Hau (30%), and Pham Thuy Hong (30%).

In April 2016, the company’s capital increased significantly to VND 440 billion. At this time, the ratio of the three founding shareholders decreased, with Mrs. Pham Thi Van Ha holding 15.727%, Mrs. Nguyen Thi Hau holding 17.045%, and Mrs. Pham Thuy Hong holding 0.409%. The remaining 66.8% belonged to undisclosed shareholders.

In August 2016, Mr. Nguyen Ngoc Thang became the General Director and legal representative of the company. However, in May 2017, Mr. Nguyen Dang Duy Hai (DOB: 1973) assumed this position.

Soon after, the company changed its name from Phu An Khang Real Estate to Dragon Village Joint Stock Company.

In July 2022, Mr. Nguyen Khanh Trung (DOB: 1971) replaced Mr. Hai as the General Director and legal representative of Dragon Village.

As of the end of 2023, the company’s charter capital was VND 1,200 billion.

In terms of business results, for the first six months of 2024, Dragon Village reported net profit of over VND 68.8 billion, nearly 3.9 times higher than the same period last year. As a result, the return on equity (ROE) also increased from 0.44% to 7.13%.

The debt to equity ratio was 6.73, indicating a debt of VND 6,720 billion as of the end of the second quarter of 2024. Of this, bond debt amounted to VND 2,800 billion, comprising the five bond series from DVLCH2124001 to DVLCH2124005.

Overview of the Rose Valley Urban Area project. Source: Dia Oc Phu Long

Dragon Village is known to be a major shareholder of Vinh Son Joint Stock Company, the investor of the Rose Valley Urban Area project (also known as Thung Lung Hoa Hong) in Me Linh and Dong Anh districts, Hanoi. This project covers an area of 75.71 hectares and has a total expected investment of VND 11,873 billion, as per the 2019 estimate. The project is planned to be implemented in five phases from 2019 to 2029.

According to PV’s documents, in March 2020, Dragon Village pledged 6.9 million shares of Vinh Son Joint Stock Company and all benefits, dividends, and/or other forms of income arising from these shares at HDBank.

The Legend Danang: A Legend Unfurls by the Dragon Bridge

The Legend Danang emerges as a rare “iconic landmark” project, situated right next to the Dragon Bridge symbol. It embodies a unique dual value proposition: a cultural and tourism landmark that also offers robust potential for value appreciation, with Danang poised to become the financial and economic hub of the region in the future.

Over 1,200 Business “Warriors” Unite at the T&T City Millennia Kick-off Event

On August 14th, the T&T City Millennia project’s kick-off event in Ho Chi Minh City attracted over 1,200 real estate agents and strategic partners, showcasing the allure of this premium riverside urban development in southern Saigon. This event marks the beginning of T&T Group’s journey into the southern real estate market, building upon their successful large-scale projects across Vietnam.

“High Interest Rates on Short-Term Deposits: Implications for Vietnam’s Economy”

The private sector in Vietnam is currently dominated by banking and real estate enterprises. This, according to Dr. Le Xuan Nghia, former Vice Chairman of the National Financial Supervisory Commission, is an inevitable phase of accumulation that many nations have gone through on their path to industrialization and the development of science and technology.