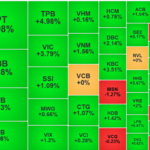

The market witnessed a positive trend during the week of May 5-9, with indices and liquidity on both listed exchanges increasing compared to the previous week.

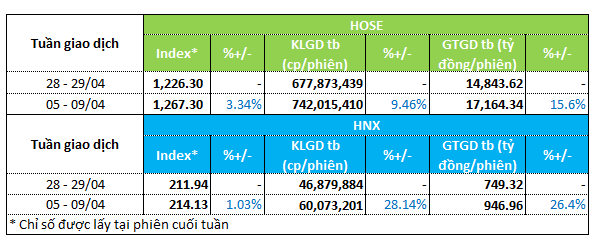

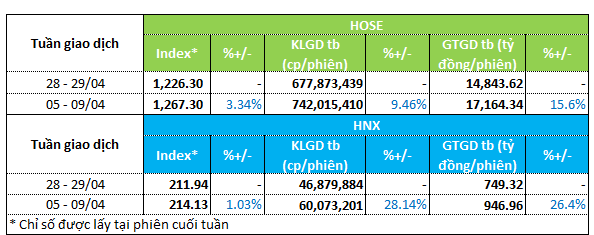

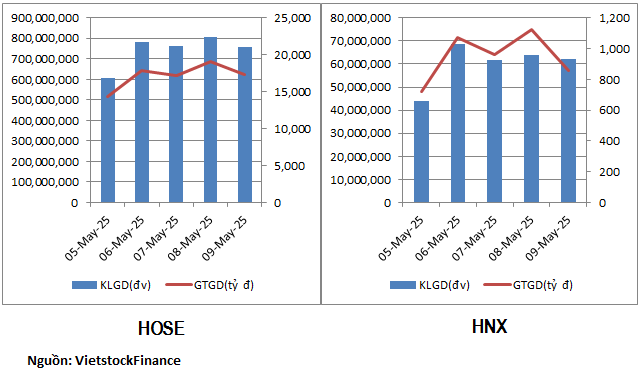

On the HOSE exchange, the VN-Index rose over 3.3% to 1,267.3. Trading volume and value increased by nearly 10% and 15%, respectively, reaching 742 million units and VND 17.1 trillion per session.

Meanwhile, the HNX-Index climbed 1% to 214.13. Liquidity on this exchange improved by over 25% from the previous week, with a volume of 60 million units and a value of VND 947 billion per session.

|

Market Liquidity Overview for May 5-9

|

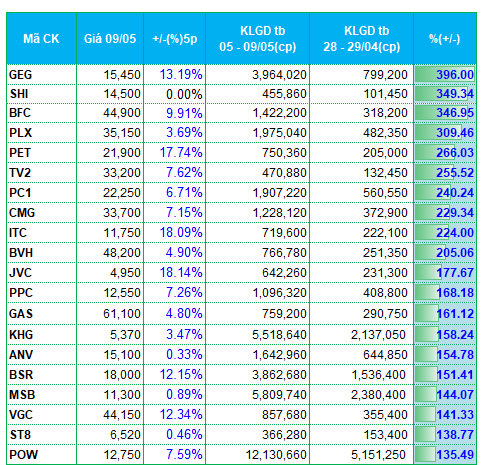

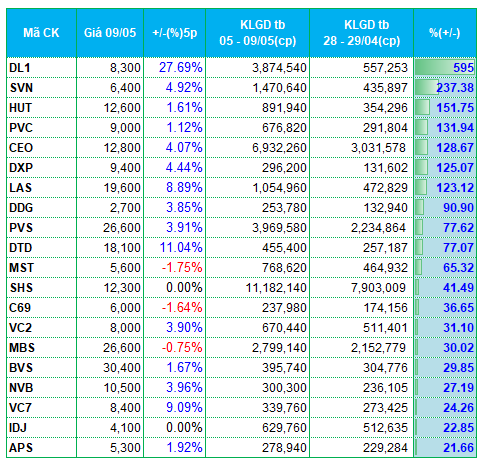

The top liquidity leaders on the HOSE exchange recorded an increase of over 100%. Specifically, GEG, SHI, BFC, and PLX witnessed a surge of more than 300% in trading volume compared to the previous week. On the HNX exchange, the significant improvement was attributed to the strong performance of individual stocks such as DL1 (trading volume increased by nearly 600%) and SVN (trading volume rose by 240%)…

In terms of sectors, the oil and gas industry witnessed a week of positive money inflows. GAS, BSR, PVC, and PVS were among the top gainers in liquidity, with an increase of 80-160% compared to the previous week.

Additionally, the construction sector experienced a slight influx of funds. TV2, PC1, MST, C69, and VC2 were among the top liquidity gainers on both exchanges.

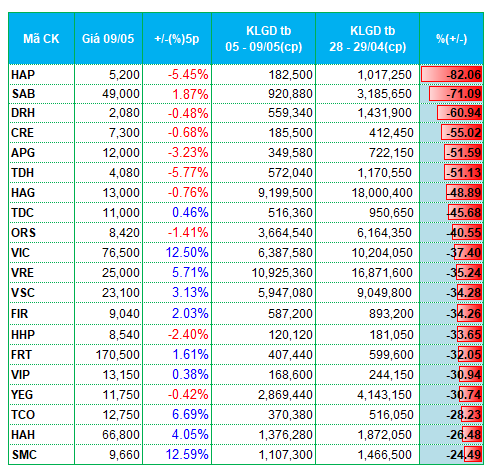

On the other hand, the market witnessed a decrease in liquidity in the marine transportation and real estate sectors. In the marine transportation sector, VSC, VIP, TCO, and HAH witnessed a decline in trading volume of 26-35%.

Multiple representatives from the real estate sector also experienced reduced liquidity, including DRH, CRE, TDH, TDC, VIC, VRE, FIR, NRC, AAV, and VC3.

Beyond the sectors with significant liquidity fluctuations, the market observed a divergence in fund allocation within the securities sector during the past week. SHS, MBS, BVS, and APS attracted strong money inflows, while APG, ORS, VIG, and VFS were among the top losers in liquidity.

|

Top 20 Stocks with the Highest Liquidity Increase/Decrease on the HOSE Exchange

|

|

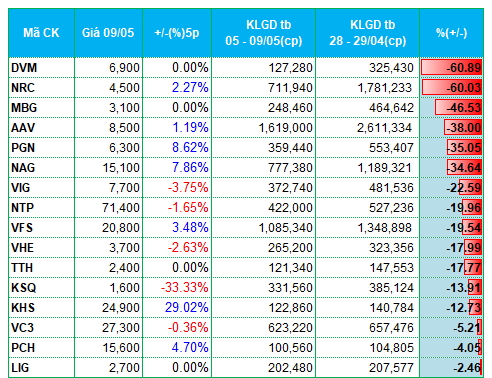

Top 20 Stocks with the Highest Liquidity Increase/Decrease on the HNX Exchange

|

The list of stocks with the highest and lowest liquidity changes is based on a minimum average trading volume of 100,000 units per session.

– 7:28 PM, May 12, 2025

“Capital Flows into Blue-Chip Stocks, VN30-Index Heals from Withholding Tax Wounds”

The significant de-escalation in tariff tensions between the economic superpowers has spurred a robust stock market rally at the start of the week. This development prompted a substantial influx of funds into the blue-chip stock category, with the VN30 basket’s liquidity surging to an 11-session high. Consequently, the representative index for this group has rebounded to pre-April 2nd levels, when the countervailing duty shock occurred.

Stock Market Outlook for the Week of May 12: What’s Next for Investors After KRX?

The stock market, after witnessing robust gains driven by the KRX system’s positive impact, might encounter profit-taking pressures as it ventures towards the psychological benchmark of 1,300 points.

Market Pulse, May 12: US-China Tariff Cuts Spur VN-Index Rally

The market closed with positive gains; the VN-Index rose by 15.96 points (+1.26%), reaching 1,283.26, while the HNX-Index climbed 1.91 points (+0.89%) to 216.04. The market breadth favored the bulls with 502 gainers versus 260 decliners. A sea of green was seen in the VN30 basket, as 27 stocks advanced, 2 declined, and 1 remained unchanged.

“Pyn Elite Fund Boosts MWG Holdings, Elevates VIX Shares to Top 10 Portfolio Holdings.”

Pyn Elite Fund views the recent market correction as an opportune time to accumulate fundamentally strong stocks at attractive valuations.