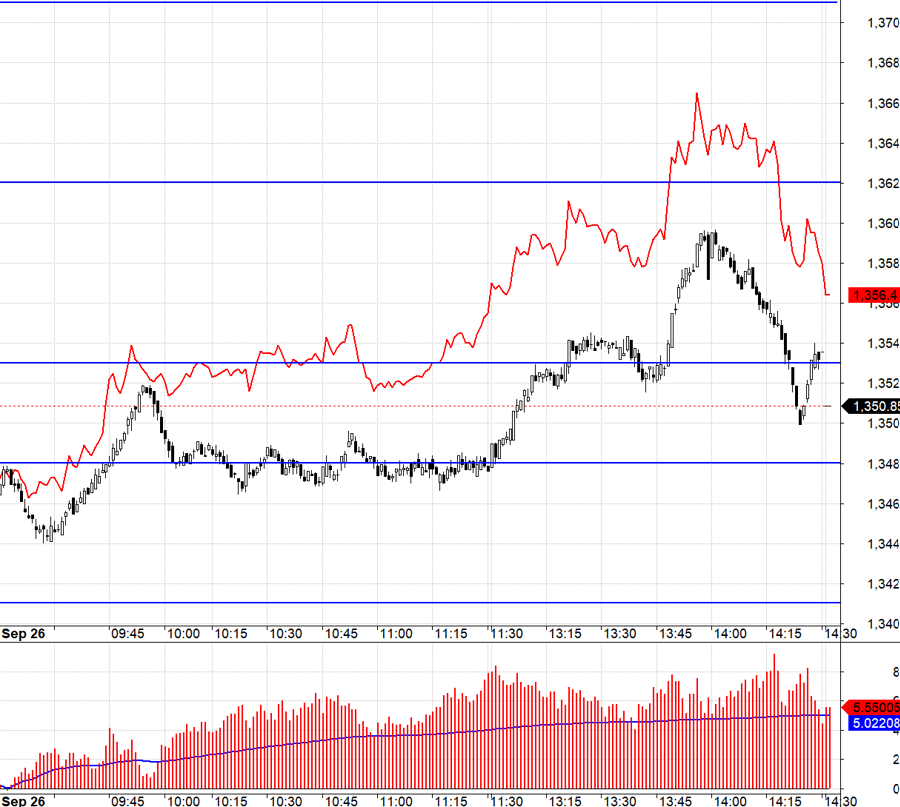

The impressive price surge of an asset closely linked to the trade cycle — which is forecast to weaken this year — is attracting market attention.

HAIAN ALFA vessel, part of Hai An’s fleet.

|

HAH’s stock price surge may be partly due to the company’s remarkable performance in Q1 2025. Hai An reported nearly VND 1,170 billion in revenue and VND 233 billion in net profit for the quarter, up 66% and 295%, respectively, from the previous year.

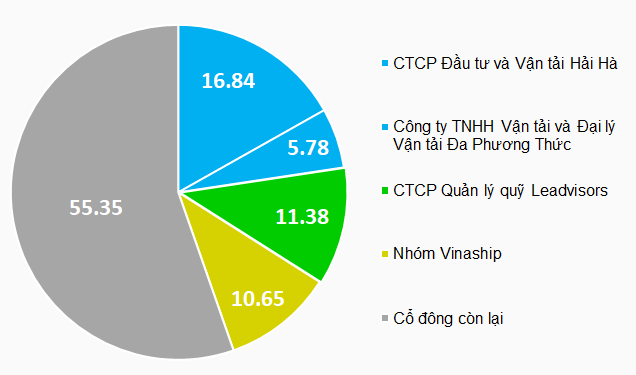

However, beyond the fundamentals, observers are particularly interested in the evolving ownership structure at Hai An, which hints at a silent race ahead of the 2025 Annual General Meeting.

A group of shareholders related to Vietnam Container Shipping Joint Stock Company (Viconship, HOSE: VSC) is actively increasing its influence. Recent transaction reports show that the group has increased its ownership in Hai An to 10.65%. This move is notable as Viconship has just completed the acquisition of 40% of Vinaship, a maritime transport company established in 1984 but with a much smaller fleet than Hai An.

Simultaneously, Multimodal Transport and Transport Agency Co., Ltd., an organization related to Hai An’s Chairman, Mr. Vu Thanh Hai, also increased its ownership from 4.91% to 5.78%. Previously, another notable organization, Leadvisors Fund Management Joint Stock Company, accumulated up to 11.38% of Hai An’s shares in the second half of 2024.

|

Hai An Shareholder Structure

Unit: %

Data updated based on large shareholders’ transaction reports. Source: VietstockFinance

|

With a fleet of 17 vessels with a total capacity of 28,200 TEU, Hai An currently accounts for approximately 68% of the total carrying capacity of Vietnam’s entire container fleet, according to information from a post on the company’s website. Earlier this month, the company and one of its subsidiaries signed a contract to build two 3,000 TEU container vessels in China.

Meanwhile, Viconship is the leading port operator in Hai Phong, with ports in its system such as Xanh Vip, Nam Hai Dinh Vu, VIMC Dinh Vu, and Cang Xanh.

At the Viconship shareholder meeting on April 26, the company’s management publicly emphasized the role of Hai An and Vinaship as “important links” in its supply chain completion strategy.

Along with HAH, Viconship’s stock, VSC, has also surged recently. The ownership race at Hai An — among organizations with strong potential and long-term vision — is making this stock one of the notable focuses in the stock market.

The stock price movement partly reflects investors’ expectations and is also influenced by transactions carried out by parties related to the deal.

– 14:52 13/05/2025

“Hyatt Place Hotel Project: VSC Divests Its Stake”

In its 2023 annual report, Viconship announced an impressive long-term business and investment collaboration contract worth 813.6 billion VND. This partnership with T&D Group marks the development of the Hyatt Place Hai Phong hotel project, which is already underway and expected to be operational by 2024.

Viconship Withdraws from Hyatt Place Hai Phong Hotel Project

Viconship is strategically withdrawing from the Hyatt Place Hai Phong hotel project to refocus its resources on its core business competencies. By redirecting its efforts, the company aims to alleviate financial burdens and streamline its cost structure, including interest expenses. This calculated move underscores Viconship’s commitment to fortifying its fundamental operations and optimizing its financial standing.