“Skyrocketing Apartment Prices: A Growing Concern for Home Seekers”

The soaring cost of apartments

After a long day at work, Mr. and Mrs. Nguyen Thoa squeeze into their cramped rented room of less than 20m2, in Thanh Xuan Ward, Hanoi. They dream of owning a condo and diligently save every day towards this goal.

“Housing prices are skyrocketing. I’ve been looking at various condo projects under construction, and they all cost around 100 million VND per square meter. I don’t know when our dream of owning a home will come true,” worries Mrs. Thoa.

Data from the Vietnam Real Estate Brokers Association (VARS) reveals that in the first half of 2025, over 10,000 apartments were released into the Hanoi market. While this is a significant increase, there’s a growing mismatch between supply and demand.

From the third quarter of 2024 until now, no new condo projects with selling prices below 60 million VND per square meter have been recorded in Hanoi. In the first half of this year, 60% of the new condo supply was priced above 80 million VND per square meter.

This mismatch is expected to persist, as an increasing number of projects hitting the market are priced at around 100 million VND per square meter.

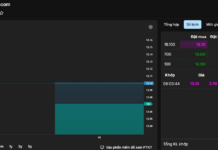

Sky-high prices for Hanoi condo projects. Source: Hoang Ha |

A survey shows that both the asking and rumored prices of new projects in Hanoi are extremely high.

For instance, condos in the Hausman Premium Residences project within the FLC Premier Parc urban area in Dai Mo Ward are priced at an average of 120 million VND per square meter (before discounts). Similarly, a project at the intersection of Le Quang Dao and Me Tri streets in Tu Liem Ward offers units at an average price of 130 million VND per square meter (excluding VAT and maintenance fees). This price is double what the developer offered in the first phase four years ago.

In Long Bien, the Long Bien Central project is expected to be priced above 120 million VND per square meter.

Several other projects under construction are also testing the market with astronomical prices. For example, the Greenera Southmark project in Thanh Tri Ward (former Thanh Tri District) has a rumored price of nearly 80 million VND per square meter.

Meanwhile, the Galia Hanoi project in Yen So Ward (former Hoang Mai District) is testing the market with an average price of 82 million VND per square meter.

Notably, a project in the Cau Giay Ward area is expected to be priced at no less than 150 million VND per square meter.

Why are prices so high?

Mr. Pham Duc Toan, CEO of EZ Property, shared that since the beginning of 2025, the supply of apartments in the Hanoi market has been on the rise.

However, the prices of these new projects are very high. Even projects that have been ‘on hold’ for many years, such as the Hanoi Signature project on Nguyen Van Huyen Street in Cau Giay Ward, are now being sold at prices exceeding 200 million VND per square meter.

Mr. Toan attributed the soaring apartment prices in Hanoi to several factors. Some developers are ‘anchoring’ their prices to the previous price surge, pushing up the cost of their products. Additionally, there are projects where developers have incurred significant financial costs due to prolonged implementation periods, and some developers have strategically positioned their products at a higher price point.

However, Mr. Toan cautioned that market liquidity is currently declining, and these high asking prices are beyond the reach of most homebuyers.

“The current supply is concentrated among a group of developers. They position their products at a higher price point, almost creating a ‘monopoly’ to manipulate the market. Apartment prices seem to be controlled by a group that is ‘manipulating’ the market to maximize their profits,” said Mr. Toan.

According to the EZ Property CEO, the market is expected to see an increase in supply soon, with nearly 300 projects to be developed following the National Assembly’s Resolution 171/2024. This resolution allows for the pilot implementation of commercial housing projects through agreements to receive land use rights or to use land that already has such rights, instead of being limited to construction on residential land as before.

Various social housing projects, including those for the armed forces and the public security force, are also expected to be implemented soon. Additionally, the renovation of old apartment buildings and collective housing in the inner city will provide a diverse range of options in terms of products and prices for homebuyers.

Nguyen Le

The FDI Equity Inflows in the First Seven Months of the Year Surged by 27.3%

According to the latest statistics from the Ministry of Finance, foreign direct investment (FDI) into Vietnam reached a remarkable high of over $24 billion as of July, marking a significant 27.3% increase compared to the same period last year.

The Infrastructure Turning Point that Changed Vũ Yên’s Real Estate “Ceiling”

The Royal Bridge is a groundbreaking infrastructure project that transforms the landscape of Haiphong. This iconic bridge connects Vu Yen Island to the historic heart of the city, reshaping the city’s central area and reducing travel time. It also acts as a catalyst for real estate growth, setting a new benchmark for property values across the region.

Why Buying a House is Still Unaffordable on a $2000/month Income

Despite earning a monthly income of 50 to 100 million VND, many young families in Hanoi still struggle to purchase property in the city due to soaring prices that far outpace their financial capabilities. This has sparked a trend of “wedding reluctance and childbirth procrastination,” casting a shadow of consequences on the real estate market.

Affordable Housing Gets an Upgrade: Are Skyrocketing Prices Justified?

In recent years, the Hanoi condominium market has witnessed an intriguing paradox. Projects that were once considered affordable have now reached, and in some cases, surpassed the price threshold of luxury developments. However, the quality and amenities remain largely unchanged. This anomaly presents a unique challenge for homebuyers, as they navigate a market where price tags no longer align with traditional expectations of value.