The recently issued Resolution 68-NQ/TW marks a significant shift in policy thinking, featuring a range of notable measures. Among these, a key strategy is the promotion and diversification of private capital sources by reviewing tax policies to facilitate investment funds’ capital injection into enterprises. Notably, voluntary retirement funds (also known as voluntary supplementary retirement funds or supplementary pension insurance funds) are emphasized as a notable capital mobilization channel.

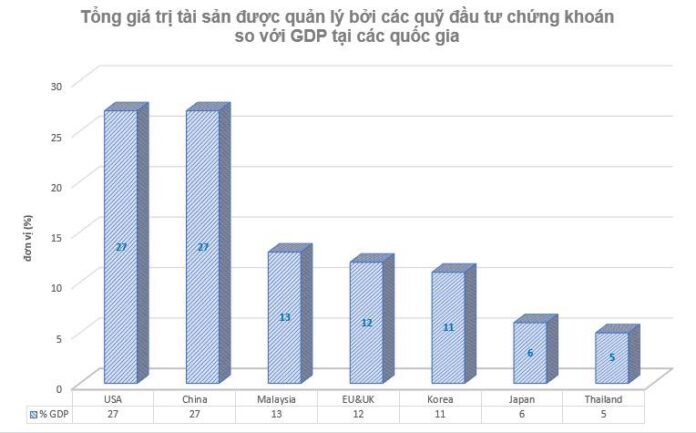

At a workshop on the development of the fund industry held by the Ministry of Finance in late March, a financial expert highlighted the important role of voluntary retirement funds as a key investor in the financial markets of many countries. However, Vietnam presents a significant contrast, with a population of over 100 million but a 0% contribution of voluntary retirement funds to GDP.

VIETNAM’S NEED FOR VOLUNTARY RETIREMENT FUNDS

Developing voluntary retirement funds is imperative for Vietnam. This is not only crucial for the development of the financial market and the private economic sector due to the ability to mobilize abundant social resources, but it is also an optimal solution for the social security of workers.

Many countries, including China, Thailand, India, and the United States, have successfully implemented tax policies to encourage their citizens to contribute to voluntary retirement funds.

For instance, China recently introduced an increased personal tax benefit of 12,000 CNY per year (equivalent to 42 million VND per year) for employees participating in voluntary retirement funds under their personal names without going through enterprises. Meanwhile, China’s Enterprise Annuity program stipulates contribution rates of 8% and 12% for enterprises and employees, respectively.

Thailand has also been applying tax incentives for voluntary retirement products (Retirement Mutual Funds, Provident Fund, etc.) for a long time, with a deduction of up to 500,000 Baht per year (equivalent to 390 million VND per year). This is impressive for a country with a population equivalent to two-thirds of Vietnam’s.

India also boasts progressive tax policies that encourage employees to directly invest in financial products for retirement savings. Specifically, the country offers tax benefits of up to 1.5 lakh per year (directly deductible from personal income), equivalent to 1,750 USD per year. Notably, this amount is almost 70% of India’s per capita GDP in 2024 (estimated at 2,500 USD).

In Vietnam, to strongly encourage employees to participate in voluntary retirement products and ensure their social security in old age, the current tax incentives need to be reconsidered. Although there is a regulation on tax incentives for supplementary (voluntary) retirement products at 12 million VND per year, issued about ten years ago through a circular on personal income tax, this amount has remained unchanged for a decade and has not provided a strong enough incentive for employees.

The unchanged tax incentive level has limited the encouragement for employees to proactively plan their personal retirement finances. On the business side, the tax incentive for contributing to voluntary retirement funds for employees is 3 million VND per month per person. While this amount is considered appropriate in the current context, it applies uniformly to all labor components in society and does not create a particular advantage for businesses with a need to develop and retain talent in highly specialized fields such as education, healthcare, or digital transformation.

PROMOTING VOLUNTARY RETIREMENT FUNDS THROUGH TAX INCENTIVES

With a workforce of over 50 million, Vietnam has significant potential to vigorously develop voluntary retirement funds through attractive tax incentives. This will encourage people to actively participate in diverse financial products, enabling them to enjoy a higher pension in addition to social insurance benefits. Vietnam can draw on the experiences of neighboring countries by enhancing tax incentives to motivate employees to proactively plan and accumulate funds for their retirement through financial products suited to their individual needs.

The current fixed tax incentive of 1 million VND per month per person no longer meets the long-term accumulation needs of employees as it fails to keep up with inflation and lacks the flexibility to cater to the diverse accumulation capabilities of different labor groups in society.

To address this issue and genuinely encourage individuals to engage in personal retirement financial planning, a shift towards applying tax incentives as a percentage (e.g., 15% – 18%) of monthly salary is recommended, along with establishing a ceiling equivalent to the social insurance contribution ceiling to prevent tax evasion for high-income earners. Upgrading the tax incentive policy in this direction is essential.

Similarly, for businesses, the tax incentive design for contributing to voluntary retirement funds should be flexible and based on a percentage (e.g., 10% to 15%) to enable companies to proactively structure their benefit packages according to the quality of human resources and development strategies. However, to ensure that even low-income earners benefit adequately, a tax incentive floor for businesses should be established (e.g., 3 million VND per month per person). Given the voluntary nature of these contributions, a ceiling on tax incentives for businesses should not be implemented, as it may limit the benefits employees can receive.

Additionally, to vigorously promote the private sector and contribute to national GDP growth, a sandbox mechanism should be established for the voluntary retirement program. This mechanism could include attractive tax incentives, such as 15% of total monthly salary and a ceiling equivalent to the social insurance contribution ceiling.

Under this voluntary retirement program, employees would have the freedom to choose financial products that align with their personal needs for accumulation and retirement investment, maximizing tax benefits. These products may include cash-value life insurance, investment funds (stocks, bonds, money market), and voluntary supplementary retirement funds or supplementary pension insurance funds (such as target funds or Lifestyle Funds).

Implementing the sandbox mechanism would provide a significant boost to the development of the private pension system, substantially contributing to GDP growth, as evidenced by the experiences of numerous countries worldwide. In addition to its positive impact on GDP, promoting private pensions is a crucial solution to ensuring the social security of Vietnamese citizens amid the rapidly aging population.

The Japanese Company Expanding its Horizons: A $132 Million Investment in Hung Yen to Quadruple Production Capacity

“Nitto Vietnam Limited (a wholly-owned Japanese company) received an investment certificate for a $132 million project in Hung Yen province in September 2023. In a recent development, the company has been granted approval to increase its investment capital to $160 million, marking a substantial increment of $28 million.”

“US-Vietnam Trade Agreement: A Mutually Beneficial Partnership”

On May 13, Prime Minister Pham Minh Chinh met with representatives of the American business community investing and operating in Vietnam. The purpose of this meeting was to listen to and address any challenges they may face, as well as to discuss proposals to enhance Vietnam-US investment and business cooperation.