The large-cap stocks witnessed a surprising boost this morning from foreign investors, with their buying power in the VN30 basket accounting for nearly 21% of the total liquidity. Foreign investment drove a 25.5% increase in the blue-chip group’s liquidity, pushing it to a 20-session high, while HoSE trading fell 7.5% from yesterday’s morning session.

The VN-Index closed the morning session up 0.8%, or 10.4 points, to 1,303.83. The VN30-Index performed even better, rising 0.85% to return to its mid-March 2025 peak, the highest since May 2022. This exceptional performance of the VN30 basket has helped it fully recover from the tax counterparty “hangover,” while the VN-Index still lags its April 2nd close by about 14 points.

VPL, which soared today, started contributing positively to the VN-Index, adding around 2.5 points. VCB’s 2.99% gain contributed 3.3 points. VIC rebounded today, rising 1.63% after a pause yesterday. Additionally, BID increased by 1.96%, TCB by 1.7%, FPT by 3.6%, and HPG by 2.13%. These stocks are all among the top 10 largest market caps on the VN-Index. Only three stocks in this group declined: VHM by 1.13%, CTG by 0.13%, and MBB by 0.2%.

While the mid- and small-cap stocks showed signs of weakening, the blue-chip basket unexpectedly strengthened, supported by these pillars. The breadth of the VN30 basket was relatively balanced, with 16 gainers and 12 losers. However, the largest caps demonstrated their resilience, and even VIC’s strength was overshadowed, ranking fourth among the top contributors.

A notable aspect of the VN30 basket was the significant increase in liquidity to nearly 7,783 billion VND, the highest in 20 sessions. Out of 27 stocks on the HoSE with liquidity exceeding 100 billion VND, 19 were from the VN30 basket, and only seven of them declined in price. FPT led the market with 810.3 billion VND, followed by VPB with 745.5 billion, HPG with 581.1 billion, MBB with 392.2 billion, and TCB with 374 billion. The absolute increase in liquidity for this group compared to yesterday’s morning session was 1,582 billion VND, while HoSE’s liquidity decreased by 861 billion VND, indicating a significant drop in trading for mid- and small-cap stocks.

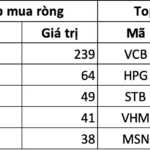

Moreover, foreign investors left a strong mark by net buying nearly 911 billion VND in the VN30 group. Their buying value accounted for about 21% of the basket’s total liquidity. The stocks that attracted significant net buying were FPT (+275.2 billion VND), VPB (+146.5 billion), HPG (+146.3 billion), MWG (+132.4 billion), CTG (+72.2 billion), MBB (+65.5 billion), MSN (+55.5 billion), BID (+54.8 billion), and VIC (+50.3 billion).

In contrast to the strength of the VN30 basket, the remaining stocks generally lacked momentum and only managed a mild divergence. The HoSE closed with a breadth of 138 gainers and 148 losers. Among the gainers, eight were from the VN30 basket. While their number was small, these blue chips maintained their leading positions in terms of liquidity. VPL, although not yet part of the VN30 basket, will soon be considered a blue chip as its market cap currently ranks ninth in the market. The mid- and small-cap groups contributed only about 13 stocks with liquidity above 10 billion VND and gains exceeding 1%. Notable performers included ORS, up 2.81% with 86.3 billion VND; CTR, up 3% with 63.5 billion VND; DGW, up 2.66% with 62.1 billion VND; CMG, up 4.23% with 52.4 billion VND; VTP, up 1.22% with 46.6 billion VND; and REE, up 2.77% with 399 billion VND…

The group of declining stocks this morning did not exhibit significant selling pressure, mainly consisting of typical profit-taking trades. Out of the 146 losers, 54 declined by more than 1%, and only 21 of them had liquidity exceeding 10 billion VND. Four blue chips dominated the liquidity in this group: SHB, down 1.15% with 319.6 billion VND; VNM, down 3.76% with 146.4 billion VND; VHM, down 1.13% with 125.7 billion VND; and VRE, down 1.18% with 107.2 billion VND. The total trading value of stocks declining by more than 1% accounted for 13.7% of the HoSE’s matched orders.

The robust buying from foreign investors pushed the net position on the HoSE to a staggering 1,112 billion VND, a record high in recent years. Notably, the block was not excessively buying but rather reducing its selling. The total investment value on the HoSE was approximately 2,175.6 billion VND, still lower than the buying value on April 11th (3,215.8 billion VND), but the net value was much higher. This buying spree over the past few days coincides with the easing of trade tensions between the US and China. Some notable stocks that were sold off this morning included VNM (-69.2 billion VND), VHM (-43 billion VND), SSI (-41.3 billion VND), and VRE (-29.7 billion VND)

Stock Market Outlook for Tomorrow, May 13: Opportunities to Invest in Bank and Real Estate Stocks?

The stock sectors that could be in focus for investors on May 13 include banking, securities, and real estate.

The Rise of Midcap Stocks: A Foreign Investment Frenzy

The liquidity dipped slightly this afternoon, but the market remained resilient and turned positive. The VN-Index closed 0.79% higher, outperforming the morning session and ending at the day’s high. This positive turn can be attributed to the price recovery of several large-cap stocks, indicating a strong and resilient market despite the slight dip in liquidity.

“Vietnam at an Economic Tipping Point: Brokerages Suggest High-Growth Stock Picks”

The An Binh Securities (ABS) team believes that this period could present significant opportunities in the stock market, which often reacts to economic news.