Novaland (Novaland JSC, stock code: NVL, listed on HoSE) has announced insider trading and related party transactions.

According to the announcement, NovaGroup, a major shareholder of Novaland, has registered to sell over 3.9 million NVL shares to balance its investment portfolio and support debt restructuring.

If the transaction is successful, NovaGroup’s ownership in Novaland will decrease from nearly 338.8 million shares to approximately 334.9 million shares, reducing its stake from 17.373% to 17.171% of the charter capital.

Another large shareholder of Novaland, Diamond Properties Joint Stock Company, has also registered to sell more than 3.2 million NVL shares for similar reasons of portfolio adjustment and debt restructuring.

Illustrative image

Prior to the transaction, Diamond Properties held nearly 168.7 million NVL shares, representing an ownership stake of 8.649% in Novaland. The successful sale of the registered shares will reduce their holdings to over 165.4 million shares, equivalent to an 8.483% stake.

Both NovaGroup and Diamond Properties are entities related to Chairman Bui Thanh Nhon.

In a similar vein, the wife and children of Mr. Bui Thanh Nhon, Chairman of the Board of Novaland, have registered to sell a total of nearly 11.6 million shares for personal reasons.

Specifically, Mr. Bui Cao Nhat Quan (son) registered to sell over 2.9 million shares; Mrs. Cao Thi Ngoc Suong (wife) registered to sell 221,133 shares; and Ms. Bui Cao Ngoc Quynh (daughter) intends to sell over 8.4 million NVL shares.

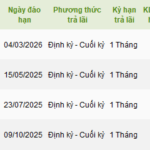

All the above transactions are expected to be conducted through matching and/or negotiation methods from May 16, 2025, to June 13, 2025.

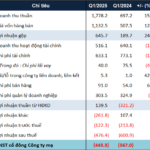

In terms of business performance, Novaland’s consolidated financial statements for Q1 2025 reported consolidated revenue of over VND 1,778 billion, 2.5 times higher than the same period last year. Gross profit for the quarter reached nearly VND 646 billion, a 3.4-fold increase compared to Q1 2024.

Revenue from the transfer of real estate accounted for the majority of the total, amounting to over VND 1,634 billion, a 3.3-fold increase, thanks to project handovers such as NovaWorld Phan Thiet, NovaWorld Ho Tram, Aqua City, Sunrise Riverside, and Palm City.

Financial revenue decreased by 19% to VND 516 billion, while financial expenses also decreased by 18% to VND 633 billion. Other expenses remained high, with selling expenses at VND 91 billion and management expenses at VND 303 billion.

Notably, other income was negative at VND 262 billion, compared to a positive VND 107 billion in the same period last year. As a result, Novaland reported a post-tax loss of VND 476 billion in Q1 2025, lower than the nearly VND 601 billion loss in the previous year.

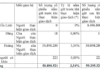

Novaland has outlined two business scenarios for 2025, based on the progress of legal resolution for its projects. Scenario 1 forecasts a gross revenue of VND 13,411 billion and a post-tax loss of VND 12 billion, while Scenario 2 takes a more cautious approach with a revenue target of VND 10,453 billion and a loss of VND 688 billion.

With the results of the first quarter, Novaland has achieved 13-17% of its 2025 revenue target and is 30.8% away from the most negative loss plan.

As of March 31, 2025, Novaland’s total assets stood at over VND 234,806 billion, remaining relatively unchanged from the beginning of the year. Short-term cash holdings increased by 32% to VND 6,126 billion.

Inventories accounted for VND 148,639 billion, or 63.3% of total assets. Of this, the value of land funds and projects under construction accounted for 94.6%, with the remaining being completed or ready-to-transfer properties.

On the other hand, total liabilities decreased by over 2% to nearly VND 185,951 billion. Short-term borrowings decreased by 13% to VND 32,164 billion, while long-term borrowings decreased by 10% to VND 27,094 billion.

“Slow Progress on Key Projects: SCID Disburses Only $29 Million of Raised Funds After Over a Decade”

As of May 5th, Saigon Co.op Investment and Development JSC (UPCoM: SID) reported on the progress of capital utilization from its public securities offering. The company has only invested slightly over VND 29 billion of the planned VND 198+ billion for the An Phu project, despite capital mobilization commencing over a decade ago.

The VDS Issuance of Corporate Bonds: An Exclusive Offering of 800 Billion VND

The Board of Directors of Rong Viet Securities Corporation (VDSC, HOSE: VDS) approved a plan to issue the second tranche of bonds worth VND 800 billion to professional investors on May 7th, 2025. This move aims to restructure the company’s debt and strengthen its financial position. With this new issuance, VDSC demonstrates its commitment to optimizing its capital structure and ensuring long-term financial stability.

The Everest Securities Chairman Registers to Purchase 2.2 Million Shares

Mr. Nguyen Hai Chau, Chairman of the Board of Directors, has registered to purchase 2.2 million EVS shares from April 28 to May 28. This move underscores his confidence in the company’s prospects and his commitment to its long-term growth.