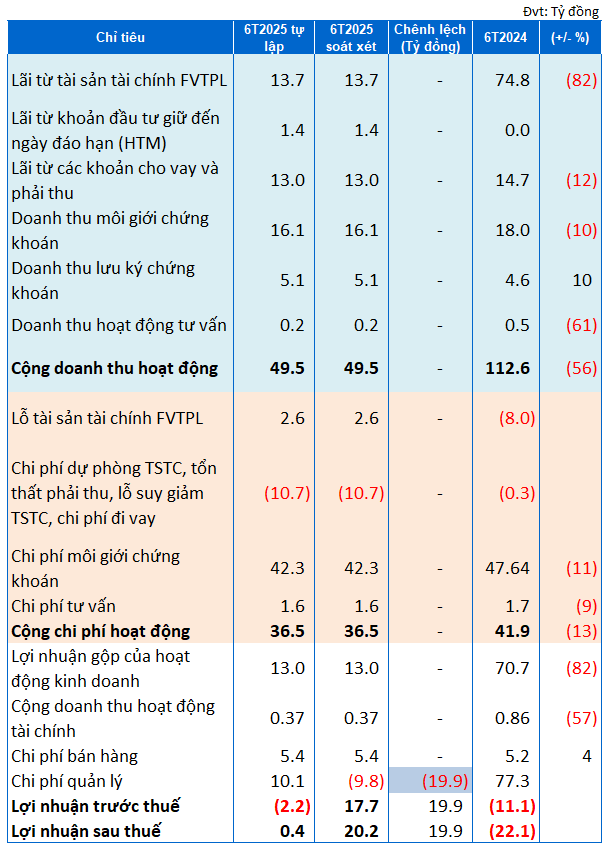

TVSI’s audited semi-annual profit after tax for 2025 increased by nearly VND 20 billion compared to the pre-audited figure, reaching VND 20.2 billion. The difference was due to the Company’s reversal of provision for contract bond expenses totaling nearly VND 20 billion.

With this result, TVSI had a brighter business period compared to the loss of over VND 22 billion in the same period last year. This improvement was mainly due to significantly lower expenses during the period. Specifically, provision for expected credit losses decreased by VND 10 billion, securities brokerage expenses decreased by 11% (over VND 5 billion), and management expenses decreased by VND 87 billion.

|

TVSI’s 2025 Semi-Annual Audit Results

Source: TVSI Financial Statements

|

In the semi-annual audit report, TVSI received some highlighted comments from the auditors.

First, in Note 39, TVSI stated that during its operations, the Company purchased corporate bonds in private placements (“Bonds”) from issuing organizations and then bought and sold them multiple times with investors. The Company had entered into repurchase agreements for some of the Bonds sold to investors at a specified price on a specified future date. The total face value of the Bonds for which the Company had entered into repurchase agreements as of June 30, 2025, was over VND 8,638 billion (as of January 1, 2025, it was over VND 10,002 billion). Of this, approximately VND 8,638 billion was due for payment on June 30, 2025, but could not be paid, and over VND 10,002 billion was due on January 1, 2025.

However, the Company is currently unable to make payments to the transferring party and has notified investors that it will not execute the transaction. Simultaneously, the Company is negotiating with investors to cancel or extend the repurchase agreements in line with the maturity dates of the issuing organization’s Bonds, but these negotiations have not yielded specific results. The Company did not recognize these Bonds in these financial statements and has made a provision of approximately VND 691 billion (approximately VND 711 billion as of January 1, 2025) for the violation of repurchase agreements for due Bonds that could not be executed. Therefore, investors still hold and exercise the rights of bondholders for these Bonds.

At the same time, the auditors also emphasized the explanation regarding TVSI’s deposits at the Saigon Commercial Joint Stock Bank (SCB). Since 2022, the balance of deposits at SCB includes investor deposits for securities transaction payments and the Company’s deposits for other payment obligations to customers; and the balance of non-negotiable certificates of deposit of the Company at SCB. As of June 30, 2025, the balance of non-negotiable deposits at SCB was approximately VND 1,625.34 billion, including investor deposits for securities transaction payments of approximately VND 889.68 billion and the Company’s deposits for other payment obligations to customers of approximately VND 736.6 billion. The balance of the Company’s non-negotiable certificates of deposit at SCB was approximately VND 29.3 billion.

By the end of June 2025, TVSI’s total assets stood at VND 4,027 billion. The majority was in the form of cash and cash equivalents (VND 1,986 billion), financial assets recognized through profit or loss (VND 1,630 billion), and loans and advances (VND 380 billion).

Yến Chi

– 14:43 19/08/2025

Putting EVN’s 44,000 Billion Dong Loss into Electricity Prices: Approve Only Reasonable Costs

Regarding the proposal to include a loss of over VND 44,000 billion in the average electricity selling price, experts argue that it is necessary to request a detailed report from EVN on the cost components that make up this loss and only approve the allocation of reasonable expenses.

The Great Debt Unravel: Unraveling the Mystery of Delayed Repayments by Enterprises

An estimated VND 36 trillion ($1.5 billion) in bonds will mature in August, the highest amount this year. The real estate sector accounts for a significant portion of this maturity, including companies affiliated with the Van Thinh Phat Group, and some businesses with a history of late payments.