In a recent development, the Hanoi Stock Exchange (HNX) has announced a series of capital divestments by three major shareholders of Saigon Bus Joint Stock Company (Saigon Bus, stock code: BSG).

Specifically, Tan Thanh Do Group Joint Stock Company, an entity related to Mr. Tran Ngoc Dan, a member of the Board of Directors of Saigon Bus, has registered to sell all 14.4 million BSG shares (equivalent to 24.05%) to serve the financial needs of investment business expansion.

At Tan Thanh Do Group, Mr. Dan serves as Chairman of the Board. Meanwhile, his two brothers-in-law, Mr. Pham Anh Hung and Mr. Nguyen Van Thanh, also simultaneously registered to sell all their BSG shares holding 9 million (15%) and 4.5 million (7.5%) shares, respectively, for personal financial needs.

Thus, the total number of BSG shares registered for sale by these three individuals amounts to 27.9 million shares (nearly 47% of capital). The above transactions are expected to take place from May 16 to June 13 through matching and negotiation methods.

If this deal is successful, the shareholder structure of Saigon Bus will undergo significant changes. Currently, the Saigon Transportation Engineering Corporation (SAMCO) is the largest shareholder of the company, holding 49% of its capital.

Following the news of the major shareholders’ complete divestment, BSG shares closed on May 15 with a sharp decline (over 12.5%), falling to VND 12,500 per share. Based on this price, the total value of the above-mentioned share lot is estimated to be over VND 348 billion.

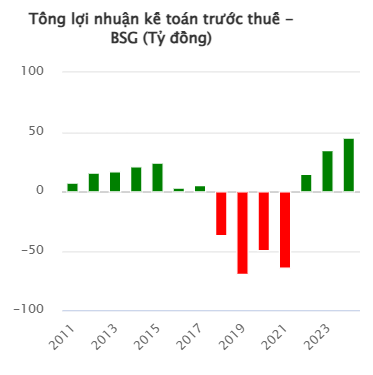

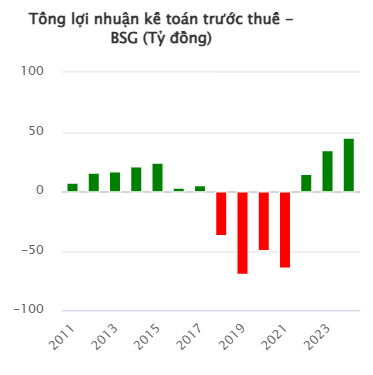

Saigon Bus’s business performance was on a strong growth trajectory but suffered a setback in Q1 2025.

According to records, the simultaneous divestment move by the three major shareholders came immediately after Saigon Bus announced its Q1 2025 financial report, which revealed less-than-favorable figures.

Specifically, at the end of Q1, the company recorded a revenue of over VND 111 billion, a 25% decrease compared to the same period last year. Consequently, after deducting expenses, the company’s pre-tax profit stood at only VND 1.5 billion, an over 84% drop from the previous year.

As of the end of Q1, Saigon Bus’s cash and cash equivalents also witnessed a significant decline of over 36% compared to the beginning of 2025, falling to VND 70.7 billion.

In recent years, the company has returned to profitability, with consecutive record profits in 2023 and 2024 following a period of heavy losses from 2018 to 2021.

Notably, in 2025, Saigon Bus set a backward-looking business plan with expected revenue of nearly VND 563 billion and a pre-tax profit of over VND 16 billion, representing an 11% and 64% decrease compared to 2024, respectively.

As of the end of Q1 2025, Saigon Bus has accomplished nearly 20% of its revenue target and over 9% of its profit target for the year.

Saigon Bus Joint Stock Company was formed through the equitization of the state-owned enterprise Saigon Bus Limited Liability Company One-Member, specializing in passenger transportation by car, contract, and fixed route…

Regarding Mr. Tran Ngoc Dan, in addition to his role as a member of the Board of Directors at Saigon Bus and Chairman of Tan Thanh Do Group, he also heads City Auto Joint Stock Company (stock code: CTF).

City Auto is an authorized distributor of Ford and Hyundai in Vietnam…

Previously, the company approved the resignation of Mr. Tran Lam (Mr. Dan’s son) from the position of general director due to personal reasons.

According to the Enterprise Law, in a public company, the general director must not be a family member of the Chairman of the Board of Directors.

“FPT Telecom to Release Over 246 Million Bonus Shares to Shareholders”

FPT Telecom is set to offer its existing shareholders an enticing opportunity to enhance their investment. The company plans to issue approximately 246.3 million new shares with a rights execution ratio of 2:1, with the record date for allocating these rights set as June 10, 2025.

The Great Discrepancy: From Half-Trillion Dong Loss to Misreported Profit, a Geleximco Enterprise Raises 1.8 Trillion Dong in Bonds

Thăng Long Thermal Power, a subsidiary of Geleximco, incurred a loss of nearly VND 530 billion in 2022, but mistakenly reported a profit of nearly VND 122 billion for the same year. In 2023, the company successfully raised nearly VND 1,800 billion through a bond issuance.