Vietnam’s stock market has witnessed significant volatility since the beginning of the year, especially in the last two months. After the tariff shock in early April, the market quickly formed a “V-shaped” bottom as more positive news emerged. The VN-Index surged over 200 points in just over a month, reclaiming the 1,300-point level. However, compared to the beginning of the year, the VN-Index is up less than 4%.

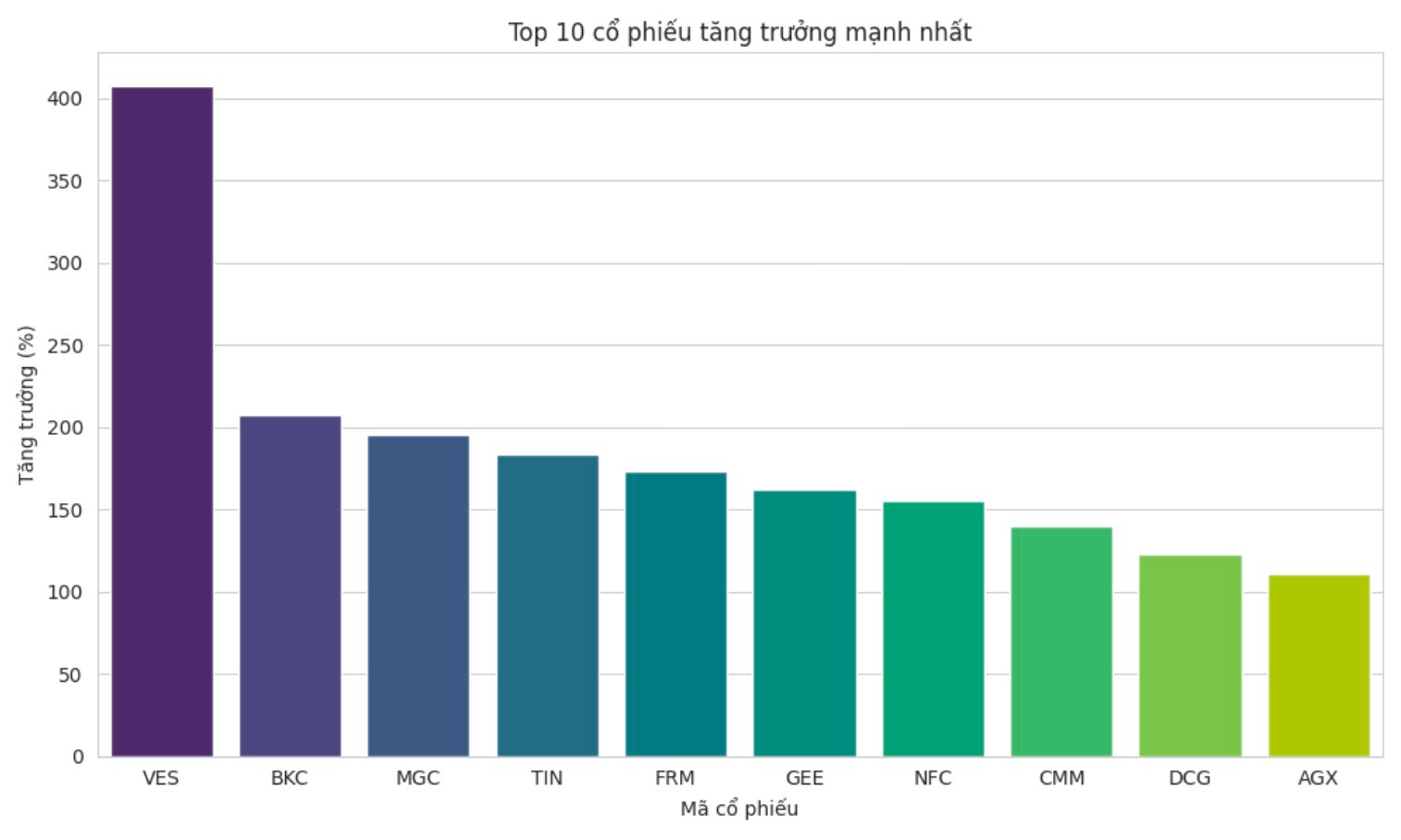

Amidst this backdrop, several stocks have seen remarkable breakouts. The top 10 best-performing stocks in the market since the year’s start have all recorded gains of over 100%. Leading the pack is MECA VNECO’s VES stock, surging over 400%, albeit with low liquidity. Following closely are mining stocks BKC of Bac Kan Minerals and MGC of MGC Mineral – TKV.

Notably, most of the top-performing stocks on the exchange since the year’s start are small-cap stocks traded on the UPCoM. The only HoSE representative in the top 10 is GEE of Gelex Electric, which has surged over 160% since the year’s start, pushing its market capitalization to nearly VND 32,000 billion and joining the billion-dollar club.

In reality, several large-cap stocks outside the top 10 have also posted impressive gains since the year’s start, outperforming the VN-Index. Notably, the Vingroup quartet of VIC, VHM – Vinhomes, Vincom Retail – VRE, and newcomer VPL – Vinpearl, stand out. Several bank stocks have also rallied strongly, including SHB, MBB, TCB, and others.

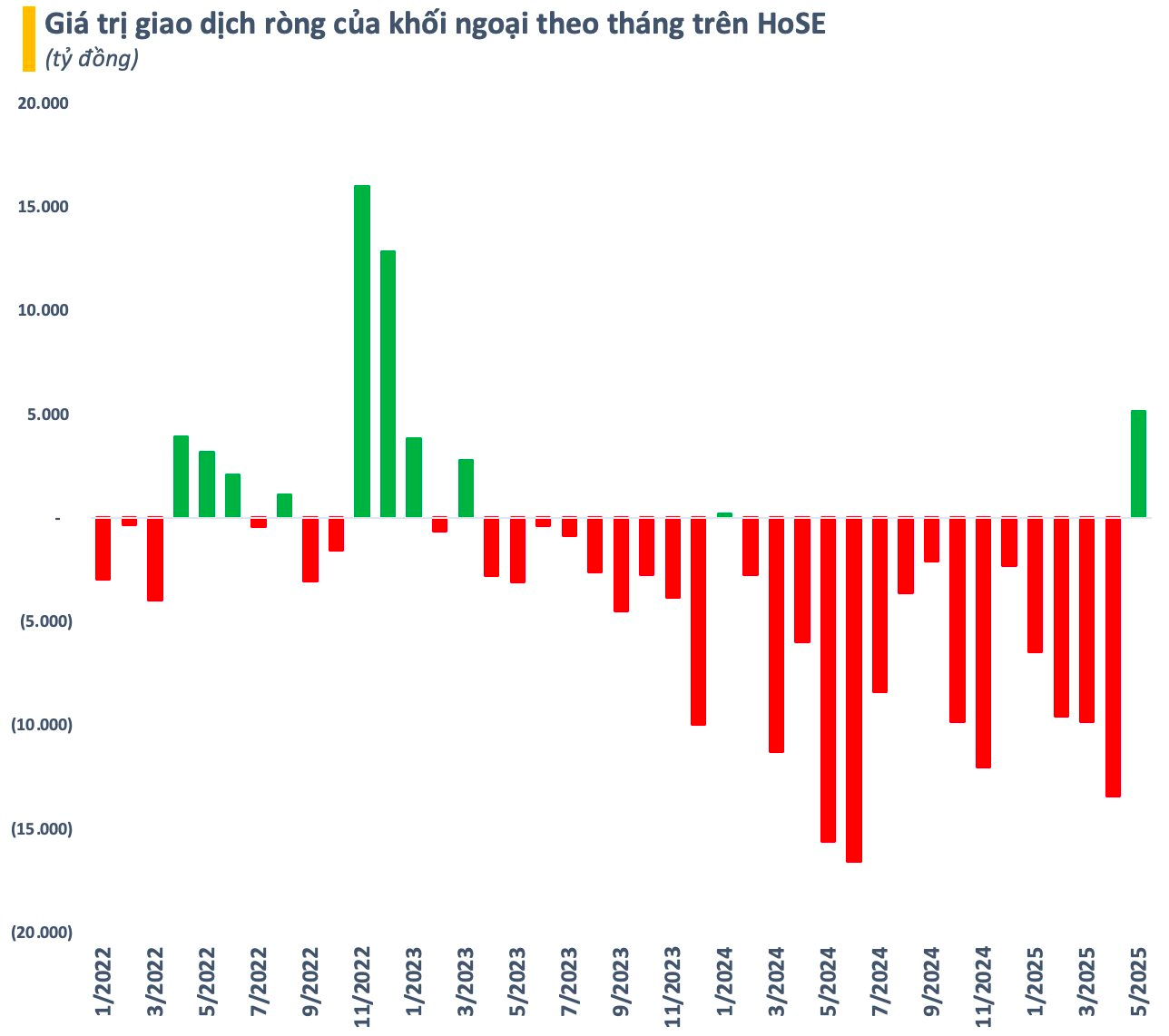

Overall, after a prolonged uptrend, the market is approaching long-term highs, and profit-taking pressure is inevitable, especially in overheated stocks. However, there are positive signals, such as easing global trade tensions and the return of foreign capital. Since the beginning of May, foreign investors have net bought over VND 5,000 billion, indicating a turnaround after persistent net selling previously.

On the domestic macroeconomic front, with the push for higher public investment, several supportive policies have been announced, such as proposing to extend the VAT reduction until 2026. Additionally, the Central Committee has issued Resolution 68 on private economic development, featuring reforms, incentives, and tax cuts to boost this sector’s growth by 10-12% annually until 2030.

Furthermore, the new trading system (KRX) successfully went live on May 5, marking a significant step forward in modernizing Vietnam’s stock market. This system paves the way for new features like central counterparty clearing (CCP) and intraday trading, facilitating the market’s upgrade process.

The Bamboo Capital Group’s Shares Take an Unexpected Turn.

The Bamboo Capital group of stocks witnessed a lively trading session, with a substantial buy surplus at the ceiling price, indicating strong demand in the market.