Q1 2025 Profits Remain Stable

According to Maybank Securities, the total profits of companies in the market in Q1 2025 increased by over 13% compared to the same period last year.

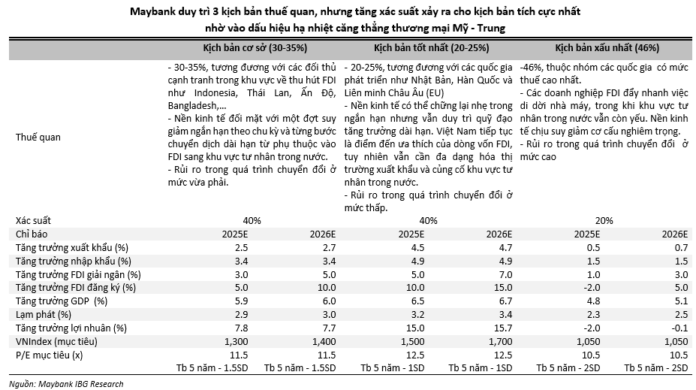

Despite weak consumer spending and slow retail credit growth, the retail sector still recorded a 51% profit increase, while the banking sector rose by 13%, in line with Maybank Securities’ expectations. On the other hand, the energy sector declined by 19% due to oil price fluctuations, while the beverage industry dropped by 23%, contrary to initial forecasts.

On a positive note, sectors such as residential real estate (up 287%), information technology (up 22%), industrial parks (up 317%), maritime logistics (down 1%), and steel (up 17%) continued to report favorable financial results. However, some signs of slowing down are starting to emerge.

In terms of individual companies, financial performance was quite varied, with leading enterprises leveraging the current context to expand their scale and market share.

Based on this, Maybank Securities has raised its profit growth forecast for the entire market by an additional 5-10 percentage points compared to previous scenarios.

Expectations for More Positive Tax Policies and Fiscal Support

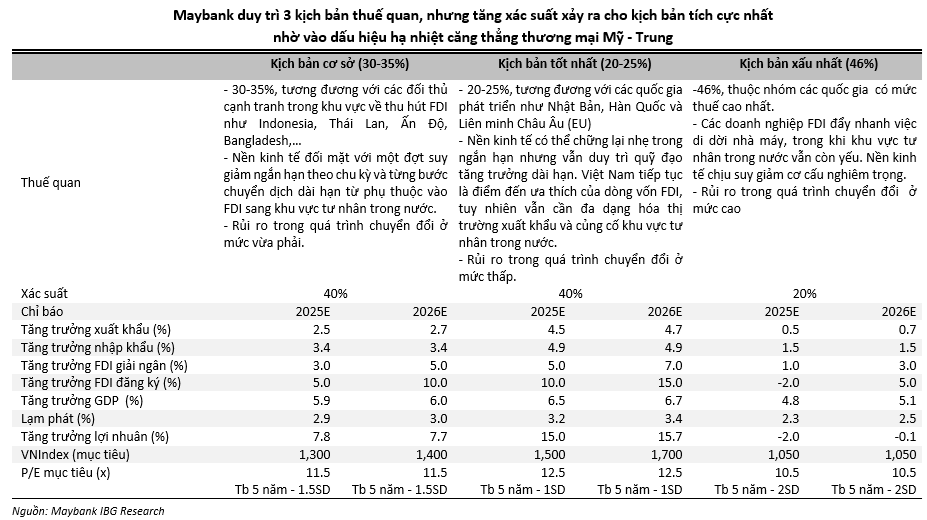

Vietnam continues to demonstrate its goodwill in trade negotiations. According to Maybank Securities, the final decision of the US on tariffs is likely to depend on two main factors: (1) the growing opposition from US corporations and domestic consumers, and (2) the outcome of trade negotiations between the US and major investors in Vietnam, such as Japan, South Korea, and especially China.

The recent positive developments in US-China relations increase the likelihood of the 20-25% tariff scenario (the best-case scenario). Additionally, the US-UK trade agreement suggests a different approach – taxing by industry rather than across the board, which could set a precedent for Vietnam in the negotiation process.

In parallel, the Vietnamese government is accelerating administrative reforms and introducing new fiscal support packages to stimulate investment and consumption. Maybank Securities estimates that the value of approved or proposed fiscal measures currently stands at about 2.7-2.9% of GDP, enough to mitigate the negative impact of tariff policies in the 2025-2026 period.

Adjusting VN-Index Target Upward

The VN-Index has recovered most of its 16% loss after Donald Trump’s tariff announcement on April 30. Maybank Securities believes that the progress in reducing escalating trade tensions continues to be a positive factor for market valuation.

With a 5-10% increase in the profit forecast for the entire market in 2025, Maybank Securities adjusts the VN-Index target for the end of the year upward to 1,300 points (base case), 1,500 points (best case), and 1,050 points (worst case).

In terms of investment strategy, Maybank Securities prioritizes high-dividend-paying stocks, focusing on sectors with resilient demand, such as information technology, aviation logistics, along with sectors supported by policies like residential real estate and steel.

|

– 6:39 PM, May 15, 2025

“Mobilizing Resources and Infrastructure for Vietnam’s International Financial Center”

The Government Office has released Announcement No. 227/TB-VPCP, conveying the conclusions of Deputy Prime Minister Nguyen Hoa Binh regarding the preparations for the development of an international financial center in Vietnam.

The Grand Ho Tram Launches Construction on New 35-Hectare Phase

The Grand Ho Tram reaches a pivotal moment with the groundbreaking ceremony of its new 35-ha expansion. This momentous occasion marks a strategic milestone in the journey towards developing a world-class, integrated tourism complex in Vietnam.