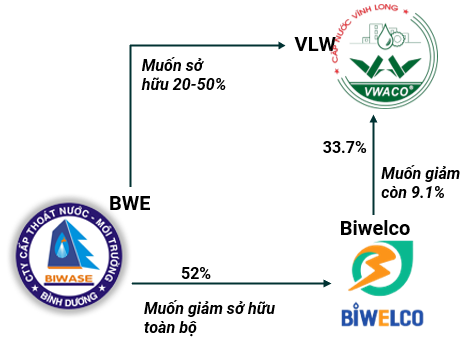

Accordingly, BWE plans to acquire 20-50% of the voting shares of VLW. Post-transaction, VLW is expected to become an associate company of BWE.

The Board of Directors authorizes the CEO to direct the execution of the next steps of the deal. The resolution does not mention the form of purchase, whether it will be through a matching order or a negotiated agreement.

On the stock market, VLW is an extremely illiquid stock. Over the past year, the average volume has only reached 137 shares/session, with the highest liquidity session reaching only 3,200 shares. Thus, it is likely that BWE will purchase VLW through a negotiated agreement.

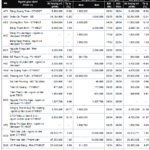

Currently, the People’s Committee of Vinh Long province is the largest shareholder, holding 51% of VLW‘s capital, followed by Biwase Construction – Electricity Joint Stock Company (Biwelco).

| VLW stock performance in the past year |

Contrary to the buying trend, from May 13 to June 6, 2025, Biwelco registered to sell 7.1 million VLW shares through a negotiated agreement, reducing its ownership from over 9.7 million shares (33.7%) to over 2.6 million shares (9.1%). Biwelco’s divestment move takes place as VLW is about to finalize the list of shareholders entitled to attend the 2025 Annual General Meeting of Shareholders on May 28. According to the plan, the meeting will be held on June 27 in Vinh Long province.

Biwelco is a subsidiary of BWE, holding 52% (equivalent to 10.4 million shares). In March, the Board of Directors of BWE issued a resolution agreeing on the direction to reduce the ownership ratio in Biwelco this year. The maximum number of shares to be transferred is 10.4 million, depending on the actual transaction results, and Biwelco may no longer be a subsidiary or an associate company of BWE.

VLW Board member Van Kim Hung Phong is currently the General Director of Biwelco. VLW Board member Tran Tan Duc is also a member of Biwelco’s Board of Directors. VLW Supervisory Board member Nguyen Huu Binh is the Chief Accountant of Biwelco.

VLW Board member Tran Tan Duc is currently a member of the Board of Directors of Biwelco and Vice Finance Director of BWE.

Biwase focuses on M&A Nuoc Tan Hiep, awaiting water price increase

|

BWE aims to increase its ownership in VLW and reduce its stake in Biwelco, while Biwelco intends to divest from VLW

Compiled by People

|

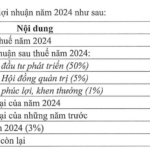

According to VLW‘s report, the Company is expanding the Vung Liem Water Plant in Vinh Long province, increasing its capacity from 3,000m3 to 9,600m3/day. The total investment is nearly VND 70 billion, and by the end of 2024, the Company had executed nearly VND 43 billion. There is also the Truong An 2 Water Plant project with a total investment of over VND 109 billion, of which VND 358 million has been disbursed.

| Financial indicators of VLW in the 2015-2024 period |

– 18:34 15/05/2025

“ACB Receives Approval for Capital Increase to Nearly VND 51,367 Billion”

The Asia Commercial Joint Stock Bank (HOSE: ACB) has received approval from the State Bank of Vietnam (SBV) for a substantial capital increase of up to VND 6.7 trillion.