Major Players Report Impressive Profits

Kinh Bac Urban Development Corporation (KBC) made a spectacular turnaround in the first quarter of 2025 with a record revenue of VND 3,117 billion, 20.5 times higher than the same period last year. As a result, its after-tax profit was VND 849 billion, a significant increase compared to a loss of VND 77 billion in the previous period and the highest since Q2/2023.

This performance was driven by the company’s main business of land, infrastructure leasing, and factory sales. Revenue reached VND 2,484 billion, with a gross profit of over VND 1,000 billion.

Similarly, the “giant” of Binh Duong industrial parks, Becamex IDC (BCM), recorded a pure revenue of nearly VND 1,843 billion, more than double that of the same period.

The main driver was the increased recognition of real estate revenue, valued at nearly VND 1,427 billion, 3.2 times higher than the previous year. Despite facing cost pressures, BCM still reported a threefold increase in quarterly profit to VND 366 billion.

Illustrative image

Meanwhile, Saigon VRG Investment Joint Stock Company (SIP) reported a Q1/2025 profit of over VND 402 billion, up 45% from the same period and the highest in the last four years.

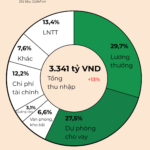

In the first three months, SIP’s consolidated revenue reached over VND 1,941 billion, up 6% year-on-year. The main driver remained the provision of electricity and water utility services to industrial parks, contributing nearly VND 1,590 billion, or over 80% of total revenue, and a 7% increase from the previous year.

However, some businesses have “slowed down” in the industry’s overall growth. One example is Idico Corporation (IDC), with a 27% decrease in Q1/2025 revenue to VND 1,793 billion.

The decline in revenue, coupled with rising costs, eroded after-tax profit to VND 417 billion, down 48% year-on-year. IDC attributed the sharp profit drop to fluctuations in infrastructure leasing contracts’ revenue, which met the conditions for one-time revenue recognition.

Contrasting Business Plans

Despite a positive first quarter, some businesses have adopted a cautious approach in their business plans following the tax shock in early April.

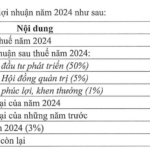

A case in point is SIP, which, despite reporting the highest quarterly profit in four years, is preparing for a “setback.” Accordingly, SIP targets consolidated revenue of VND 5,657 billion and after-tax profit of nearly VND 833 billion, down 33% and 35%, respectively, from 2024 results.

SIP plans to lease 45 hectares of industrial land this year, with a focus on 30 hectares in Phuoc Dong Industrial Park and 5 hectares each in Dong Nam, Le Minh Xuan, and Loc An – Binh Son Industrial Parks. Regarding factory leasing, the company aims to rent out nearly 25,900 square meters.

To achieve these goals, SIP will concentrate on compensating and clearing the site for the third phase of Phuoc Dong Industrial Park, striving to finalize the remaining area this year. They will also work on completing legal procedures for residential and resettlement projects to initiate business activities. Additionally, they will seek new projects in the south. For the Dong Nam Industrial Park, SIP will continue to develop and improve the remaining transportation infrastructure to attract investment.

Similarly, at the 2025 Annual General Meeting of Shareholders, Idico approved a consolidated revenue plan of VND 8,918 billion and a pre-tax profit of VND 2,596 billion, a decrease of 1% and 13%, respectively, from the previous year. The plan includes leasing infrastructure land in industrial parks covering 123.5 hectares and renting out nearly 33,300 hectares of factory space.

This year, IDC will focus on legal procedures and compensation, site clearance, and resettlement for four industrial parks with approved investment policies: Tan Phuoc 1 Industrial Park in Tien Giang (470 hectares), My Xuan B1 expanded by 111 hectares in Ba Ria – Vung Tau, Vinh Quang Industrial Park in Hai Phong (226 hectares), and Phu Long Industrial Park in Ninh Binh (416 hectares). The development of these industrial parks will increase IDC’s remaining commercial land area to over 1,430 hectares.

In contrast, some major players remain optimistic about the global economic outlook and have set ambitious targets. BCM aims for a consolidated revenue of VND 9,500 billion in 2025, a 29% increase, and an after-tax profit of VND 2,470 billion, a 3% rise compared to 2024 performance. The company plans to commence the construction of the second phase of Bau Bang expanded Industrial Park (380 hectares) and Cay Truong Industrial Park (700 hectares), expanding the land bank available for lease in Binh Duong.

After a challenging year, Kinh Bac sets its sights on a consolidated revenue of VND 10,000 billion and an after-tax profit of VND 3,200 billion, triple and septuple the previous year’s results, respectively. The company intends to lease over 200 hectares of industrial land this year and has already achieved more than 30% of this target in Q1.

“Proposal to Hike Import Tax on Resin Pellets: Safeguarding Vietnam’s Petrochemical Industry”

SCG, a prominent Thai industrial conglomerate, boasts an extensive presence in Vietnam with 27 subsidiary companies, 15,500 employees, and over $7 billion in investments.

The State Bank Approves Capital Increase for NCB to Over 19.2 Trillion VND

The State Bank of Vietnam has approved a capital increase of VND 7,500 billion for the National Commercial Joint Stock Bank (NCB). This move will see the bank issue private shares to professional securities investors, boosting its charter capital and strengthening its financial position.