The broad-based profit-taking pressure this morning, coupled with weakness in some large-cap stocks, caused significant market volatility. On the bright side, cash flow remains positive, especially from foreign investors. As the VN-Index returns to near its previous high, a divergence of opinions is normal.

The market showed early signs of weakness as the VN-Index rose slightly and traded sideways for the first 40 minutes before gradually declining. The index hit its intraday low at 10:56 AM, falling 8.1 points to just above the 1300 level (1301.61) before a mild recovery in the final minutes. At the morning session’s close, the VN-Index was down 3.01 points, or -0.23%.

The prolonged downward trend of the index was largely influenced by significant losses in large-cap stocks, notably VHM. This stock also touched its intraday low at 11:00 AM, plunging by 5.46% from its reference price. VHM recovered slightly towards the session’s end, closing the morning down by 4.47%. Two other Vin stocks, VIC and VRE, fell by 1% and 4.86%, respectively. In contrast, VPL surged for the third consecutive session, contributing nearly 2.6 points to the VN-Index, offsetting VHM’s loss. VPL has climbed to the eighth position in market capitalization on the HoSE.

The VN30-Index ended the morning session down by 0.44%, with 12 gainers and 16 losers. After leading the market surge yesterday, blue-chips took a breather today. Among the ten largest stocks by market capitalization, only two, VPL and VCB, posted gains, rising by 0.51% and 2.04%, respectively. MBB stood out in the basket with a substantial trading volume of over 1,344 billion VND. Foreign investors aggressively bought MBB, resulting in a substantial net buy value of 456.3 billion VND. However, due to MBB’s limited market capitalization, its impact on the VN-Index was equivalent to VIC’s loss, contributing 0.7 points.

The VN30-Index reached an intraday high of 1400 today, matching its peak in March and the highest level since early May 2022. This level presents a strong technical resistance, especially with today being the expiration day for VN30 index futures contracts. Despite the initial sharp decline of 0.94%, the VN30-Index recovered to close 0.44% lower, a relatively positive outcome. All 30 stocks in the basket rebounded from their intraday lows, with ten stocks recovering by at least 1%.

The broader market is also witnessing a certain recovery. At the VN-Index’s intraday low, there were 84 gainers and 221 losers, and at the close, this ratio improved to 112 gainers and 189 losers. Approximately 26% of the traded stocks on the HoSE rebounded by at least 1% from their lows, while around 72% recovered by at least one tick. However, the narrow breadth still indicates that selling pressure above the reference price persists.

Among the 189 stocks in the red, 86 declined by more than 1%, with ten of them recording a trading volume of over 100 billion VND. These stocks experienced the most evident selling pressure, including non-blue-chips such as GEX, which fell by 2.93%, TCH by 1.66%, HHS by 2.64%, and NVL by 1.22%. Lower-liquidity stocks that plunged by over 2% include GEG, down 3.47%, VPI by 3.42%, CRC by 2.95%, SBG by 2.58%, HAG by 2.57%, and VHC by 2.19%. Combined, this group of deep decliners accounted for approximately 29.1% of the HoSE’s total trading volume, with about 77% concentrated in the ten most actively traded stocks.

On the upside, as selling pressure emerged early, not many stocks managed to maintain their gains. Most of the gainers turned positive during the late rebound, resulting in short durations and modest gains. However, the strongest stocks largely stayed in positive territory and exhibited high trading volumes. MBB and ACB, two prominent blue-chips, traded firmly in positive territory throughout the session, accompanied by substantial volumes of 1,344 billion VND and 401.8 billion VND, respectively. Other notable gainers include CII, up 3.4% with a volume of 232.7 billion VND, HCM rising 1.14% with 172.7 billion VND, VCG climbing 1.63% with 151.5 billion VND, LPB surging 2.66% with 131.1 billion VND, and HHV advancing 1.23% with a volume of 106 billion VND.

Foreign investors continued to make a strong impression by increasing their purchases. While the net value on the HoSE was approximately 683 billion VND, down significantly from 1,112 billion VND yesterday, they are indeed stepping up their buying activity. Specifically, their total investment value rose by 3.3% from yesterday morning to 2,246 billion VND. However, as selling also increased by 47% to 1,563 billion VND, the net position decreased. Besides MBB, stocks that witnessed strong foreign buying included SHB (+178 billion VND), VPB (+96.3 billion VND), FPT (+66.8 billion VND), STB (+40 billion VND), PNJ (+39 billion VND), MWG (+38.5 billion VND), and BID (+33.5 billion VND). On the selling side, VHM (-211.6 billion VND), VRE (-157.1 billion VND), GEX (-65.3 billion VND), and TCH (-35.1 billion VND) saw notable net selling.

Are Bank Stocks “Exhausted” After Leading the VN-Index Past the 1,300-Point Mark Last Week?

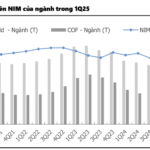

The banking sector has witnessed a stellar performance in the past week, with bank stocks surging ahead. Despite this recent rally, the industry’s valuation remains attractive for long-term investors. With a current price-to-book (P/B) ratio of 1.37x, the sector is trading below its five-year average of 1.73x, presenting a compelling opportunity for those seeking sustainable returns.

“US Tariff Deferral: Will the VN-Index Retreat to 1250 as Trade Talks Loom?”

The recent market rebound was a direct response to the temporary tariff truce between the US and other nations. Now, the market awaits official news on the outcome of tariff negotiations. During this waiting game, investors will be quick to take profits and exit the market.

Market Beat: Foreigners Resume Net Selling, VN-Index Halts Rally

The market closed with the VN-Index down 11.81 points (-0.9%), settling at 1,301.39. The HNX-Index also witnessed a decline of 0.59 points (-0.27%), ending the day at 218.69. The market breadth tilted towards decliners, with 444 stocks falling against 332 advancing stocks. Within the VN30 basket, bears dominated as 24 stocks dropped, while only 4 rose, and 2 remained unchanged.

Market Pulse, May 15: Real Estate Pressures Mount, But Banking Sectors Come to the Rescue

The VN-Index demonstrated its resilience in the face of morning pressures, with the critical 1,300 level providing excellent support as buying interest emerged. The index rebounded to close at 1,313.2 points, a gain of 3.47 points. The contrasting performances of the two large-cap sectors, banking, and real estate, were the highlight of the session.