According to research conducted by the One Mount Group’s Market Research and Customer Insight Center, only approximately 340 new apartments were released for sale in Ho Chi Minh City in Q1/2025, a decrease of 31.1% compared to the same period last year. This is the lowest number since the beginning of 2023.

The main reason for this decline is attributed to the cautious mentality of investors due to macroeconomic uncertainties and the market’s need for time to restore confidence. Additionally, the timing of the Tet holiday also contributed to the delay in sales deployment.

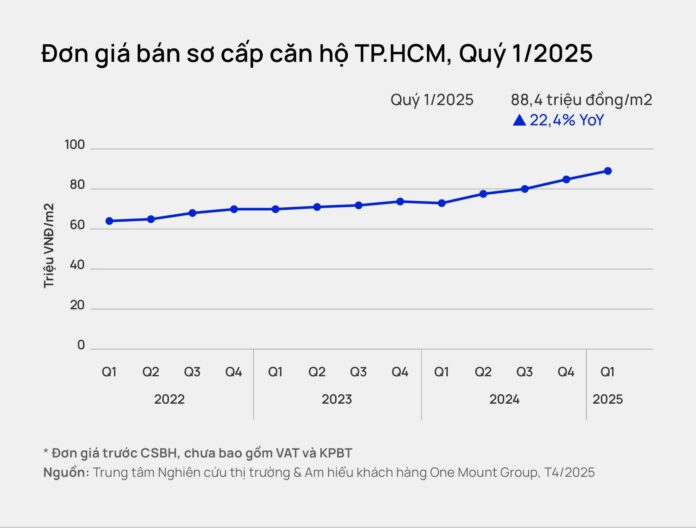

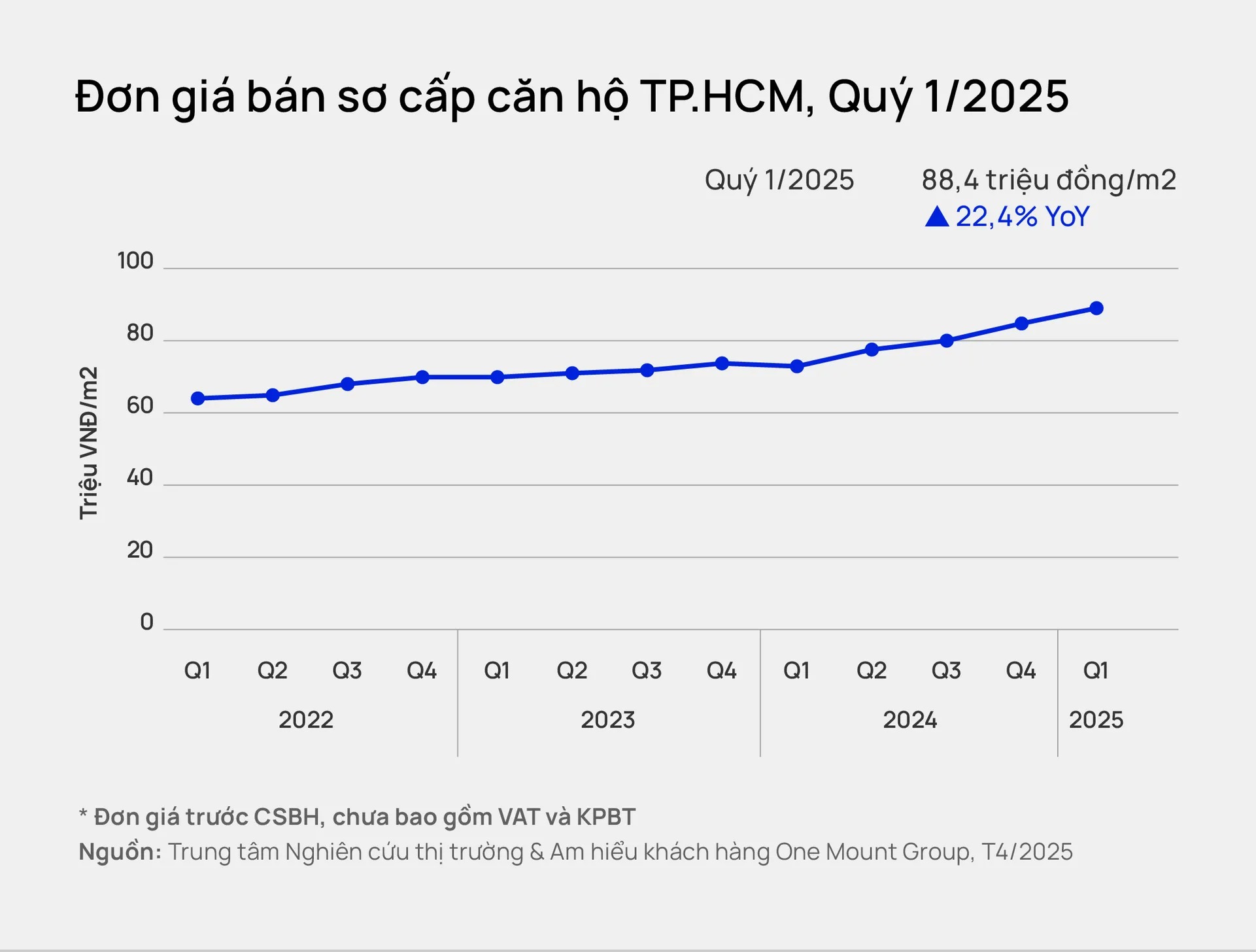

In contrast to the declining new supply, primary apartment prices continued to surge. The average price in the market reached VND 88.4 million/m2, a 4.9% increase compared to the previous quarter and a significant 22.4% jump from the same period last year.

Notably, most of the projects currently on sale have undergone price adjustments. Vinhomes Grand Park witnessed price increases ranging from 3% to 13% compared to the previous quarter. Meanwhile, Thao Dien Green recorded price hikes of over 20%, mainly due to the very limited number of remaining units. This indicates the scarcity of new supply, coupled with improving infrastructure, such as the operational Metro Line 1 and the anticipated completion of the Ring Road 3 section passing through Vinhomes Grand Park, which has fueled the growth of apartment prices in Ho Chi Minh City.

Mr. Tran Minh Tien, Director of the One Mount Group’s Market Research and Customer Insight Center, stated, “The continued surge in primary selling prices amid scarce supply reflects the market’s genuine demand. However, the concentration of new launches in the luxury segment also underscores the risk of supply-demand imbalance, with middle and affordable segments increasingly scarce.”

During the first quarter of 2025, the market absorbed 855 apartments, a 19.2% increase compared to the same period last year. The absorption rate in relation to the total primary supply reached 12%, a 5-percentage-point increase from the previous year, indicating resilient genuine housing demand despite overall challenges. However, the structure of primary apartments currently on the market remains skewed towards the luxury segment, accounting for approximately 60% of the total.

Primary Prices Expected to Continue Climbing

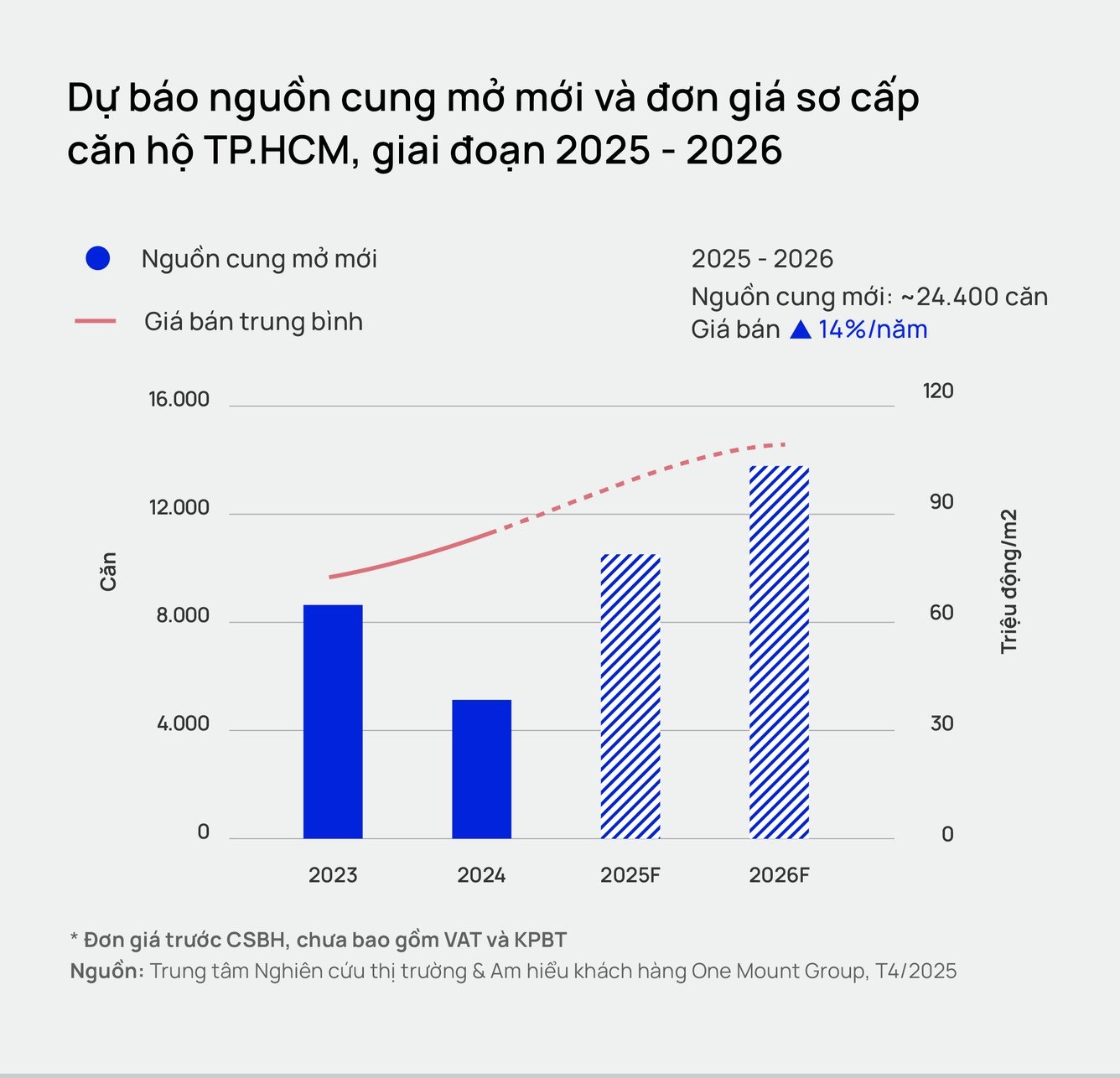

For the period of 2025–2026, the research unit forecasts that the Ho Chi Minh City apartment market may receive approximately 24,400 new units for sale, an increase of 4,400 units compared to previous estimates. This surge primarily originates from large-scale mega-urban projects such as Vinhomes Green Paradise and The Global City, along with legally unblocked projects by NovaLand and Dat Xanh Group…

Primary selling prices are projected to maintain their upward trajectory and are likely to surpass the VND 100 million/m2 threshold as soon as 2025.

Moreover, the Ho Chi Minh City apartment market receives positive signals from the potential merger with Binh Duong and Ba Ria – Vung Tau provinces. One notable benefit is the potential resolution of supply imbalance among segments. The expanded administrative boundaries will create more development opportunities for projects in neighboring areas, thereby boosting supply for the Ho Chi Minh City market.

Mr. Tran Minh Tien believes that, in addition to the supply factor, the cost of developing projects in Binh Duong and Ba Ria – Vung Tau is currently more competitive compared to undertaking projects in central Ho Chi Minh City. This could enable developers to offer more competitive pricing, contributing to a diversification of price segments and enhancing housing accessibility for buyers in the long term post-merger.

Concurrently, the merger will catalyze infrastructure development and connectivity between the provinces. Improved transportation systems will enhance connectivity, reduce travel time, and elevate the value of real estate in peripheral areas. This could trigger a new wave of investment in projects in previously overlooked locations.

The Big Spender: A Deep-Pocketed Client Accounts for 67% of Duc Giang’s Yellow Phosphorus Revenue: In Advanced Talks with Vingroup, Masan, and Major Players in Power and Auto Industries

Mitsubishi has a strong investment portfolio in Vietnam, with stakes in two significant BOT power plant projects. The Vung Ang 2 and Vinh Tan 3 power plants boast impressive capacities of 1,330 MW and 1,980 MW, respectively. These investments showcase Mitsubishi’s commitment to Vietnam’s energy sector and its potential for growth.

Enhancing the Quality of Life in Condominiums

Apartment complexes, from the humble resettlement flats to the more luxurious abodes, are a melting pot of diverse residents, each with their own unique cultural, regional, and professional backgrounds. To foster a friendly, civil, and secure living environment, a myriad of issues must be addressed and resolved.

The Ultimate Guide to Affordable Luxury: Redefining the 3-Billion-Dong Apartment as the New Norm in Ho Chi Minh City’s Property Market

The Ho Chi Minh City apartment market has witnessed a significant shift in pricing dynamics, and the criteria for segmenting it have evolved. What was once considered a mid to high-end apartment priced at VND 3 billion per unit is now deemed as affordable housing in the current market landscape.