CTS Announces Plans for Capital Increase and Leadership Changes

The annual general meeting of shareholders in 2025 approved the distribution plan, derived from undistributed post-tax profits up to the end of 2024. After completing the dividend payout in shares, CTS will increase its charter capital from over VND 1,487 billion to nearly VND 2,127 billion. This is CTS’s first capital increase since the last time in October 2022.

According to CTS’s leadership, the capital increase is a necessary step to expand its business and meet the capital requirements for future development plans. A larger charter capital and owner’s equity will also enable the company to optimize its capital costs, enhance its competitiveness, improve its transaction market share, and elevate its position in both domestic and international markets.

The general meeting also approved the 2025 business plan, targeting a pre-tax profit of over VND 297 billion and a dividend payout ratio of 9%.

Additionally, at the meeting, board member Dang Anh Hao and independent board member Pham Thi Huyen Trang were dismissed, and Mrs. Bui Thi Thanh Thuy was elected to the board, along with Mr. Pham Viet Hung, who will serve as an independent board member.

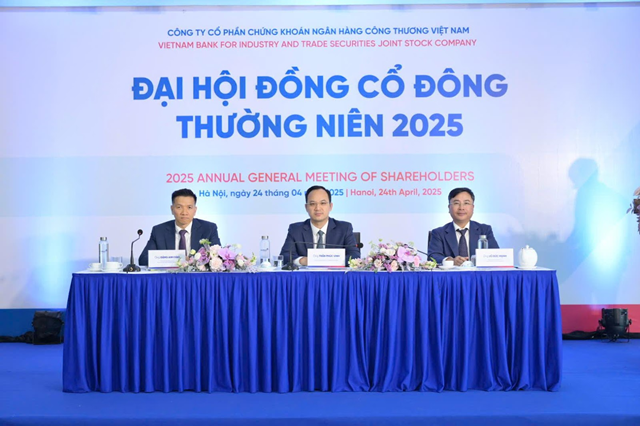

Board of Directors of the 2025 Annual General Meeting of Shareholders of CTS on 04/24/2025 – Photo: CTS

|

In the first quarter of 2025, CTS achieved a pre-tax profit of nearly VND 133 billion, up 7% over the same period and completing 45% of the yearly plan. Net profit increased by 7%, reaching nearly VND 106 billion, marking the highest profit since the first quarter of 2022.

| CTS records highest after-tax profit in 13 quarters |

Huy Khai

– 20:22 05/15/2025

The Dragon Capital Securities: Stock Issuance Roadmap for Dividend Payout and Private Placement

The Board of Directors of Rong Viet Securities JSC (VDSC, HOSE: VDS) approved a resolution on May 13 to increase the company’s charter capital in 2025 by offering a maximum of 77 million new shares, starting with a dividend payout of 24.3 million shares.

“Sotrans CEO on the 54% Profit Growth Plan: What’s the Strategy?”

Despite aiming for over a 50% growth in after-tax profits in 2025, the leadership of Southern Logistics Joint Stock Company (Sotrans, HOSE: STG) believes that this is not an unrealistic expectation. This confidence is based on positive business signals since the beginning of the year and significant improvements in previously challenging operational areas.

“US Electronics Manufacturer Witnesses a Tenfold Revenue Surge: A North Vietnamese Province’s Economic Success Story.”

The Fukang Technology plant (owned by Foxconn) is an impressive venture with a massive investment of over VND 12,507 billion. With an annual capacity of 16 million products, the factory will be a powerhouse for Apple, manufacturing a diverse range of their sought-after goods.