Illustrative Image

Sacombank, MSB, and SeABank Plan to Acquire Securities Companies in 2025

Sacombank’s recent Annual General Meeting of Shareholders approved the Board of Directors’ proposal to acquire a securities company as a subsidiary. Accordingly, Sacombank will contribute capital and/or purchase shares in a securities company, aiming for a majority stake of over 50%, with a maximum investment value of VND 1,500 billion.

The target securities company for Sacombank must meet basic criteria, including transparent and clear financial reporting, a comprehensive range of services for investors, appropriate capital scale, stable operating systems, and the ability to connect with partners. The bank also prefers listed securities companies.

Currently, Sacombank holds nearly 14% of SBS Securities Company’s shares. While Sacombank used to be the parent company, it started divesting from SBS in 2011 and even considered selling all its stakes in the securities company to restructure inefficient investments. However, Sacombank’s leadership affirmed to its shareholders that the bank would choose a new securities company instead of repurchasing SBS shares. The identity of this new company has not yet been disclosed.

At the recent general meeting, MSB also received shareholder approval to contribute capital and acquire shares in a securities company and an asset management company, making them subsidiaries of MSB.

According to General Director Nguyen Hoang Linh, MSB targets securities companies with clean assets and a charter capital of around VND 300-500 billion. MSB will then participate in their management and adjust the capital accordingly during the development process, while also providing related products.

At the 2025 Annual General Meeting of Shareholders, SeABank also approved the plan to acquire shares of ASEAN Securities Company, aiming to make it a subsidiary. Currently, ASEAN Securities has a charter capital of VND 1,500 billion. SeABank intends to purchase shares to own up to 100% of the securities company’s charter capital. The acquisition is planned for 2025 and/or in accordance with the approval of competent state agencies, legal regulations, and practical situations.

Meanwhile, VPBank, which already owns the leading VPBank Securities, also wants to deepen its involvement in this field. At the 2025 Annual General Meeting of Shareholders, VPBank approved a plan to contribute capital, acquire capital contributions, and/or purchase shares to make an asset management company its subsidiary. The participation of VPBank and related parties is expected to reach a maximum of 100%.

Previously, TPBank completed the acquisition of Viet Cat Fund Management Company (VFC) with a holding rate of 99.9% at the beginning of 2024. TPBank currently owns 9.01% of Tien Phong Securities (TPS), with an actual capital contribution of VND 270.3 billion.

Additionally, some other banks also own or hold a controlling stake in securities companies, such as Techcombank with TCBS, MB with MBS, VCBS under VCB, and Agribank with Agriseco.

Why Are Banks Seeking Deeper Involvement in the Securities Sector?

In their proposal to shareholders, MSB’s management expressed their optimism about the Vietnamese stock market’s continued qualitative and quantitative development, supported by various factors. They cited the market’s goal of reaching a capitalization of 120% of GDP by 2030 and the aspiration to upgrade from a frontier market to an emerging market by 2025, which is expected to attract approximately $25 billion in annual foreign indirect investment into Vietnam.

Recognizing these trends and growth potentials, MSB has identified the securities and investment banking sector as a key focus for future development. Therefore, investing in securities and asset management companies will enable MSB to expand into investment banking, offering comprehensive financial services such as securities brokerage, financial advisory, and securities issuance, as well as asset management and fund investment. This will allow MSB to become a comprehensive financial institution, similar to the successful models of Vietcombank (VCBS) and MB (MBS). MSB will be able to manage the assets of individual and large corporate clients alongside its retail banking services.

Moreover, owning a securities company and an asset management company enhances MSB’s capacity to provide premium securities and wealth management services to potential high-value clients, offering diverse investment options in securities, bonds, and more.

This ownership also enables MSB to engage more deeply in the capital market, elevating the long-term development of the market. Particularly, MSB gains the advantage of providing both banking services and supporting businesses in capital raising through the securities channel.

Sacombank’s leadership shared a similar perspective, stating that investment banking is a global trend that generates significant revenue for banks worldwide, and some Vietnamese banks have already effectively implemented this strategy through their ownership of securities companies. Therefore, contributing capital and acquiring shares in a securities company will enhance Sacombank’s service revenue and competitive edge.

SeABank’s management believes that while core banking activities remain central, the acquisition of a securities company will provide an opportunity to expand their business, diversify product and service offerings, facilitate cross-selling, and diversify investment activities, thereby optimizing revenue and shareholder capital.

Vice Chairman of VPBank, Bui Hai Quan, emphasized that an asset management company, along with life insurance, is one of the two essential components of a financial group, which is the model VPBank aspires to emulate.

The Stock Market’s “Royal” Attractions

The stock market witnessed a surge in numerous stocks that demonstrated robust momentum and witnessed a boom in trading volume. This rally was further fueled by substantial net buying from foreign investors, indicating their confidence in the potential of these stocks.

The Big Buy: Foreign Investors Snap Up Nearly a Trillion Dong, Targeting Blue-Chip Stocks

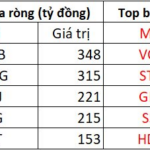

In the afternoon trading session, MBB stock witnessed a significant surge in buying activity, making it the most actively bought stock across the market. The value of the net buying reached an impressive peak of VND 348 billion.