Đà Nẵng has seen a surge in property prices, with both apartments and land becoming increasingly expensive. This sudden increase has left potential buyers bewildered as prices fluctuate daily.

The area around the lotus pond in Ngu Hanh Son Ward has been bustling with real estate agents and land brokers. Photo: Thanh Hien

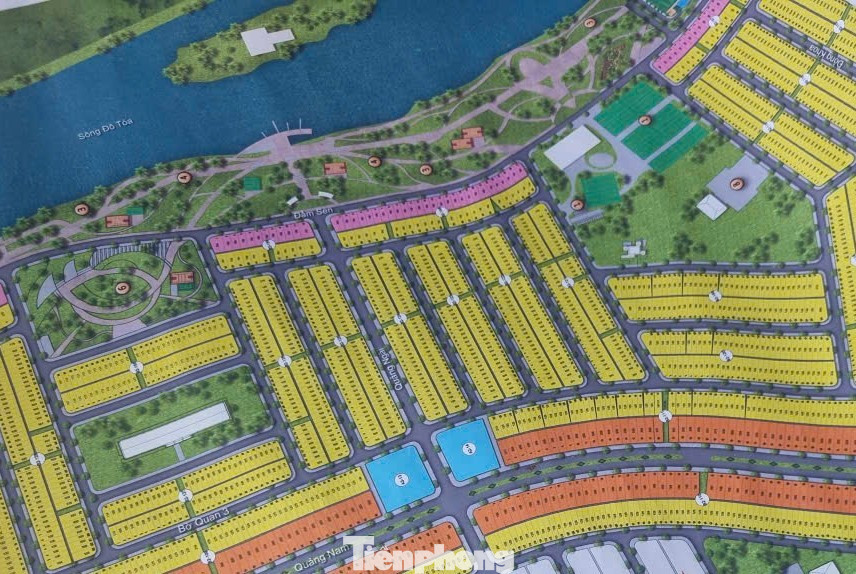

According to land brokers, 900 lots were recently sold in this area, with prices starting at VND4.5 billion per 100 sq. m lot. Placing a deposit directly with the investor is said to be VND100-200 million cheaper than buying from resellers, but these lots are very limited, so interested buyers must act fast.

Real estate agents and land brokers can be seen on every street, holding maps and soliciting customers. “A customer bought a lot on Quang Ngai Street a few days ago for VND6.5 billion, and now it’s being resold for over VND7.3 billion. That’s a profit of nearly VND1 billion. This area is very popular, so you can rest assured that investing here will be profitable and easy to flip for a large profit,” said L.K., a land broker.

Reports indicate that land prices in this area are already high, ranging from VND5 billion per lot and above, depending on the street. Lots on larger roads can cost more than VND6 billion, and prices increase as you get closer to ongoing construction projects. “Just last week, I inquired about a lot near the lotus pond in Ngu Hanh Son Ward and was quoted over VND4 billion. I arranged the money to make a deposit, but now the broker is saying that the price has gone up by almost VND100 million,” said Minh Hoang, a 37-year-old local.

While there are few buyers, land brokers and agents can be found everywhere, soliciting potential customers.

Meanwhile, Thu Giang, a resident of Cam Le Ward, shared that a month ago, she was considering buying land near Quang Nam Street, which was priced at around VND3.8 billion at the time. “I hesitated and didn’t buy it then, but now the price has gone up to over VND4 billion. Land brokers advised me to make a decision as soon as possible because we’re still at the beginning of the wave, and land prices will continue to rise, so I’m guaranteed to make a substantial profit,” she said, expressing her concerns.

Land prices in coastal areas and near ongoing construction projects are also skyrocketing. Minh Hai, a resident of Son Tra Ward, shared that he was quoted over VND6 billion for a lot of land near Son Tra Beach, but a few days later, the price had jumped to over VND8 billion, leaving him wondering if this was a case of artificial price inflation. In Tan Tra, a coastal area, land prices have also soared since the beginning of the year. Thuy Anh, a resident of Le Thi Rieng Street, said that at the beginning of July, lots in her neighborhood were selling for around VND3.5 billion, but by August, the price had risen to VND3.7-3.8 billion per lot. “I see land brokers swarming this area every day, and I don’t understand why land prices are skyrocketing like this,” she shared.

Since July 7, Da Nang has adjusted and supplemented land prices for over 3,000 roads and areas. With many projects underway in the city, the real estate market is booming. However, the fluctuating land prices, which change daily, remain a concern for many potential buyers.

The surge in real estate transactions has led to a proliferation of real estate agencies. Ms. Duong Thuy Dung, Director of CBRE Vietnam, asserted that if land prices are increasing by 20-30% overnight, it is definitely a case of artificial inflation. Therefore, buyers need to do their research and carefully consider their investment strategies to avoid getting caught at the peak and suffering losses.

The Perils of Legalized ‘Virtual’ Land Prices: As the Real Estate Market Heats Up, Homebuyers Face Challenges

Despite the lack of infrastructure in many areas, land prices remain high. Notably, there are signs of speculation and price manipulation in certain regions, where artificially inflated values are then used as a basis for official land pricing. This essentially legitimizes these “illusory prices.”

“Ho Chi Minh City Reassesses Land Prices for Three Build-Transfer Projects in Thu Thiem New Urban Area”

The three build-transfer (BT) projects in the Thu Thiem New Urban Area are undergoing a land value reassessment by the People’s Committee of Ho Chi Minh City. These projects, which were under the inspection of the Government Inspectorate, involve a reevaluation of the land already compensated to the investors.

The High Cost of Changing Land Use: A Burden on Livelihoods

“Recently, numerous households in Hanoi and Ho Chi Minh City faced challenges when attempting to change the purpose of their land use. “