According to the Ministry of Construction, there were approximately 25,294 unsold properties in the second quarter of 2025, including apartments, detached houses, and land plots. Land plots accounted for the largest proportion with 11,717 plots, remaining unchanged from the previous quarter. In contrast, the number of apartments increased significantly by 41% to 3,287 units, while detached houses saw a 9% increase to 10,290 units.

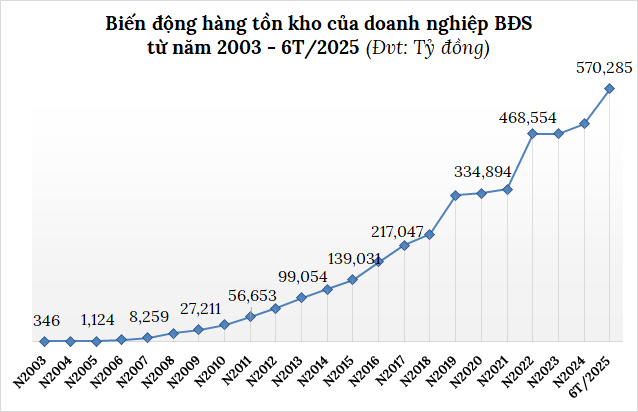

**Record-high Inventory**

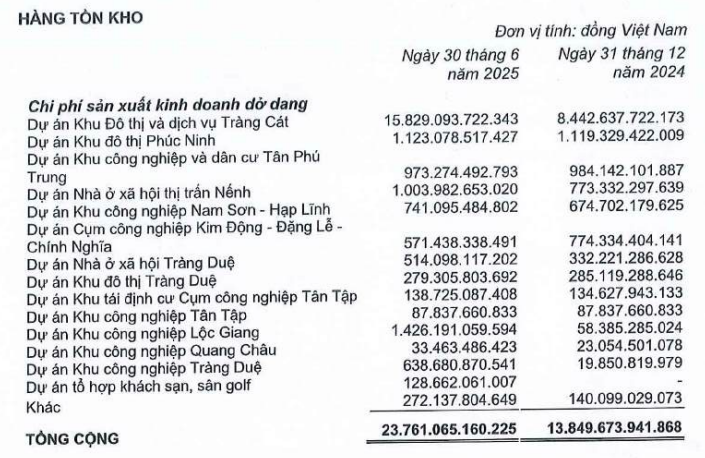

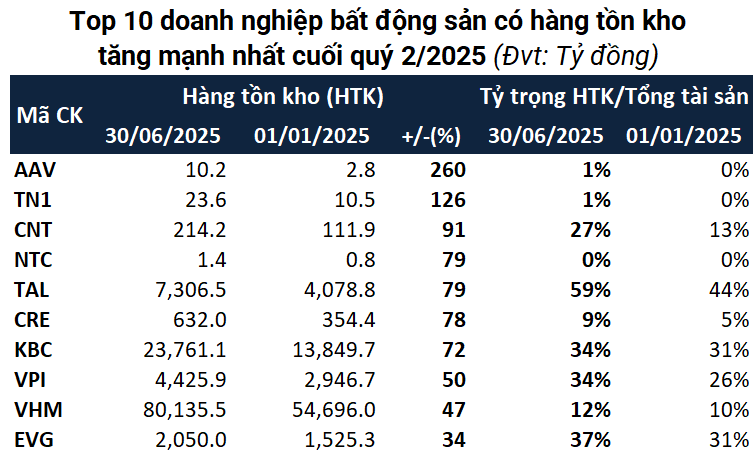

Data from VietstockFinance, aggregated from 104 companies listed on HOSE, HNX, and UPCoM in the residential and industrial real estate sectors, revealed that the inventory value at the end of the second quarter reached nearly VND 570.3 trillion, a 14% increase from the beginning of the year and the highest level ever recorded.

Source: VietstockFinance

|

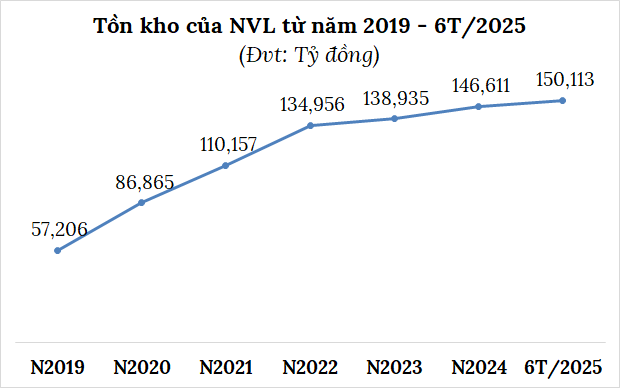

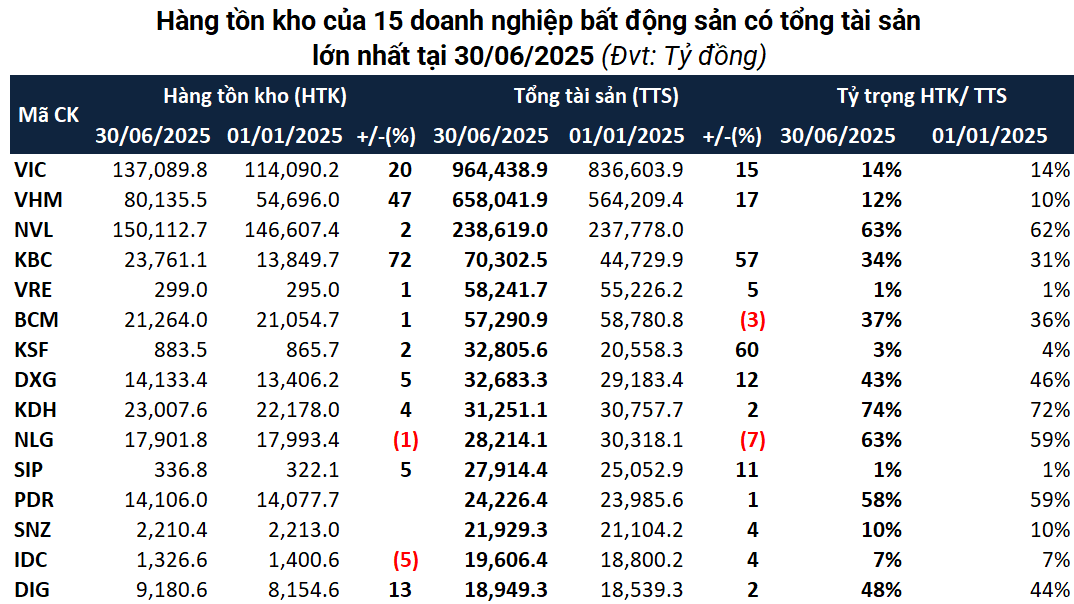

Novaland (HOSE: NVL) maintained its top position with over VND 150.1 trillion in inventory, a 2% increase from the beginning of the year, accounting for 26% of the entire industry. The majority of this value comprises real estate under construction, amounting to nearly VND 143 trillion, while completed properties account for over VND 7.7 trillion. Compared to the end of 2019, before the COVID-19 pandemic, Novaland’s inventory has more than doubled.

Source: VietstockFinance

|

Vingroup (HOSE: VIC) ranked second with nearly VND 137.1 trillion, a 20% increase from the beginning of the year. Approximately VND 83.6 trillion is invested in projects under construction, while VND 10.5 trillion is allocated to real estate ready for sale. Its subsidiary, Vinhomes (HOSE: VHM), witnessed a rapid increase with over VND 80.1 trillion in inventory, a 47% surge, mainly comprising real estate under construction, such as Vinhomes Ocean Park 2 and 3, Grand Park, and Smart City.

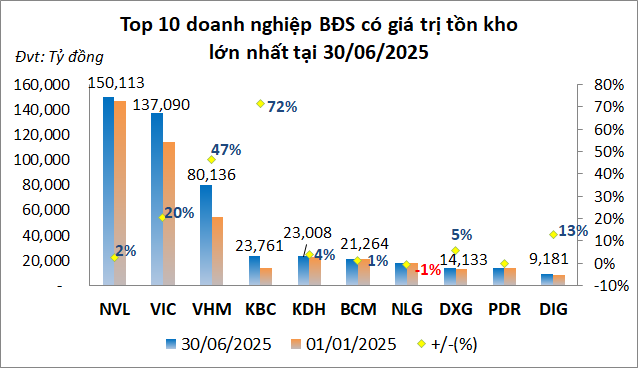

Among industrial real estate companies, Kinh Bac City Development Holding Corporation (HOSE: KBC) recorded a record-high inventory of nearly VND 23.8 trillion, a 72% increase. This surge is attributed to an 88% increase in the Tràng Cát urban and service area project, amounting to over VND 15.8 trillion. Other projects contributing to KBC’s inventory include the Phúc Ninh urban area project (over VND 1.1 trillion), the Tân Phú Trung industrial and residential area project (VND 927 billion), and the Nếnh social housing project (over VND 1 trillion).

Source: KBC

|

Becamex IDC (HOSE: BCM) reported an inventory value of nearly VND 21.3 trillion, a slight increase from the beginning of the year, mainly comprising costs related to infrastructure construction, land clearance, and land use rights.

Several other companies with inventories exceeding VND 10 trillion include Nha Khang Dien (HOSE: KDH) with over VND 23 trillion, a 4% increase; Nam Long Investment Corporation (HOSE: NLG) with over VND 17.9 trillion, a 1% decrease; Dat Xanh Group (HOSE: DXG) with a 5% increase to over VND 14.1 trillion; and Phat Dat Real Estate Development Corporation (HOSE: PDR) with over VND 14.1 trillion.

Source: VietstockFinance

|

**Businesses Struggling with High Inventory Levels**

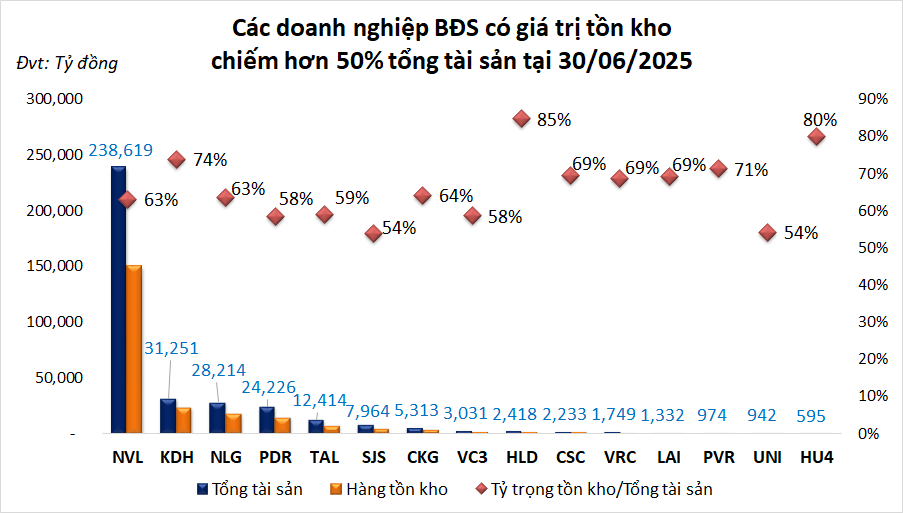

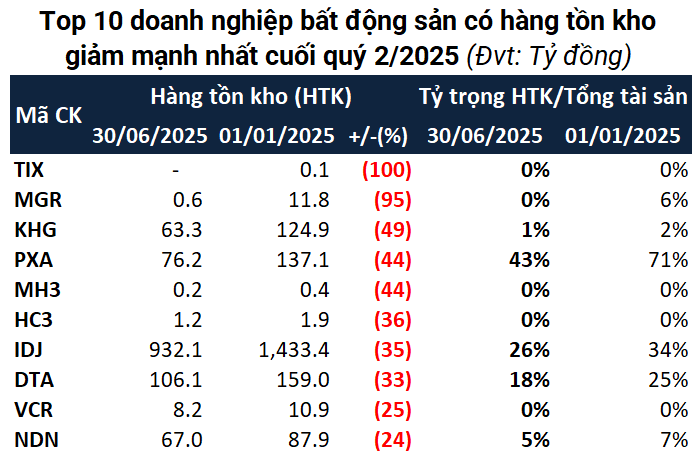

At the end of the second quarter, 15 real estate businesses had inventory levels accounting for over 50% of their total assets, mainly in the residential sector. HUDLAND (HNX: HLD) topped the list with inventory of over VND 2 trillion, a 12% increase from the beginning of the year, equivalent to 85% of its total assets.

Despite a 22% decrease, the inventory of Investment and Construction Joint Stock Company No. 4 (UPCoM: HU4) still accounted for 80% of its total assets, amounting to nearly VND 480 billion. COTANA Group (HNX: CSC) also fell into this category, with over VND 1.5 trillion in inventory, a 6% decrease from the beginning of the year, representing 69% of its total assets.

Source: VietstockFinance

|

In terms of total assets, the top three companies, VIC, VHM, and NVL, accounted for 64% of the entire industry, with a combined inventory value of over VND 367 trillion, a 16% increase from the beginning of the year. The industrial real estate group, comprising BCM, KBC, and Saigon Investment Corporation (HOSE: SIP), represented approximately 8% of the industry, with a total inventory value of nearly VND 45.4 trillion, a 29% increase from the start of the year.

Source: VietstockFinance

|

Additionally, notable fluctuations were observed in Rox Key Holdings (HOSE: TN1), with its inventory nearly doubling to reach nearly VND 24 billion. On the other hand, MGROUP (UPCoM: MGR) and Khai Hoan Land (HOSE: KHG) witnessed significant decreases of 95% and 49%, respectively, with their inventories now standing at over VND 600 million and VND 63 billion.

Source: VietstockFinance

|

Thanh Tú

– 08:12 25/08/2025

The Ultimate Guide to the Real Estate Market’s Year-End Outlook

The real estate market in 2025 is looking bright, according to experts. With positive indicators on the horizon, the latter half of the year is set to be a dynamic one, full of potential twists and turns. As we enter this pivotal period, it’s essential to recognize the diverse scenarios that could play out and the subsequent impact they may have.

“Real Estate Tycoon with Thousands of Hectares of Land, Dang Thanh Tam, Flourishes with Trump International Hung Yen Development”

The urban development giant, Kinh Bac, is projected to reach staggering figures in revenue and profit for the year 2025. According to a securities analysis by DSC, the corporation is estimated to attain a revenue of VND 6,213 billion and a profit of VND 2,054 billion. This impressive performance is attributed to the strategic launch and sale of real estate projects, which have injected significant capital into the company’s coffers.

The Second Quarter Boom for Industrial Park Businesses

The industrial real estate sector has witnessed a significant surge in land and factory rentals during Q2, resulting in substantial profit growth for numerous businesses. While some companies struggle with declining core revenues, others are reaping the benefits of this increased demand. VCI attributes this positive outlook to the influx of FDI and the expansion of land banks, anticipating continued growth in the industry.