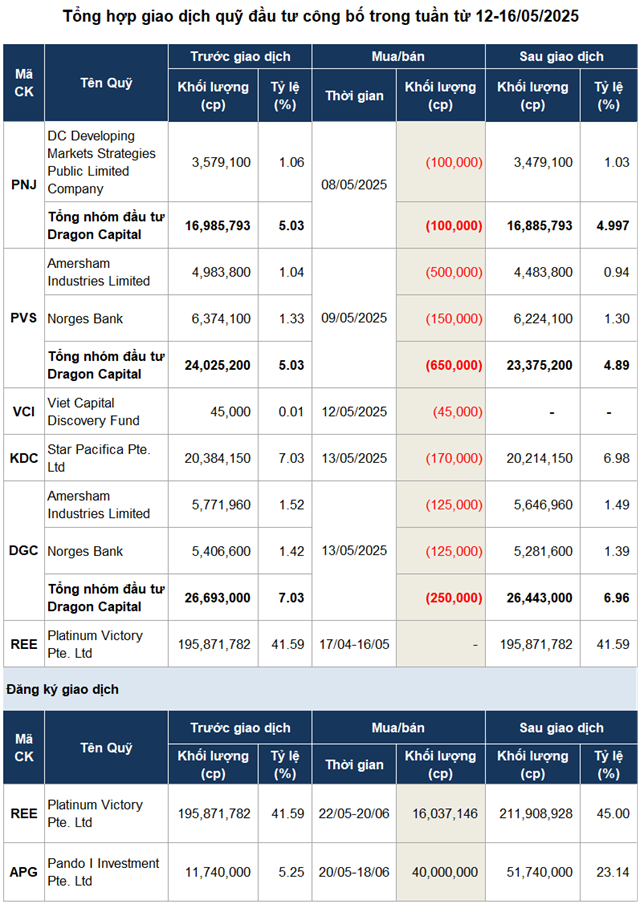

Specifically, foreign fund Dragon Capital sold 250,000 shares of DGC (Duc Giang Chemical Group) on May 13, thereby reducing its ownership stake in the company to below 7%, equivalent to just over 26.4 million shares.

It is estimated that with DGC’s closing price on that day at VND 91,600/share, Dragon Capital may have pocketed nearly VND 23 billion.

| DGC share price movement from the beginning of 2024 to May 16, 2025 |

Dragon Capital’s move comes as DGC’s share price has recovered about 25% since its low on April 9 due to tax policies.

In a similar vein, Viet Capital Discovery Fund sold all 45,000 shares of VCI (Viet Capital Securities Joint Stock Company) on May 12, no longer holding any stake in this enterprise. Meanwhile, Star Pacifica sold 170,000 shares of KDC (Kido Group) on May 13, reducing its ownership in KDC to below 7%.

| VCI share price movement from the beginning of 2024 to May 16, 2025 |

| KDC share price movement from the beginning of 2024 to May 16, 2025 |

Notably, both VCI and KDC shares have risen by approximately 17% and 3%, respectively, in the past month, since the market hit bottom and rebounded following the news of the US tariff delay.

Source: VietstockFinance

|

– 07:28 18/05/2025

The Penultimate Word-Smith: Crafting Captivating Copy

“A Member of the Board of Directors of Dat Xanh Group Accumulated 5 Million Shares”

Mr. Ha Duc Hieu, a prominent member of the Board of Directors at Dat Xanh Group, has demonstrated his confidence in the company’s prospects by significantly increasing his stake. Between May 7 and May 15, Mr. Hieu acquired an impressive 5 million DXG shares, elevating his ownership to 0.66% of the group’s capital. This substantial purchase underscores Mr. Hieu’s faith in the company’s future trajectory and potential for growth.

“Dragon Capital Increases Ownership Stake in Dat Xanh Group to Over 13%”

Dragon Capital, a prominent foreign investment fund, has successfully acquired 2.8 million DXG shares, increasing its stake in Dat Xanh Group to 13.0399%.