The USD Index (DXY) closed on May 16 with a gain of 0.56 points, settling at 100.98. This marks the fourth consecutive weekly gain for DXY, reflecting positive market sentiment towards the US dollar.

The primary driver behind the dollar’s strength stems from a joint statement between the world’s two largest economies. As a result, the retaliatory tariffs that President Donald Trump signed on April 2, imposing a 24% import tax on Chinese goods, will be delayed for 90 days. Additionally, the total import tariffs on Chinese goods will temporarily drop significantly from 145% to 30%. In response, China pledged to remove some retaliatory tariffs on US goods, reducing taxes on American products from 125% to 10%.

This agreement eases trade tensions and boosts optimistic sentiment in global financial markets, supporting the upward trajectory of the US dollar.

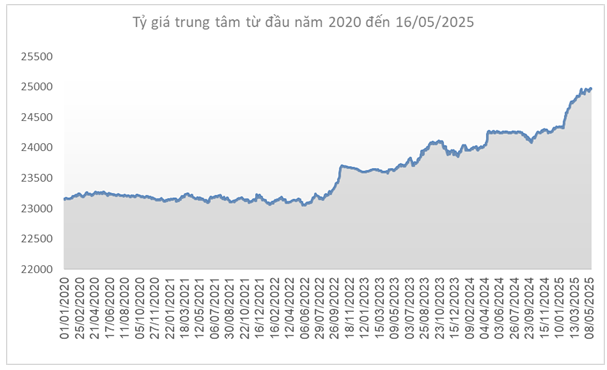

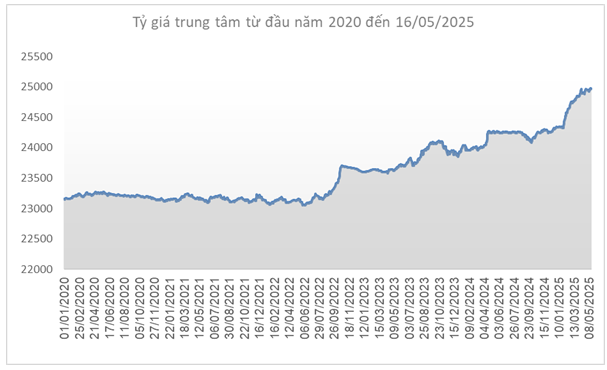

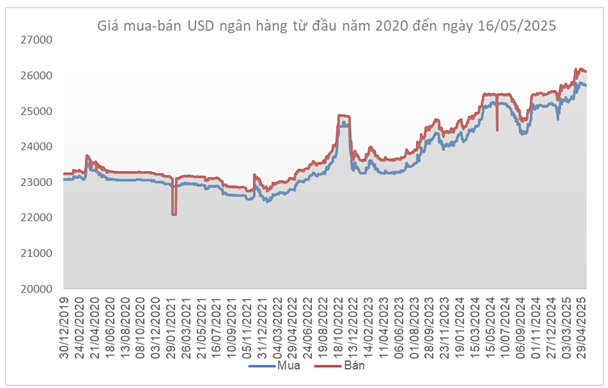

Source: SBV

|

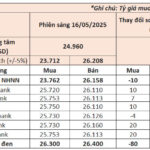

Domestically, the central exchange rate set by the State Bank of Vietnam on May 16 increased slightly by 9 units compared to the previous week, reaching 24,960 VND/USD.

With a trading margin of 5%, commercial banks are allowed to trade the USD within a range of 23,712-26,205 VND/USD.

The reference exchange rate for USD/VND at the State Bank of Vietnam’s Foreign Exchange Management Department is 23,762-26,158 VND/USD (buying-selling), an increase of 8 units on the buying side and 10 units on the selling side compared to the previous week.

Source: VCB

|

At Vietcombank, the closing exchange rate on May 16 stood at 25,720-26,110 VND/USD (buying-selling), a decrease of 30 units on both sides compared to the previous week.

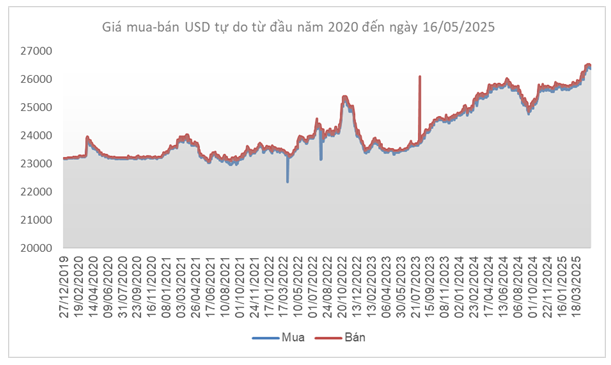

Source: VietstockFinance

|

In the free market, the USD rate increased by 25 units, trading at 26,400-26,500 VND/USD (buying-selling).

– 14:58 18/05/2025

The Greenback Slides in Vietnam

The US dollar witnessed a surprising decline at commercial banks, hovering just above the 26,000 VND mark.

The VN-Index Ticks Up 4%, But a Plethora of Stocks Soar Even Higher Since the Start of the Year, Including Billion-Dollar Market Cap Giants

Although the VN-Index has risen by less than 4% since the beginning of the year, many stocks have witnessed a remarkable surge, outperforming the index with substantial gains, and even doubling in value.