STOCK MARKET REVIEW FOR THE WEEK OF 05/12/2025 – 05/16/2025

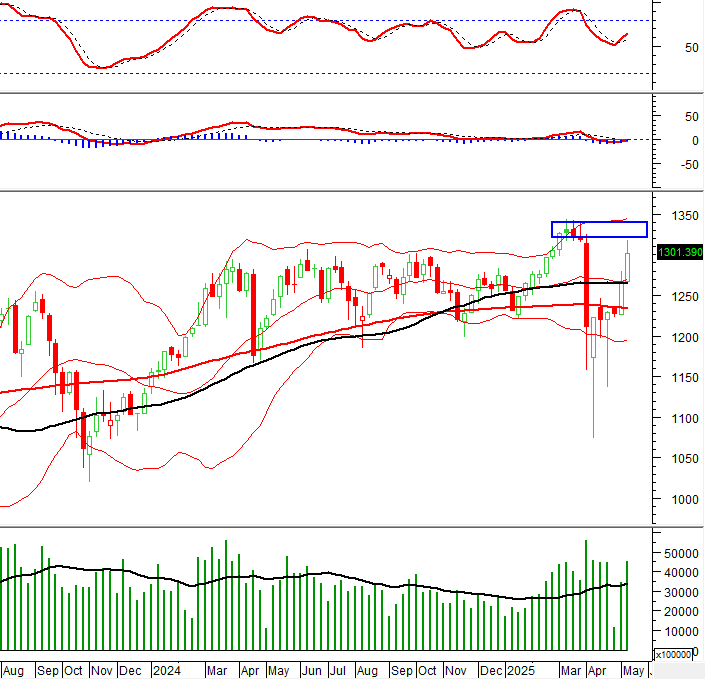

During the week of 05/12/2025 – 05/16/2025, the VN-Index continued its upward trend since breaking above the SMA 200-week moving average. Moreover, trading volume remained above the 20-week average, indicating strong participation from investors. This momentum was crucial in pushing the index beyond the 1,300-point mark. If the VN-Index can sustain these levels in the coming weeks, it may have the potential to reach the March 2025 highs (approximately 1,320-1,340 points). This range also represents the highest peak since May 2022.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – Stochastic Oscillator has given a sell signal

On 05/16/2025, the VN-Index declined after four consecutive gaining sessions, accompanied by trading volume surpassing the 20-day average, indicating investors’ cautious sentiment.

Additionally, the Stochastic Oscillator has provided a sell signal within the overbought territory, suggesting an increased possibility of a short-term downward adjustment if the indicator falls below this region in the upcoming sessions.

However, the index remains close to the upper band of the Bollinger Bands, while the MACD continues its upward trajectory after delivering a buy signal and crossing above zero, implying persistent positive prospects over the medium term.

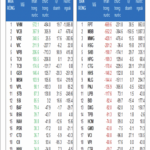

HNX-Index – Bollinger Bands are gradually expanding

On 05/16/2025, the HNX-Index witnessed a slight decline, coupled with trading volume exceeding the 20-session average, reflecting investors’ indecision.

Currently, the index remains close to the upper band of the Bollinger Bands, which are gradually widening, while the MACD is consistently expanding its gap with the signal line following a buy signal, indicating sustained positive momentum.

Money Flow Analysis

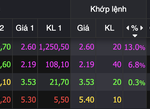

Smart Money Flow Variation: The Negative Volume Index for the VN-Index has dropped below the EMA 20-day moving average. If this condition persists in the next session, there is an increased risk of a sudden downturn (thrust down).

Foreign Money Flow Variation: Foreign investors turned to net sellers during the trading session on 05/16/2025. If this sentiment continues in the upcoming sessions, the outlook may become increasingly pessimistic.

Vietstock Technical Analysis Team

– 17:28 05/18/2025

The Flow of Funds: A Shake-Up to Re-test Old Peaks?

The exhilarating surge across the first three trading sessions of the week helped the VN-Index recoup all losses incurred from the April 3rd tax countermeasure shock. However, intense profit-taking pressure on the last trading day also signaled the market’s potential to conclude its short-term upward trend.