DKRA Consulting has released its April 2025 report on the residential real estate market in Da Nang and its vicinity, including Hue City and Quang Nam Province.

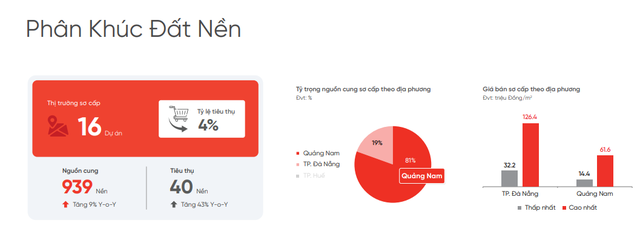

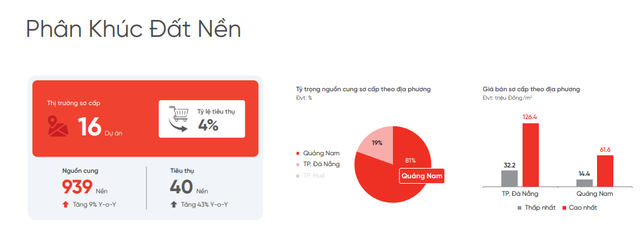

In the land segment, primary supply increased by 9% year-on-year, mainly from projects that had been launched previously. Quang Nam and Da Nang led the supply, while Hue City continued to face a scarcity of products.

Market demand remained low, with a consumption rate of about 4% of the total supply, a 43% increase year-on-year, but still weak. Secondary prices rose slightly by 2% compared to March, with liquidity concentrated in urban areas with synchronous infrastructure, full utilities, and complete legal procedures.

According to DKRA, primary land prices in Da Nang ranged from VND 32.2 million/sq m to VND 126.4 million/sq m. In Quang Nam, prices started at VND 14.4 million/sq m and peaked at VND 61.6 million/sq m.

For the apartment segment, primary supply decreased by 14% year-on-year, concentrated in Da Nang, Hue, and Quang Nam. The primary consumption rate reached 13% of the supply, with most sales coming from projects that had been launched previously.

The primary supply of apartments was mainly in Son Tra District, Da Nang, accounting for 32.8% of the total primary supply in the market. There were no significant changes in primary and secondary apartment prices, and secondary liquidity focused on projects that had been handed over, conveniently connected to the city center.

In April 2025, primary apartment prices in Da Nang by district were as follows: In Hai Chau District, prices ranged from VND 35 million/sq m to VND 175 million/sq m; in Son Tra District, the lowest price was VND 57 million/sq m, and the highest was VND 118 million/sq m; in Ngu Hanh Son District, prices ranged from VND 27 million/sq m to VND 109 million/sq m; and in Lien Chieu District, the lowest price was VND 26 million/sq m, and the highest was VND 64 million/sq m.

DKRA expects an increase in supply in the coming months, especially in June 2025, as several apartment projects in Da Nang are currently in the marketing and booking stages.

Meanwhile, in the villa/townhouse segment, primary supply increased slightly by 0.3% year-on-year, mostly from existing inventory, while new supply remained scarce, accounting for only 2% of the total supply.

Market demand improved year-on-year but remained low. Transactions were mainly in large-scale projects with clear legal procedures and prices ranging from VND 25-30 billion/unit in Da Nang and VND 3-7 billion/unit in Quang Nam and Hue.

Hue City dominated the supply, contributing 46% of the total market supply, while Da Nang led in consumption, accounting for 47%.

Primary prices remained stable, with no significant changes year-on-year. Developers continued to offer attractive incentives such as bank loan support, interest rate incentives, and grace periods to improve liquidity.

Secondary price levels continued the horizontal trend from the end of last year but showed a slight decrease of 4% year-on-year, mainly in the group of projects that had been implemented for many years, with slow construction progress and incomplete legal procedures.

The resort villa segment continued to experience a decrease in primary supply, with a drop of about 3% year-on-year. Most of the current supply comes from the inventory of old projects, while new supply has been absent for the past three years.

For condotels, according to DKRA, primary supply continued to decline, with a decrease of about 1% year-on-year, and new supply has been scarce in the past year. The market remained subdued, with liquidity challenges, and no transactions were recorded in the past month. Quang Nam and Da Nang continued to lead the market, accounting for 93% of the total supply in the region.

The condotel market is expected to face difficulties and challenges due to the unclear legal framework for this segment, low liquidity, and declining investor confidence, hindering the market’s short-term recovery…

The Unending Saga: $10 Million Bridge Project Remains a Distant Dream

The Tam Tien Bridge and approach road project, with a total investment of VND 220 billion, has been left hanging over the river since its commencement in 2019, much to the dismay of the people of Nui Thanh District, Quang Nam Province.

Millennials Hesitant to Buy Homes in Outer Suburbs Due to Skyrocketing Prices

The young, a key demographic in the housing market, are facing challenges in finding affordable accommodations as apartment prices in suburban districts surrounding Hanoi have surged to over 50 million VND per square meter.