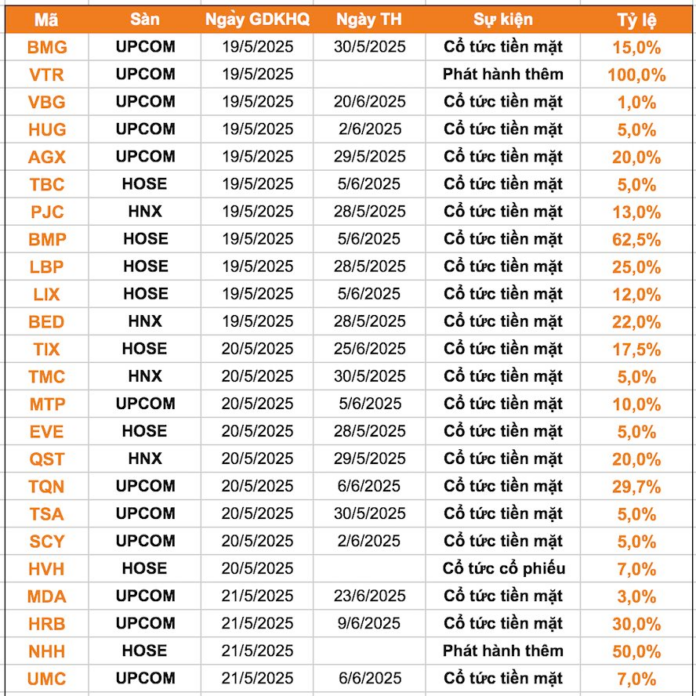

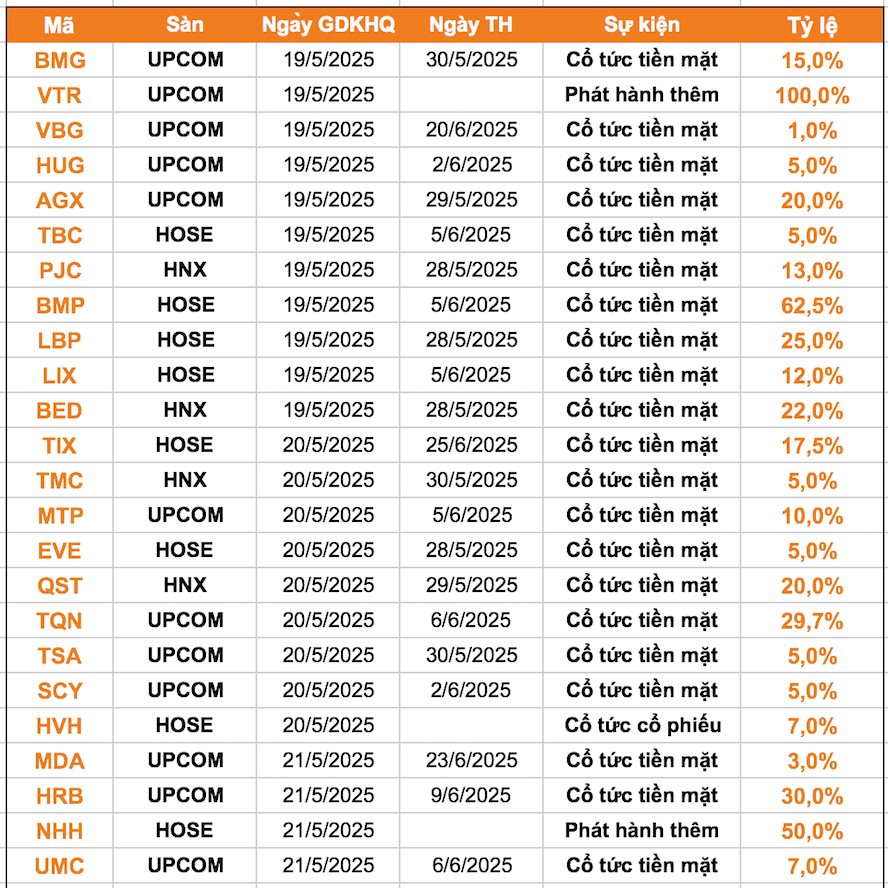

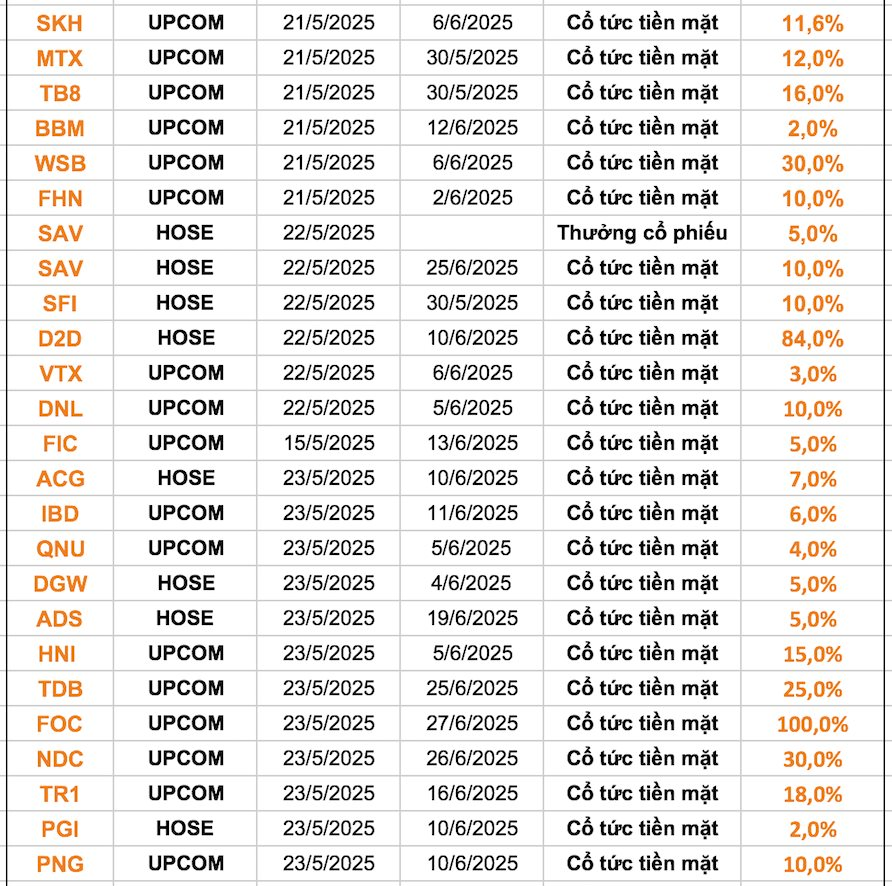

This week, 51 companies announced dividend closures for the week of May 19-24, with 46 companies paying cash dividends ranging from 1% to 100%. Additionally, one company paid stock dividends, two companies issued additional shares, and two companies paid mixed dividends.

Vietnam Tourism and Transportation Marketing Joint Stock Company (Vietravel, code: VTR) has announced a public offering of shares. The last day to close the right to buy additional shares is May 20, 2025. The subscription and payment period is from May 26, 2025, to July 7, 2025.

According to Vietravel’s disclosure, the number of shares offered is 28,658,247 shares, with an offering price of VND 12,000/share, corresponding to a total capital mobilization of approximately VND 344 billion.

The distribution method is an offering to existing shareholders at an exercise ratio of 1:1. The additional shares issued to existing shareholders are common shares and are not restricted from transfer. Any remaining shares that are not distributed to existing shareholders will be offered to other investors and these shares will be restricted from transfer for one year from the date of completion of the offering in accordance with regulations.

Saigon – Mekong Beer Joint Stock Company (code: WSB) will close the dividend payment of VND 3,000/share on May 22. The ex-dividend date is May 21, and the expected payment date is June 6.

This is the remaining payment in the total 2024 dividend of VND 5,000/share – the highest ever, exceeding the initial plan (40%).

With 14.5 million shares outstanding, WSB needs to pay approximately VND 43.5 billion for this period. Previously, the Company had advanced VND 2,000/share, bringing the total dividend payment for 2024 to VND 5,000/share – the highest in history, equal to 2019 and 2020.

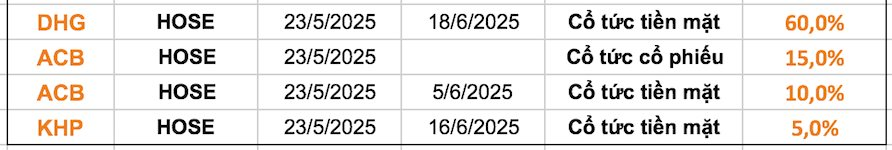

Hau Giang Pharmaceutical Joint Stock Company (code: DHG) recently announced that May 26, 2025, will be the record date for shareholders to receive 2024 dividends.

Accordingly, the company will pay dividends in cash at a rate of 60% (equivalent to VND 6,000 per share). The payment date is June 18, 2025.

Thus, with more than 130.7 million shares outstanding, Hau Giang Pharmaceutical will spend nearly VND 784.5 billion to pay dividends to shareholders from after-tax profit not yet distributed in the audited financial statements for the year 2024 and after-tax profit not yet distributed from the reinvestment fund.

FPT Online Service Joint Stock Company (FOC) has just announced the record date for receiving 2024 cash dividends at a rate of 100% – the highest rate since 2021, equivalent to a budget of nearly VND 185 billion. May 23 is the ex-dividend date. The expected payment date is June 27.

FPT currently holds 23.86% of FOC’s capital – equivalent to receiving more than VND 44 billion; while FPT Telecom (FOX) owns 56.51% – equivalent to receiving nearly VND 105 billion.

Asia Commercial Joint Stock Bank (ACB, code: ACB) has just announced that May 26, 2025, is the record date for receiving 2024 dividends in cash and shares. The ex-dividend date is May 23, 2025.

Accordingly, ACB shareholders will receive cash dividends at a rate of 10% (one share receives VND 1,000). The amount of money that ACB expects to use to pay dividends is VND 4,467 billion. Dividends will be paid on June 5, 2025.

For the dividend component in shares, ACB plans to pay a dividend rate of 15% (holding 100 shares will receive 15 new shares). The time of implementation of dividend payment in shares has not been announced.

The Value Investing Strategy is “Making a Comeback”

Warren Buffett, the greatest investor of all time, has just announced his retirement, shocking the value investing community. But they have bigger problems to worry about. Their favored investment style has been out of favor for years, and their clients are growing impatient. In a world where the US stock market consistently outperforms, low-cost passive funds seem like the sensible option.

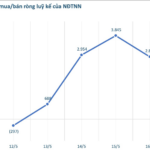

The Flow of Funds: A Shake-Up to Re-test Old Peaks?

The exhilarating surge across the first three trading sessions of the week helped the VN-Index recoup all losses incurred from the April 3rd tax countermeasure shock. However, intense profit-taking pressure on the last trading day also signaled the market’s potential to conclude its short-term upward trend.