The financial reports for Q1 2025, released by banks at the end of April, paint a positive picture of credit growth from the very start of the year. Contrary to previous years, when the first quarter usually saw low growth due to seasonal factors and a wait-and-see approach to policies, this year, many banks proactively pushed for early loan growth. Data shows that both state-owned and private banks achieved positive credit growth. Notably, about six banks reached a growth rate of around 9% – double the industry average.

Meanwhile, the retail banking group improved credit growth compared to the same period last year, but the momentum did not come from consumer credit as expected. Instead, the positive results mainly stemmed from a diversification strategy in their loan portfolios, with an increase in the proportion of loans to the production and non-personal consumption trading sectors. This indicates that the recovery in consumer credit is still unclear and may need more time in the coming quarters for verification. Notably, at the 2025 Annual General Meeting of Shareholders, many retail banks still set high credit growth targets, reflecting their expectation that the consumption sector will soon play a more significant role in the overall growth of the entire system.

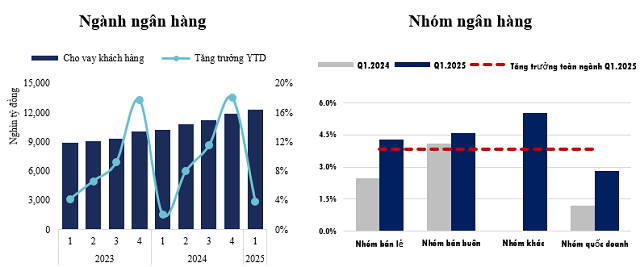

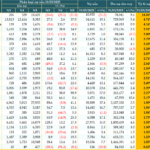

Credit growth of the banking sector in Q1 2025

According to data from the State Bank of Vietnam, the credit growth of the entire system in the first three months of 2025 reached 3.93%, significantly higher than the 1.42% recorded in the same period last year. Based on the financial statements of 27 listed commercial banks, total outstanding loans to customers increased by approximately 3.82% from the beginning of the year, equivalent to nearly VND 452,500 billion in additional disbursements, bringing the total outstanding loans of the group to nearly VND 12.3 quadrillion. This development indicates that credit in the first quarter of this year has had a very positive start.

The reason lies in the difference in growth allocation: while in previous years, the fourth quarter was usually a period of concentrated growth efforts, resulting in a slower first quarter, 2024 witnessed a more stable credit growth momentum throughout the year. As a result, entering Q1 2025, banks did not need to compensate as before and could maintain a steady pace of credit expansion from the outset.

|

Chart 1: Credit Growth of the Banking Sector compared to the End of the Year (YTD Growth)

Source: Consolidated

|

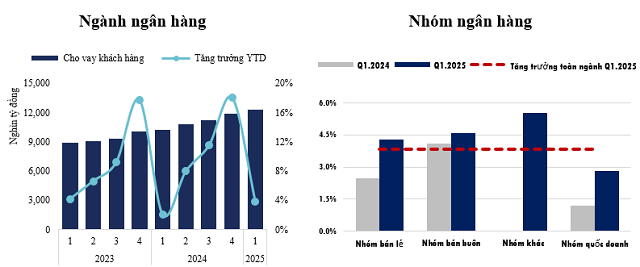

Looking at each group of banks, credit growth in Q1 2025 was relatively evenly distributed among the groups, unlike the clear differentiation of the previous two years. Chart 1 shows that most banks had a credit balance growth of around 5% compared to the beginning of the year. In contrast, in 2023 and 2024, the gap between the groups usually ranged from 1.5 to 2%. Notably, the state-owned bank group achieved the lowest growth rate of about 2.8%. However, this does not reflect inefficiency but rather their cautious approach, aligning with the goals set at the 2025 Annual General Meeting of Shareholders – focusing on risk management, bad debt handling, and improving asset quality, thereby continuing to play a stabilizing role in the system.

On the other hand, private banks took the lead in driving credit growth for the industry in the first quarter. Notably, the gap between the wholesale banking group and the retail banking group narrowed significantly: the wholesale group achieved a growth rate of 4.6%, while the retail group reached 4.3%. Additionally, the group of small-scale banks, which had previously experienced slow growth in Q1 of the past two years, witnessed a strong breakthrough with a growth rate of 5.5% in the first quarter of this year, compared to only 1.5% in 2023 and almost no growth in the same period in 2024.

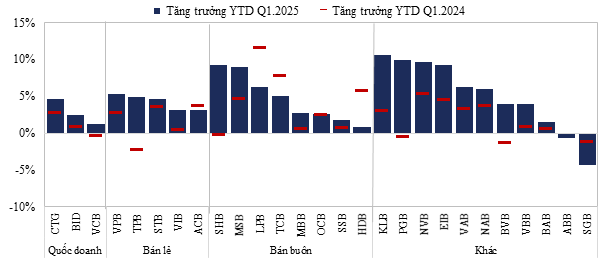

Credit growth dynamics of banks in Q1 2025

Given the surprisingly favorable credit growth in Q1, the question arises as to which bank group has primarily contributed to this outcome. In the state-owned bank group, BID and CTG stood out with significantly improved credit growth rates of 2.5% and 4.6%, respectively, far surpassing the low base of the same period in 2024. According to BID’s outstanding loan report by industry, the processing industry and services played a dominant role, while wholesale and retail lending recorded negative growth. VCB, although achieving the lowest growth rate of 1.2% among state-owned banks, still demonstrated a considerable improvement compared to the negative growth in the first quarter of last year, reflecting positive developments in its credit activities.

In the retail banking group, the recovery picture becomes even clearer as most banks recorded outstanding growth compared to the previous year. Banks such as VPB, TPB, and VIB, which had faced low-growth pressure in Q1/2024, experienced a strong turnaround in the past quarter. However, a deeper analysis by industry reveals that the growth momentum mainly stemmed from their portfolio diversification strategies, with the processing industry and wholesale and retail sectors being the positive growth areas. In contrast, consumer credit – the core business of many retail banks – has not shown clear signs of recovery, indicating that credit growth in this segment still needs time to rebound.

|

Chart 2: Credit Growth of Banks in Q1/2025 compared to the End of 2024

Source: Consolidated

|

In the wholesale banking group, SHB and MSB stood out with exceptional credit growth rates, both surpassing 9%, significantly higher than the industry average. The growth drivers for these two banks differed markedly: SHB mainly expanded its outstanding loans in the wholesale and retail sectors and real estate business lending, while MSB focused on industries such as mining, finished steel production, and light industrial goods trading. LPB and TCB also maintained stable growth momentum with rates of 6.2% and 5.1%, respectively. In contrast, HDB achieved a modest growth rate of 0.8%, a significant decrease from the 5.8% recorded in the previous year. This is largely related to the slowdown in consumer credit, which accounts for nearly one-third of the bank’s loan portfolio, significantly impacting HDB‘s overall results.

Notably, among the other small banks, there was a clear differentiation in growth results. Some banks, such as KLB, PGB, NVB, and EIB, recorded impressive growth rates of over 9%. While not all banks disclosed their loan portfolio structure by industry, the publicly available data from KLB and PGB showed that the increase in outstanding loans mainly focused on the wholesale, retail, and construction sectors. In contrast, some banks, such as ABB and SGB, recorded negative credit growth, repeating the pattern of the previous year, reflecting the seasonal nature and characteristics of this group of banks.

The credit growth in Q1/2025 reflects a recovery trend in the industry, but with varying degrees across segments. Although retail credit is expected to become a growth driver this year, enterprise credit – particularly in the industrial, wholesale, and retail sectors – played a dominant role in the first quarter. However, with many retail banks setting high loan growth targets for 2025, it is evident that consumer credit is still anticipated to be the key to unlocking the pressure on credit growth and promoting economic development in the coming period.

Le Hoai An, CFA – Nguyen Thi Ngoc An, HUB

– 10:00 19/05/2025

“Profit-Taking Pressure Mounts, Blue Chips Push VN-Index Down to Near 1,300 Points”

The sell-off by both domestic and foreign investors dominated Friday’s session, with the stock market breadth heavily skewed towards decliners. Foreign investors withdrew nearly VND 957 billion net, following three consecutive net buying sessions, and sold particularly heavily in the VN30 basket, offloading VND 1,127 billion. Only a few large-cap stocks managed to keep the VN-Index afloat, while banking stocks witnessed a steep decline across the board.

The End of Easy Profits: What’s Next for Banks to Sustain Profitability?

In the first quarter, banks navigated a challenging environment marked by a continuing compression in net interest margins (NIM). Lending rates were lowered to support the economy, while funding costs remained relatively high to attract deposits. This squeeze on interest rate margins impacted the core income stream from credit activities, directly affecting the bottom line of banking institutions.

Market Pulse, May 15: Real Estate Pressures Mount, But Banking Sectors Come to the Rescue

The VN-Index demonstrated its resilience in the face of morning pressures, with the critical 1,300 level providing excellent support as buying interest emerged. The index rebounded to close at 1,313.2 points, a gain of 3.47 points. The contrasting performances of the two large-cap sectors, banking, and real estate, were the highlight of the session.

Is There an End in Sight to the Declining Interest Rates?

According to analysts, deposit interest rates have continued their downward trend, albeit at a slower pace. It is predicted that input interest rates will gradually increase towards the end of the year, with expectations of positive economic growth and credit growth reaching or even surpassing the set target of 16%.