According to the resolution of the Board of Directors, June 10, 2025, is the record date for shareholders to receive a 5% cash dividend for the fiscal year 2024, and June 20, 2025, is the payment date for securities holders.

At the 2025 Annual General Meeting of Shareholders (AGM) held in April, SHB’s leadership emphasized their readiness and proactive approach to distributing dividends as early as possible. SHB is a customer-centric and market-driven bank that always ensures the interests of its shareholders and investors.

With over 1,500 shareholders and proxies attending the AGM out of more than 100,000 shareholders, SHB is one of the companies with the highest attendance on the market, demonstrating investors’ interest and trust in the bank. Shareholders expressed their delight with SHB’s business results and consistent annual dividend policy, offering attractive rates in both stocks and cash.

Shareholders also showed strong confidence in the bank’s strategic objectives, governance, and management. They believe in SHB’s long-term growth potential, credibility, and market position. Additionally, SHB’s community initiatives, such as COVID-19 prevention, supporting the eradication of temporary housing nationwide, social welfare, and sponsoring the Vietnamese football team’s victory in the 2024 ASEAN Cup, have left a strong impression on shareholders.

In the stock market, statistics show that SHB’s share price has increased by over 40% since the beginning of the year. It is one of the most liquid stocks in the market, with an average volume of over 83 million shares traded per session in the past month. The appeal of SHB shares is evident in the eyes of foreign investors, as reflected in their net buying of SHB shares in the highest volume ever.

For the fiscal year 2025, SHB aims to surpass VND 832,000 billion in total assets. The bank targets a pre-tax profit of VND 14,500 billion, a 25% increase from 2024. Credit growth is projected at 16%, while non-performing loan ratios are tightly managed below 2%. As of the first quarter of 2025, SHB’s total assets reached VND 790,742 billion, a 6% increase from the end of 2024. Credit balance stood at VND 575,777 billion, a 7.8% increase, focusing on investments in key production and business sectors and industries with high growth potential aligned with the sustainable development orientation of the economy. Pre-tax profit for the first quarter reached nearly VND 4,400 billion, achieving 30% of the full-year plan. This growth demonstrates SHB’s solid internal capacity and a favorable foundation for breakthrough growth targets. SHB is also among the Top 5 private banks and Top 15 private enterprises contributing the most to the state budget.

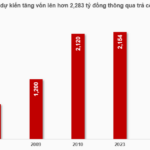

SHB plans to increase its charter capital to VND 45,942 billion, maintaining its position in the Top 5 largest private banks in Vietnam. The bank is also finalizing the necessary documentation and procedures for the issuance of bonus shares as a dividend for 2024, with a proposed ratio of 13%. The expected dividend payout ratio for 2025 is 18%.

SHB sets a target for 2026 to become a bank with total assets of VND 1,000,000 billion, marking a significant step forward in its market position in the domestic and regional financial markets.

Recently, Fitch Ratings announced SHB’s first-time international credit rating. The bank received a Long-Term Issuer Default Rating of ‘BB–’ with a Stable Outlook, placing it among the top-rated banks. Fitch is one of the world’s leading credit rating agencies, and this rating affirms SHB’s reputation and financial strength in the international market while reflecting its solid financial foundation and stable profitability.

Committed to sustainable, safe, and efficient development, SHB continuously enhances its governance capabilities according to international standards and adopts a modern model. The bank implements rigorous risk management policies, maintains adequate capital adequacy ratios, and complies with the State Bank of Vietnam’s regulations, adhering to Basel II and III standards.

For the period of 2024-2028, SHB has set a strategic goal to become the Top 1 bank in terms of efficiency, the most favored digital bank, and the best retail bank. Simultaneously, SHB aims to be a leading provider of capital, financial products, and services to strategic private and state-owned enterprises with supply chains, value chains, and ecosystems, focusing on green development. By 2035, SHB envisions becoming a modern retail bank, a green bank, and a leading digital bank in the region.

Moreover, SHB is undergoing a comprehensive transformation based on four pillars: reforming mechanisms, policies, regulations, and processes; valuing human capital; customer-centricity and market orientation; and modernizing information technology and digital transformation. SHB remains steadfast in its commitment to six core cultural values: “Heart – Trust – Faith – Wisdom – Intelligence – Vision.”

As SHB embarks on a new era, it continues to safeguard the interests of its shareholders, care for its employees, and bring prosperity to its customers, shareholders, partners, investors, employees, and the broader society and community.

– 10:55 19/05/2025

“Agriseco Prepares to Release Nearly 13 Million Shares as Dividends, Boosting Capital to Over VND 2,283 Billion”

AgriBank Securities Joint Stock Company (Agriseco, HOSE: AGR) is pleased to announce a dividend payout for the year 2024 in the form of a stock dividend. Over 12.9 million new shares will be issued, entitling shareholders to a dividend ratio of 100:6. This equates to a total value of over VND 129 billion. The ex-dividend date is set for June 2nd, 2024.

Billionaire Nguyen Thi Phuong Thao’s Airline to Deploy 50 Boeing 737 Aircraft to Vietjet Thailand

Let me know if you would like me to tweak it further or provide additional content suggestions.

“Vietjet Thailand is thrilled to announce the delivery of its first aircraft in October 2025. This marks a significant milestone in the airline’s expansion plans, enabling us to strengthen our domestic and international flight network. With these new aircraft, we aim to offer our passengers enhanced connectivity and an unparalleled travel experience.”

“High-Speed Revolution: Embracing VinSpeed’s Vision for Vietnam’s Railway Future”

“Professor Bui Quang Tuan, Vice President of the Vietnam Economic Science Association and former Director of the Vietnam Institute of Economics, asserts that VinSpeed’s proposal to invest in a high-speed rail link between the North and South is a positive signal. It demonstrates the private sector’s pioneering spirit in strategic infrastructure projects. With high hopes, this project will create a backbone to pave the way for Vietnam’s high-growth phase.”