Today’s recovery attempts fell flat, despite VIC and VHM’s efforts to push prices higher. The ‘green shell’ didn’t last long as a large volume of T+ stocks hit the market, indicating a significant shift in supply and demand dynamics, especially with no new supportive information.

Even though the VNI showed a climbing rhythm and surpassed the reference price in the morning, the breadth was still overwhelmingly on the decline. The stocks reflected a different picture from the index, indicating that selling pressure persisted even as the index rose. By the afternoon, the pressure to cut losses increased, and VIC’s efforts to maintain its ceiling price were futile.

The VNI’s loss of the 1300-point mark today was, in fact, worse than expected, considering the strength of VIC and VHM. Additionally, too many stocks declined, with a large number falling more than 1% after a sharp drop last weekend. The situation now is a crucial change in supply and demand, especially without any new supportive information.

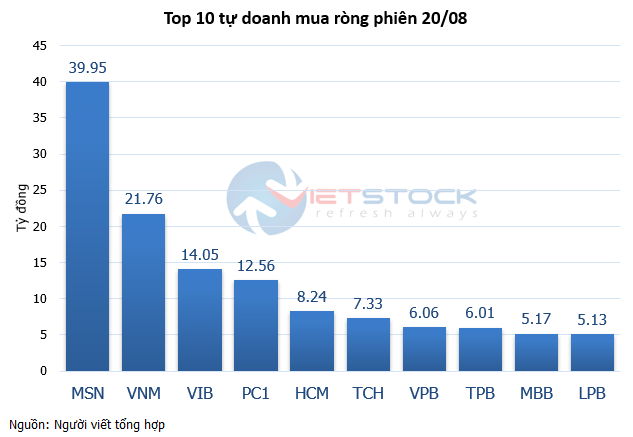

The matched order liquidity of the two floors remained equivalent to the previous weekend session, at about VND 20.6 thousand billion, excluding agreements. This is quite high, and the widespread decline in stocks confirms the pressure to narrow the portfolio. This is understandable, as profits have been good, and the market has not been strong enough to peak; thus, selling partially and waiting to buy again or restructuring to other stocks is not a bad choice. The market has already discounted all the risks and expectations at the present.

In the context of nothing new, short-term transactions are likely to push the market into a state of differentiation due to revolving money flow. With the weakening of the pillar and relying only on VIC and VHM, the index may decrease slowly, but individual stocks may open prices quickly when investors decisively change their holdings. Many codes today fell by more than 2% with very high liquidity, confirming decisive selling actions.

Now, instead of focusing on the index, it’s crucial to pay attention to the performance of individual stocks in your portfolio. There will undoubtedly be strong stocks with potential for further gains or sideways accumulation, but there will also be stocks undergoing significant adjustments. Therefore, effective portfolio management strategies will help optimize capital, even if the entire portfolio consists of high-quality stocks.

This adjustment phase is not expected to be strong or cause significant damage but is rather a normal effect of capital flow dynamics. A slight retreat in prices will attract buying interest, creating a more stable foundation. Currently, trade negotiations are approaching crucial weeks, and as no one can predict the outcome with certainty, capital flow is unlikely to be overly enthusiastic as before. A state of fluctuating sideways with low liquidity is not necessarily negative, as it also signals a risk assessment perspective aligned with the current situation.

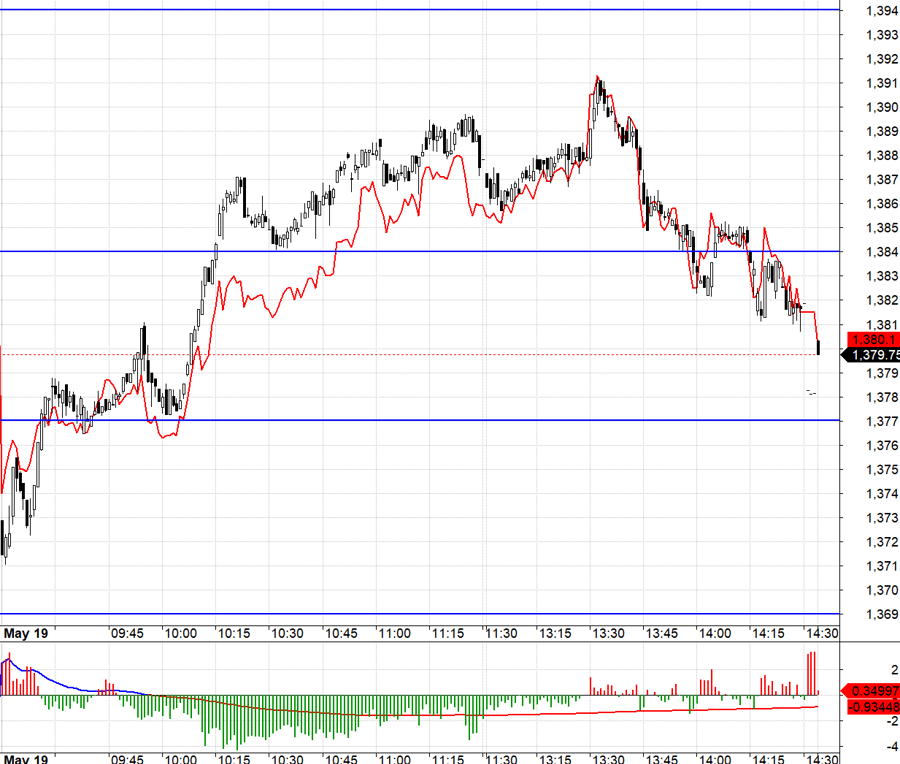

The futures market fluctuated significantly today, mainly due to the VN30 pillar stocks. The positive was that the F1 basis was narrow, so going long or short was not too disadvantageous. VN30 fell to near 1369.xx at the beginning of the session and then rebounded to hover around 1377.xx. That was a good time to go long with a negligible basis and a stop-loss determined for VN30 in case it turned and pierced 1377. The subsequent upward movement was supported by VIC, FPT, and a few major recovering banks. VN30 even rose above 1384.xx but failed to reach 1494.xx. In the afternoon, a large volume of selling pressure caused all stocks except VIC to turn negative intraday. However, shorting was ineffective as VN30 pierced 1384.xx near the end of the session, and there wasn’t much room to fall further.

Selling pressure in the spot market is showing signs of increasing, and investors are willing to accept lower prices. This portfolio restructuring process is not yet complete. The most likely scenario is that the market will gradually slide with alternating rising and falling sessions and weakening liquidity. The phase of transitioning to a sideways market with small fluctuations and low liquidity is an opportunity to choose when to cover stocks again. The strategy remains to wait and buy, going long or short with futures contracts.

VN30 closed today at 1379.75. The next resistance levels are 1384, 1394, 1400, 1407, and 1416. Support levels are 1377, 1367, 1362, 1351, 1345, and 1334.

“Blog Securities” is personal and does not represent the opinions of VnEconomy. The views and assessments are those of the individual investors, and VnEconomy respects the author’s views and writing style. VnEconomy and the author are not responsible for any issues arising from the investment views and opinions published.

Market Beat: VN-Index Fails to Hold 1,300 Points

The market closed with the VN-Index down 5.1 points (-0.39%) to 1,296.29, while the HNX-Index fell 1.45 points (-0.66%) to 217.24. The sell-side dominated today’s trading with 452 declining stocks versus 287 advancing stocks. Within the VN30 basket, 24 stocks decreased, 4 increased, and 2 remained unchanged, resulting in a sea of red.

The Stock Market Soars: Vietnam Index Breaks 1,300 Points, but Why Are Investors Still Wary?

The stock market has staged a remarkable rebound following the tariff-induced tumble, but many investors are still licking their wounds, with portfolios bearing the scars of recent losses.

The Value Investing Strategy is “Making a Comeback”

Warren Buffett, the greatest investor of all time, has just announced his retirement, shocking the value investing community. But they have bigger problems to worry about. Their favored investment style has been out of favor for years, and their clients are growing impatient. In a world where the US stock market consistently outperforms, low-cost passive funds seem like the sensible option.