Bian Ximing is a reclusive Chinese billionaire. He rose to prominence by making a fortune through astute gold transactions. Now, Bian Ximing has become China’s largest copper buyer, betting nearly $1 billion on the copper market amid escalating US-China tensions.

Bian Ximing first made his mark in plastic pipe manufacturing and then chose a reclusive life in Gibraltar. Over the past two years, he has made waves in the market by betting on gold futures in China, predicting a decline in the world’s reliance on the US dollar and concerns about inflation. His investment fund entered the market just as gold began its record-breaking rally, raking in a whopping $1.5 billion in profits, according to Bloomberg’s calculations.

Bian Ximing during a visit to a Zhongcai factory in Zhejiang province in 2018, according to the company’s WeChat account. Source: Zhongcai Merchants Investment Group Co./WeChat

|

Currently, with trade tensions and uncertainties over a potential truce rattling the markets, Bian and his brokerage firm, Zhongcai Futures Co., hold the largest net long position in copper contracts on the Shanghai Futures Exchange. According to insider sources and exchange data, after ten months of active accumulation, as of last Friday, they held nearly 90,000 tons of copper in futures contracts, including Bian’s personal investments and funds he manages through Zhongcai, far surpassing any other player in the market.

Much of Zhongcai’s current copper speculative position is Bian’s personal money, and at 61, he remains committed to this investment despite some other investors pulling back due to geopolitical concerns, according to inside sources. This move reflects his strong belief in the potential of copper and the resilience of the Chinese economy, the world’s largest consumer of the metal. These sources requested anonymity as the information is confidential.

“This is a very special copper investment position, worth watching,” commented Li Yiyao, vice president of Cofco Futures’ Shanghai North Bund branch. “It reflects a long-term optimistic view based on fundamentals, which is different from the short or medium-term strategies commonly seen in the market.” She also emphasized that Bian’s steadfastness in maintaining his position amid market chaos and investor flight is noteworthy.

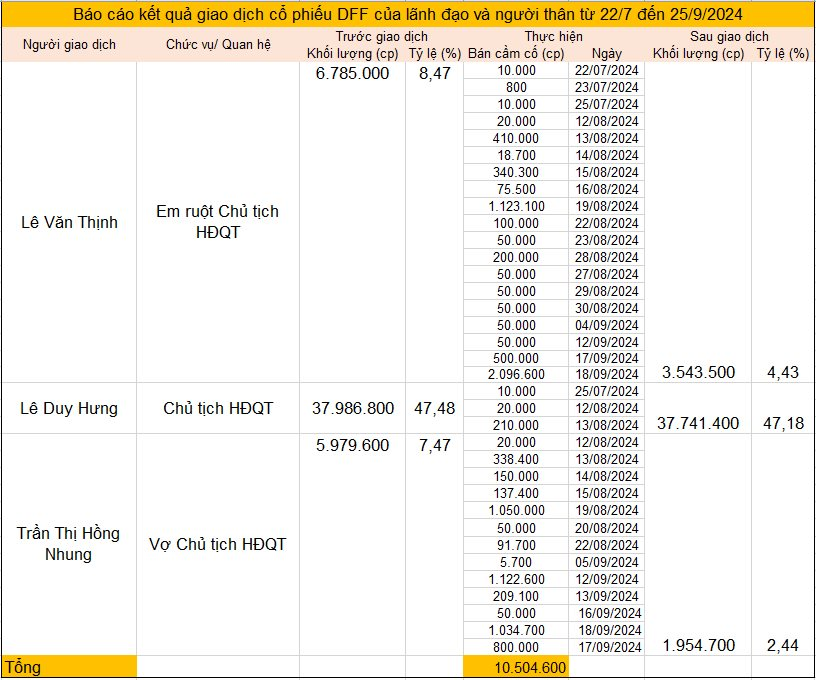

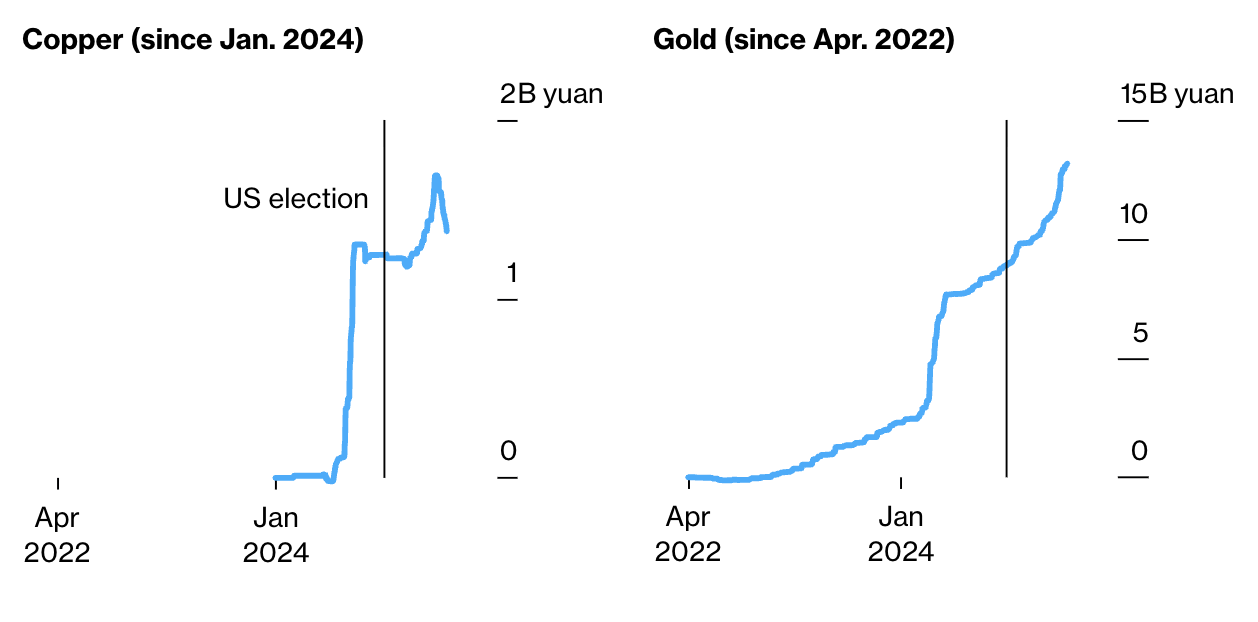

Big Bets on Copper

The amount of copper buy positions managed by Zhongcai has soared since the end of 2024.

In the two decades of China’s economic boom, only a handful of “giants” have shaped the commodity trading landscape, altering market dynamics. Bian Ximing is now ranked alongside illustrious names like Xiang Guangda (the nickel king of Tsingshan), He Jinbi (founder of Maike Metals, now missing), and Ge Weidong (founder of China’s first commodity hedge fund, Shanghai Chaos Investment).

Although not a traditional trader, Bian is respected by rivals and colleagues for his deep understanding of the enigmatic Chinese commodity market for international investors.

According to those who know him, the billionaire stands out for his humble, straightforward character and discreet lifestyle. He manages his team and the brokerage firm he took over more than 20 years ago mostly through video calls from southern Iberia. After leaving eastern China over a decade ago, attracted by the warm climate and proximity to European assets, Bian rarely visits his investment team or factories.

Despite living abroad, he has built a loyal following in China through his philosophical investment writings reminiscent of Warren Buffett. These writings are closely analyzed by investors as his strategies bear the imprint of Western hedge funds, distinct from traditional domestic speculation.

In a post last January, Bian shared, “A good investor must set aside ego, reduce stubbornness, identify the right goals, and persevere. When choosing a goal, pay attention to trends. When implementing a project, be mindful of timing. And when maintaining a project, keep costs under control.”

His associates also regularly post reflective pieces on the company’s website.

Bian declined to comment for this article, and Zhongcai did not respond to interview requests. To sketch his activities and strategies, Bloomberg used exchange data and interviewed business partners, rivals, and market traders.

Spotting Opportunities in Copper

Bian is not alone in his bullish outlook for copper, an essential metal for global electrification. Many long-term optimistic investors have emphasized factors like the energy transition and tightening mine supply. In recent months, commodity traders have seized opportunities from Trump’s threats of copper tariffs, leading to a buildup of inventory in US warehouses and creating shortages in other world markets. Kostas Bintas, head of metals at Mercuria Energy Group Ltd., one of copper’s strongest supporters, predicted in March that copper prices could surge to $12,000 or even $13,000 per ton, far surpassing the previous record and the current level (around $9,500 per ton).

However, the copper market remains volatile, making the next move difficult to predict. Copper’s high prices are also putting pressure on major consumers in China.

Bian has entered and exited the copper market multiple times. For most of 2024, he held short positions even though other investors were optimistic about China’s economic prospects. Just before the US election in November, he unexpectedly switched to a strong long position, predicting that a Trump victory would boost domestic manufacturing investment in the US, while China would unleash economic stimulus packages.

Since the beginning of January, Bian has accelerated his copper purchases, using both personal funds and assets from the funds he manages, pushing Zhongcai’s total position to a record high of nearly 40,000 lots, equivalent to 200,000 tons of copper, by early April—just before Trump escalated tariffs, according to exchange data. He then shifted a portion of the position to the CME Group’s Comex exchange in the US to take advantage of price volatility there, according to two insider sources. By the end of April, Zhongcai’s copper investments had yielded total profits of about $200 million, according to Bloomberg calculations.

According to sources, Bian currently holds no short positions in copper.

Winning Big with Metals

Source: Shanghai Futures Exchange and Bloomberg calculations.

Note: Data as of April 2025. Estimates are based on the daily volume-weighted average price of the contract. Profits and losses on open contracts are not included in the analysis. |

According to Bloomberg estimates, the accumulated profits from Zhongcai’s copper and gold investments have soared since 2024.

Bian focused his bets on the Shanghai market, a decision that later proved fortunate. When copper prices plunged in the short term due to tariff uncertainties last month, the Chinese market was on a national holiday, allowing Bian and Shanghai traders to avoid the selling frenzy and recover in time.

However, some of his investors have withdrawn since then, according to two sources, due to trade war concerns and the risk of a global economic recession.

Undeterred, Bian has increased his copper buy positions in Shanghai and other markets over the past month. He shared with investors his faith in the resilience of the Chinese economy and the bullish outlook for copper. Rivals interpret this move as a wager on China’s transition to a high-tech economy, which would boost copper demand, and a way to leverage ample liquidity to support this trend.

“This position is not large enough to move the market, but it does offer a rare glimpse into Bian’s strategy,” said Jia Zheng, head of trading at Shanghai Soochow Jiuying Investment Management Co. “The investment community is closely monitoring his gold and copper trading activities.”

Born in 1963, just after China’s tumultuous Great Leap Forward, Bian grew up in Zhuji, a small town in Zhejiang province, eastern China. The Cultural Revolution disrupted his education, but he eventually graduated from a vocational school under the Central Bank in 1985.

In 1995, as China prepared to enter a phase of robust growth, Bian established a factory producing high-end plastic pipes. Like many entrepreneurs of his time, he seized the economic transformation to build a diversified business empire spanning construction materials, financial services, and real estate, with branches in the US, UK, Hong Kong, and factories in India. In 2003, he acquired a futures contract brokerage firm, later named Zhongcai in Shanghai, and also invested heavily in Alibaba Group’s film production arm.

In his early years of trading chemicals and plastics, Bian became known for his independent trading style, a contrast to the group collusion prevalent in the market.

However, Bian’s business journey has not always been smooth. While his safe-haven strategy paid off handsomely in gold, it also led to losses in domestic stock and bond investments, according to insider sources.

“Pitfalls and opportunities go hand in hand—risks present opportunities, and opportunities contain pitfalls,” Bian wrote in a blog post last year. “Investing is, in essence, a survival game.”

Quoc An (According to Bloomberg)

– 19:55 19/05/2025

The New Deposit Record: People Are Now Banking Almost VND 2,900 Billion Every Day

As of the end of August, the total amount of savings deposits held by Vietnamese citizens in banks stood at an impressive 6.92 million billion Vietnamese Dong. This figure highlights a significant trend; on average, during August, citizens deposited nearly VND 2,900 billion in banks every single day.