ASEAN Economic Growth in Q1 2025: Vietnam Leads, Indonesia Slows

Indonesia

Official statistics from Indonesia’s statistics agency show that in Q1 2025, the country recorded a GDP growth rate of 4.87% year-on-year. This is the lowest Q1 growth rate Indonesia has seen in the last three years.

According to the Central Statistics Agency (BPS), in 2022-2024, Southeast Asia’s largest economy recorded a growth rate of 5.11% in Q1 2024. Meanwhile, growth in Q1 2022 and Q1 2023 was 5.02% and 5.04%, respectively.

BPS Head, Amalia Adininggar Widyasanti, attributed the slower growth in Q1 2025 compared to the previous year to the general elections held in the country last year. Specifically, in February 2024, Indonesia organized the world’s biggest single-day election, causing a spike in government spending at that time.

Of the 4.87% growth rate, household consumption accounted for the largest share, contributing 2.61 percentage points. This was followed by gross fixed capital formation (0.65%), net exports (0.83%), and other factors (0.86%). However, government consumption recorded negative growth of 0.08% in the first three months of 2025.

Indonesia’s Coordinating Minister for Economic Affairs, Airlangga Hartarto, stated that the country’s growth rate was higher than that of Malaysia (4.4%) and Singapore (3.8%).

“Within ASEAN, we are just a bit behind Vietnam,” said the minister.

Vietnam

According to statistics from the General Statistics Office (GSO), Vietnam’s GDP in Q1 2025 is estimated to have grown by 6.93% year-on-year, the highest growth rate compared to Q1 in the period of 2020-2025.

This growth rate exceeded the target set for Q1 2025 in Resolution No. 01/NQ-CP, but did not reach the higher goal pursued in Resolution No. 25/NQ-CP dated February 5, 2025, due to rapid global changes and instability affecting the country’s economy. The agriculture, forestry, and fishery sector grew by 3.74%, contributing 6.09% to the total added value of the economy; the industry and construction sector grew by 7.42%, contributing 40.17%; and the service sector expanded by 7.70%, contributing 53.74%.

According to the Asian Development Bank’s (ADB) latest report on Asian and Pacific Development Outlook, experts assessed that Vietnam’s GDP will grow by 6.6% in 2025 and 6.5% in 2026, after a strong 7.1% growth last year. The service sector is expected to grow by 7.2% in 2025, driven by a boom in domestic and international tourism as well as technology industries.

Malaysia

Official data from Malaysia shows that in the first quarter of 2025, the country’s economy grew by 4.4% year-on-year, lower than the 4.9% growth recorded in Q4 2024.

Malaysia’s central bank stated that economic growth in the first quarter was driven by household spending amid a positive labor market, as well as steady expansion in investment and sustained export growth.

Governor of Bank Negara Malaysia, Abdul Rasheed Ghaffour, mentioned that the growth in the first quarter was propelled by exports as companies rushed to stock up before the imposition of countervailing duties, with demand for Malaysia’s electrical and electronic products expected to hold up.

“Growth was affected by lower oil and gas output and the normalization of car sales and production. This year’s growth is expected to be slightly lower than the forecast range of 4.5% to 5.5%,” said the governor.

Thailand

Thailand’s economy in the first quarter of 2025 grew by 3.1% year-on-year. The country’s planning agency forecast Thailand’s GDP growth for 2025 to be in the range of 1.3% to 2.3%, down from the previous estimate of 2.3% to 3.3% projected in February.

Philippines

According to official data from the Philippine Statistics Authority, in Q1 2025, the country’s GDP grew by 5.4%, slightly higher than the 5.3% growth recorded in Q4 2024.

Household consumption and government spending were the main contributors to the Philippines’ growth amid mounting hurdles from US tariffs.

Specifically, government spending in Q1 2025 surged by 18.7%, the fastest pace since Q2 2020. Meanwhile, household consumption also increased by 5.3%, higher than the previous quarter’s 4.7%, thanks to easing inflation.

Singapore

Singapore’s Ministry of Trade and Industry (MTI) recently announced that the country’s GDP grew by 3.8% year-on-year in Q1 2025, lower than the 5% growth recorded in Q4 2024.

For the full-year growth outlook, MTI downgraded its forecast to 0-2% from the previous range of 1-3% as Singapore braces for the impact of countervailing duties from the US.

The ministry stated that developments related to tariffs are expected to significantly affect global trade and growth. As a result, Singapore’s external demand outlook has weakened considerably.

Particularly, the manufacturing sector is likely to be impacted by weaker global demand. Weaker global trade will also affect the wholesale trade sector, as well as the transportation and storage industry, through reduced demand for transportation and air freight services.

Meanwhile, financial and insurance services trade could weaken due to risk aversion, negatively impacting banking, fund management, foreign exchange, and securities dealing.

“Additionally, the uncertain economic environment could dampen capital expenditure by companies and constrain credit intermediation. The growth of payment services providers may also slow alongside subdued business activities and lower consumer spending,” MTI added.

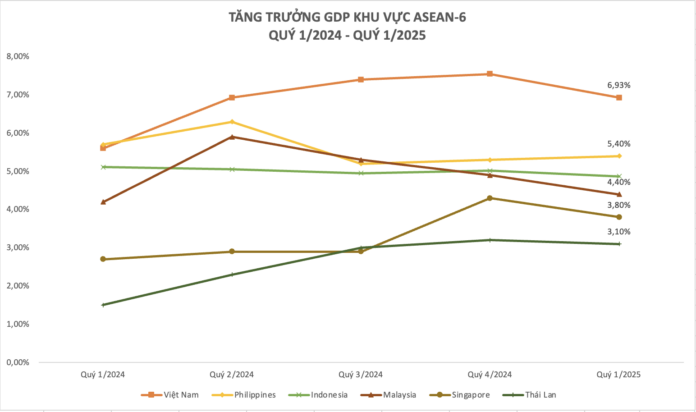

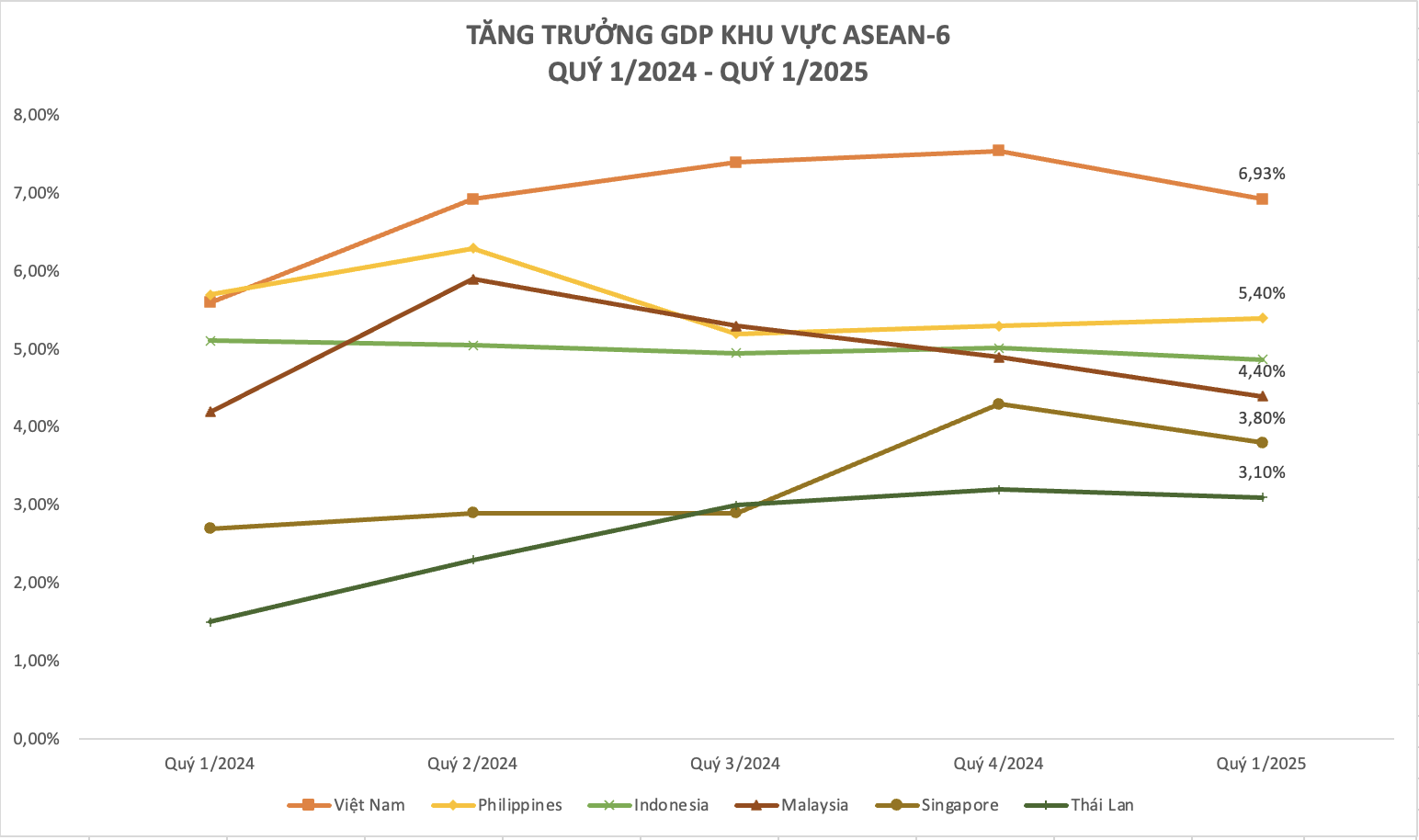

How have the growth rankings of the ASEAN-6 countries changed?

With a GDP growth rate of 6.93% in Q1 2025, Vietnam emerged as the fastest-growing economy among the ASEAN-6 countries.

Following Vietnam is the Philippines, with a GDP growth rate of 5.4%. Indonesia ranked third with a Q1 2025 GDP growth rate of 4.87%.

Malaysia came in fourth with a growth rate of 4.4%, while Singapore and Thailand took the fifth and sixth spots with growth rates of 3.8% and 3.1%, respectively.

The World’s Second-Largest Economy Hunts for a Surprising Commodity from Vietnam: A Surprising Surge in Exports and 20 Million Tons of Annual Production

Vietnam is one of the top three exporters in the world, a powerhouse in the global market with an incredible capacity to produce and ship goods internationally. With a diverse range of products, from electronics to agricultural produce, Vietnam has firmly established itself as a key player in the realm of international trade. The country’s economic prowess and ability to cater to the demands of a global market are truly remarkable.

The Capital’s 20,000-Billion-Dong Cable-Stayed Bridge Project Takes Flight: A Soaring Dragon Symbolizing Hanoi’s Ambition

“Introducing Hanoi’s newest landmark – the city’s second cable-stayed bridge. This stunning structure, with its sleek design and modern engineering, is a testament to the progress and development of Vietnam’s capital. Like a graceful dancer, it spans the waters, connecting the shores with elegance and strength. A true marvel to behold, it captivates all who witness its majestic presence.”