With over 71.1 million shares currently in circulation, the upcoming issuance corresponds to a 1:11 rights offering ratio (shareholders holding 1 share will receive 1 right to subscribe for new shares, and for every 11 rights held, 1 new share will be received), and the ex-rights date is set as May 29, 2025.

BMSC plans to utilize owner’s equity based on the audited financial statements for 2024 to fund this issuance, including over VND 67 billion in retained earnings and over VND 11 billion in financial and business risk reserve funds.

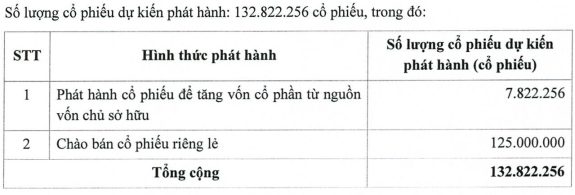

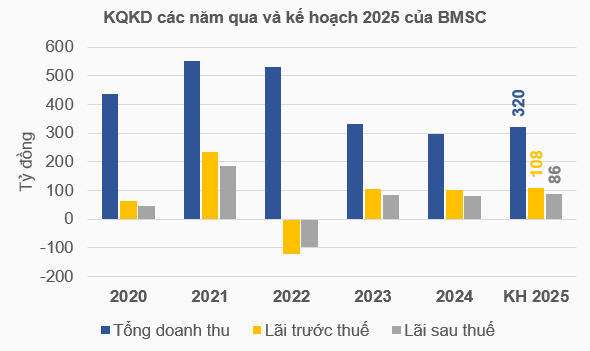

In reality, the issuance of 7.8 million shares is part of the share issuance plan to increase charter capital, which was approved at the 2025 Annual General Meeting of Shareholders (AGM) held on April 28, 2025. The Company also intends to offer 125 million shares in a private placement to professional securities investors, equivalent to a ratio of 175.78%, with a one-year lock-up period.

With a minimum price of VND 10,000 per share, the Company expects to raise a minimum of VND 1,250 billion from this private placement. Of this amount, 52% will be allocated to proprietary trading activities, 16% to margin lending and pre-paid contract financing, and 32% to repay bank loans and bonds.

By combining these two issuances and offerings, BMSC aims to increase its number of shares from over 71.1 million to over 203.9 million, resulting in a corresponding increase in charter capital from over VND 711 billion to over VND 2,039 billion.

Source: BMSC

|

At the 2025 AGM, CEO Phan Tan Thu emphasized that increasing capital to over VND 2,000 billion is one of the key strategies to ensure the Company has sufficient financial resources to realize its business ideas in 2025.

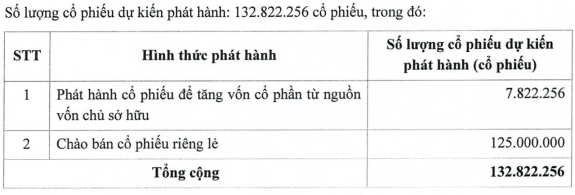

Accordingly, BMSC has set a target of generating revenue of over VND 320 billion, pre-tax profit of over VND 108 billion, and net profit of over VND 86 billion for 2025, representing increases of 8%, 7%, and 6%, respectively, compared to the 2024 financial results.

Source: VietstockFinance

|

Proprietary trading is expected to contribute nearly VND 256 billion in revenue, accounting for 80% of the total. The Company will adopt a proactive, flexible, and sustainable investment approach, balancing short-term and long-term portfolios.

For the long-term portfolio, BMSC will focus on corporate bonds, securities, listed and unlisted stocks. As for the short-term portfolio, the Company will allocate resources to government bonds and listed stocks, targeting an annual profit margin of 10-15%.

The CEO of BMSC emphasized that investment and proprietary trading have been the Company’s core strengths for many years. The Company’s direction is not to engage in speculative activities but to evaluate investments and businesses with strong growth potential. BMSC will also focus on financial services, which may not be as attractive as bond trading on the exchange but still offers a decent return on investment.

“This strategy is entirely correct and will continue to be effective. In the period from the beginning of April to now, BMSC has remained largely unaffected by market factors. The first-quarter financial results are temporary and in line with our roadmap, ensuring that we meet our plans. The Company will also continue to promote government bond and corporate bond trading activities to generate better revenue.” – said the CEO.

CEO Phan Tan Thu speaking at the AGM – Photo: Huy Khai

|

In terms of brokerage services, the Company expects to generate VND 32.5 billion in revenue in 2025, contributing 10% to the total. BMSC will reduce lending rates, build a margin basket, and focus on VN30 stocks. They will also seek to attract new and potential customers and provide special care to high-volume traders. The Company plans to launch a trading app in the second quarter to diversify trading channels for investors and enhance service quality.

Financial advisory and underwriting services, accounting for approximately 10% of revenue, are expected to bring in more than VND 30 billion. BMSC will leverage its strong banking background and relationships with other financial institutions. They will focus on capital arrangement and M&A advisory through capital market and debt market channels, including initial public offerings, additional share issuances, convertible bond issuances, public bond offerings, and private corporate bond placements. Additionally, the Company will maintain traditional financial advisory services such as listing advisory, registration for trading, AGM advisory, and information disclosure advisory.

Another notable item on the agenda that was approved by the AGM is the listing of the Company’s shares on the Ho Chi Minh City Stock Exchange (HOSE).