“Global sugar prices have hit a three-year low and rebounded, reaching 16.55 cents per bag. Additionally, the shift of Indian and Brazilian sugar mills towards ethanol production from later this year could usher in a new price hike cycle for sugar.”

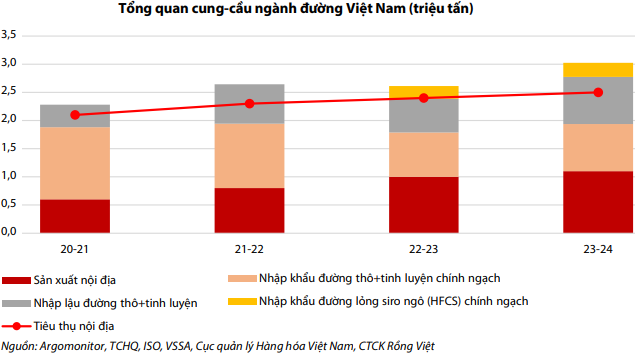

“Domestically, the oversupply situation is improving as inventories at factories gradually decrease towards the end of Q2 2025. The risk of illicit sugar has also diminished due to tighter border controls and collaboration between the Vietnam Sugarcane and Sugar Association and Thailand to curb smuggling.”

|

“According to VDSC, sugar consumption will recover in Q3 2025 as agents resume imports after depleting their stocks to avoid additional costs incurred by Decree 70. Q3 also coincides with the peak consumption season of summer and the Mid-Autumn Festival. Notably, the official import price is significantly higher than that of smuggled sugar, contributing to higher domestic selling prices.”

“Another factor that could improve the industry’s outlook is the roadmap for implementing E10 gasoline from 2026. The Ministry of Industry and Trade is presenting the plan to the government, starting with a pilot program in August 2025 in Hanoi, Ho Chi Minh City, and Hai Phong. Ethanol, the main component of E10, is produced from sugarcane, cassava, corn, and other sources, helping reduce greenhouse gas emissions. This is considered a driving force to balance the production of sugarcane and sugar mills in the long term, following the trend in India and Brazil.”

“In this context, VDSC assesses that the prospects of Quang Ngai Sugar (QNS) have significantly improved. Q3 2025 revenue is expected to reach VND 2,943 billion, unchanged from the previous quarter but up 8% year-on-year. Net profit is estimated at VND 553 billion, a surge of over 41% from the previous quarter, despite being nearly 20% lower than the same period last year.”

“For the full year 2025, QNS’s revenue is projected to reach VND 10,524 billion, a nearly 3% increase from 2024. Net profit is estimated at VND 2,035 billion, a decrease of over 14%, with an EPS of VND 5,536. VDSC also notes that QNS maintains a high cash dividend policy, usually exceeding 55% of post-tax profit, equivalent to an interest rate of 6.5-11%/year, higher than the current deposit interest rate.”