On May 19, Novaland Group (stock code: NVL) announced that it would seek shareholder approval in the near future, followed by submitting the proposal to the State Securities Commission for necessary procedures, in accordance with legal regulations.

This move aims to implement the plan to issue shares in exchange for debt owed to some shareholders who have sold secured assets to repay loans and bonds to Novaland. Among these shareholders are two major stakeholders: NovaGroup and Diamond Properties.

NovaGroup and Diamond Properties, both associated with Mr. Bui Thanh Nhon, will receive shares in exchange for their debt.

During Novaland’s most challenging period, these major shareholders committed to supporting the company by helping to repay maturing debts and ensuring continuous operations. As per the signed agreement, between 2022 and 2024, the shares pledged by these shareholders to guarantee Novaland’s debt obligations were sold to settle debts. Consequently, Novaland acknowledged the debt obligations to these shareholders in its financial statements.

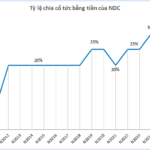

At the end of 2021, before Novaland faced financial difficulties, the group of shareholders related to Mr. Bui Thanh Nhon, Chairman of Novaland’s Board of Directors, held a controlling stake in Novaland with over 61.4% ownership.

In early 2022, Novaland’s share price started to decline, and soon after, a series of unfavorable market developments pushed the company into a crisis, causing NVL shares to plunge sharply. To rescue Novaland, the group of shareholders related to Mr. Bui Thanh Nhon lent their shares to the company for sale to repay debts, while also actively selling a large number of NVL shares to support the restructuring of the company’s debt portfolio. As a result, their ownership decreased to 60.8% in June 2022 and further down to 38.7% by December 2024.

Recently, five shareholders related to Mr. Bui Thanh Nhon registered to sell nearly 19 million NVL shares to balance their investment portfolios, support debt restructuring, and for personal reasons. The transactions are expected to be executed through matching and negotiated deals from May 16 to June 13. If successful, the total ownership of Novaland’s major shareholder group will decrease to 37.4%.

Novaland’s management affirmed that the development and submission of the share issuance plan at this stage are based on the need to compensate major shareholders. Novaland will maintain transparency and ensure fairness for all investors.

“While the additional share issuance may temporarily dilute existing shareholders, Novaland, together with its major shareholders, is committed to achieving the set business plans and recovery goals… to safeguard the interests of shareholders and all related parties,” said a Novaland representative.

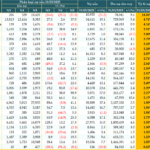

As of March 31, Novaland Group’s total debt amounted to over VND 59,000 billion, a decrease of nearly 4% compared to the end of 2024 and a reduction of almost 9% compared to the end of 2022 – before the restructuring.

As of March 31, Novaland Group’s total debt exceeded VND 59,000 billion.

The total debt maturing within 12 months, according to the previous term, is approximately VND 32,000 billion, including bond issuances, foreign loans, and domestic loans. Given the current financial situation and the slower-than-expected progress in resolving legal issues related to projects, which significantly impacts revenue and disbursement of loans, Novaland’s management has formulated a plan to settle debts with each group over the next three years.

“TDC Raises $13.6 Million in Private Placement of 35 Million Shares”

On May 15, Binh Duong Business and Development JSC (HOSE: TDC) concluded its private placement of 35 million shares, with 27.2 million shares (equivalent to 77.79%) allocated. The remaining nearly 7.8 million unallocated shares will be canceled.

Corporate Bond Issuance in 2025: A Strategic Move for Non-Financial Businesses to Refinance Debt.

“Following the recovery phase in 2024, the bond issuance value of non-financial enterprises in 2025 is forecasted to remain stable, primarily aimed at debt restructuring. “