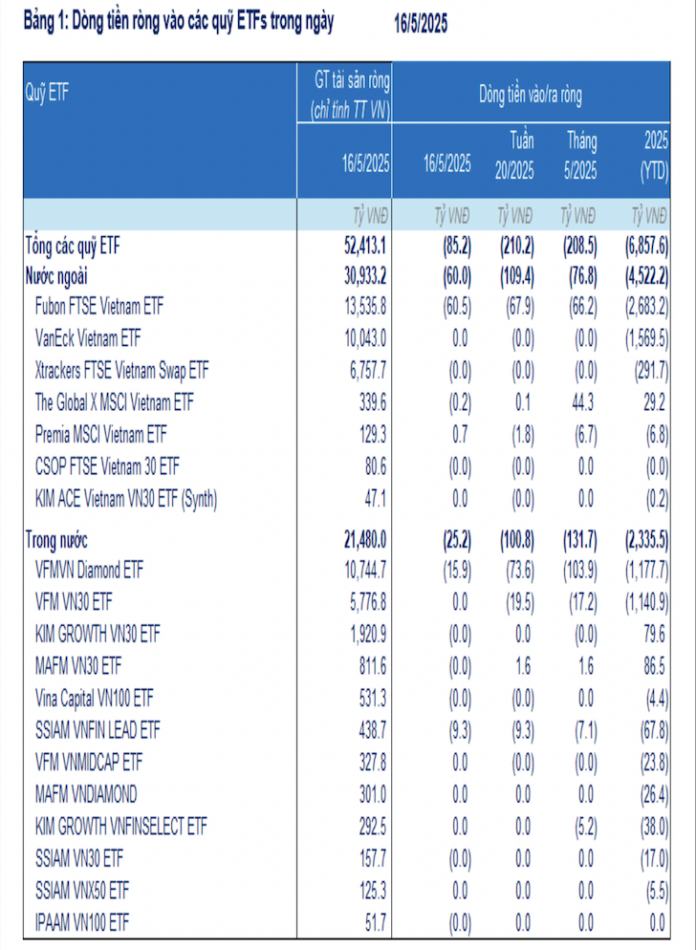

For the week of May 12-16, 2025, ETFs investing in the Vietnamese stock market experienced net outflows of over VND 210 billion, according to FiinTrade.

Outflows were seen in 11 out of 19 funds, mainly in the domestic VFM VNDiamond ETF. Foreign ETFs witnessed outflows of more than VND 109 billion, concentrated in the Fubon FTSE Vietnam ETF (-VND 4.9 billion). Similarly, the Premia MSCI Vietnam ETF also experienced a slight net outflow of over VND 1 billion.

The value of outflows from domestic ETFs increased significantly, with over VND 100 billion. Dragon Capital-managed funds, VFM VNDiamond ETF (-VND 73.6 billion) and VFM VN30 ETF (-VND 19.5 billion), accounted for the majority of these outflows. In contrast, the MAFM VN30 ETF attracted a slight net inflow of nearly VND 2 billion.

Regarding Thai investment through depository receipts (DRs): Thai investors net bought 600,000 DRs in the VFM VNDiamond ETF (FUEVFVND01), equivalent to VND 19 billion. Similarly, investors also net bought 500,000 DRs in the VFM VN30 ETF (FUEVFVND01), valued at VND 11.9 billion.

In May 2025, ETFs experienced net outflows of more than VND 208 billion, bringing the total net outflows since the beginning of 2025 to over VND 6,800 billion (lower than the 2024 figure of VND 21,800 billion)

As of May 16, 2025, the total net asset value of ETFs (only considering allocations to the Vietnamese market) stood at VND 52,400 billion, a decrease of 7.8% compared to the end of 2024. The top stocks bought by ETFs during the week of May 12-16, 2025, were TCB, ACB, GMD, MBB, and VPB.

On May 19, 2025, the Fubon FTSE Vietnam ETF reversed course, recording a net inflow of over VND 7 billion, with no buying or selling of stocks in its portfolio. Meanwhile, the VFM VNDiamond ETF and VFM VN30 ETF saw no changes in their cash flow.

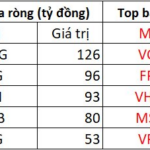

In the past week, foreign investors net bought VND 2,920.7 billion, and their matched orders net bought VND 3,195.1 billion. Foreign investors’ main net buying sectors were Banking and Retail. The top net bought matched orders by foreigners were MBB, MWG, FPT, PNJ, VPB, CTG, SHB, NLG, HSG, and BID.

On the net selling side, foreigners’ net sold matched orders were in the Real Estate sector. The top net sold matched orders by foreigners were VHM, VCB, VRE, GEX, STB, VNM, SSI, HDB, and DGC.

Commenting on foreign capital flows, Mr. Nguyen The Minh, Director of Retail Research at Yuanta Securities, stated that since 2024, foreign investors have maintained a net selling position. However, a very positive development last week was the net buying by foreign investors.

Foreign investors net bought VND 2,881 billion in the week of May 12-16, 2025, the highest weekly net buying in two years. This could be attributed to recent outflows from the US stock market and the cooling of Vietnam’s 5-year CDS after surging to 150 in early April 2025 due to concerns over tariff policies affecting the macro economy.

This indicates a reduction in country risk and suggests that long-term risks have eased as negotiations are ongoing, with expectations for positive outcomes in the coming weeks.

“Foreign capital is new money, not just P-notes, as the net buying value is distributed across many stock groups,” emphasized Mr. Minh.

According to Yuanta, capital continues to flow out of the US stock market due to high market valuations and tariff policy risks. Therefore, global capital is expected to continue allocating to other markets, including Vietnam, which still offers attractive valuations.

The Big Buy: Foreign Investors Go on a Shopping Spree, Splurging on Vietnamese Bank Stocks

Foreign transactions continue to be a bright spot, with net buys of 891 billion VND in today’s session.

Breaking News: Foreign Investors Pour in Nearly VND 2.3 Trillion, Sending VN-Index Soaring Past 1,300 Points

The FPT stock witnessed a significant surge in buying activity during the afternoon trading session, with a staggering net buy value of VND 541 billion, making it the most actively bought stock across the market. This was followed by several other stocks that also experienced substantial net buying in the hundreds of billions of VND.