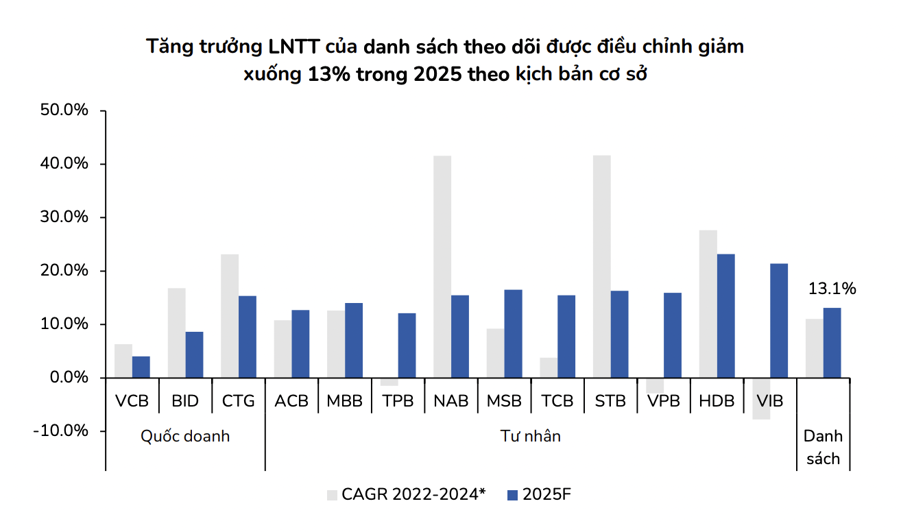

Private banks continue to set stronger 2025 profit plans compared to state-owned banks, with the BSC private bank composite tracking a 2025 pre-tax profit target growth of over 16% year-on-year. In contrast, only VCB has officially presented to the General Meeting of Shareholders a 2025 pre-tax profit target with a cautious growth of 3.5%.

NIM CONTINUES TO NARROW

Banks assess that the immediate risk is insignificant, at least in the first half of 2025, with positive growth prospects. If there are adjustments to the business plan, they will have to be made from the third quarter of 2025 onwards, after the 90-day tax deferral period ends.

The direct impact of the FDI & Export group on banks is currently insignificant, but it needs to be monitored in the second half of the year. According to data as of the end of 2024, state-owned banks usually have higher loan balances for the FDI group compared to private banks, thanks to their advantages in terms of capital scale, long-standing reputation, and long-term customer base.

However, the proportion of loans to sectors directly related to exports to the US is currently relatively low, accounting for only about 2% to 10% of total outstanding loans depending on the bank.

During the general meeting of shareholders in April, the bank’s management also stated that with the low contribution ratio of import-export and FDI groups, the direct impact of tariff policies on the bank’s business is insignificant in the short term. However, the indirect impact is relatively difficult to measure as it relates to employment and income issues of workers.

Based on a preliminary assessment, BSC believes that the short-term impact of changes in the US export environment on the banking industry is insignificant. However, for a more comprehensive and accurate assessment, it is necessary to continue to closely monitor developments in the medium term to fully evaluate the long-term spillover effects on the banking sector, especially macroeconomic factors.

Credit growth rate improved compared to the same period last year. According to the State Bank, by the end of March 2025, credit growth and mobilization of the whole system reached 3.5% and 2.3% from the beginning of the year, respectively, more positive than 1.4% and -0.5% in the same period last year.

The State Bank has just announced the deployment of a VND 500,000 billion credit package to support infrastructure and digital technology investments. The capital commitment comes from commercial banks. However, financing infrastructure projects also poses challenges for banks in terms of long-term lending, large total investment, limited participation of state budget funds (bank capital often accounts for ~80%), long recovery time, uncompetitive NIM, etc.

This also increases the demand for medium and long-term capital mobilization (typically through bond issuance) from banks, which somewhat puts pressure on capital costs.

Involvement in lending to related businesses such as steel, plastics, construction materials, etc., would be more advantageous in terms of asset quality management and NIM from the perspective of banks.

However, NIM continues to narrow, with little prospect of improvement as the “arms race” intensifies. NIM in Q1/25 for the BSC-monitored list fell to 3.4% at the end of the quarter, close to the lowest level recorded in 2020.

RELYING ON BAD DEBT RECOVERY

Bad debt recovery is an important driver for some banks in 2025, offsetting the trend of sacrificing NIM for growth scale.

With the prospect of the real estate market continuing to warm up in terms of liquidity thanks to legal unblocking, BSC believes that bad debt recovery will be the “spare tire” for banks to reach their 2025 profit targets, especially for banks with a high rate of debt write-offs in recent years and where the choice of collateral is carefully evaluated.

A typical example is CTG, where the management shared at the 2025 Annual General Meeting that the bank expects to profit from bad debt recovery of VND 10,000 billion in the base scenario (compared to VND 8,500 billion in the same period), striving to reach VND 12-14,000 billion.

Other banks have not yet shared specific profit targets from resolved risky debts in their 2025 plans, but BSC believes that this will be a significant contributing component in this year’s profit structure, especially if Resolution 42 is officially legalized (discussed at the National Assembly session in May 2025).

In contrast, some other non-interest income segments such as foreign exchange trading and securities investment, mainly from the government bond portfolio, are expected to face more difficulties this year due to unpredictable exchange rate and cash flow movements in the face of macroeconomic information from external sources. In addition, many banks realized profits from the government bond portfolio in 2024, reducing the proportion of this component in total assets to a historical low. Along with the fundamental factors, these are also two segments that recorded a relatively high base in the same period last year.

Fee and service income remain uncertain in the coming time due to the possible negative impact of tariffs on import and export activities, thereby affecting trade finance income, while the insurance market through the bank channel continues to recover slowly.

As an intermediary organization, the banking industry will still be one of the industries that will be affected last if the US decides to impose a higher-than-expected countervailing duty rate on Vietnam. This is somewhat reflected in the market as bank stocks have recovered relatively well (compared to other industries) after the initial reactions to the information about the 46% tax rate.

Therefore, in BSC’s base scenario that Vietnam negotiates the tax rate down to about 22-28%, the banking industry remains one of BSC’s top picks, but stock selection is necessary as most banks have been discounted significantly compared to history.

BSC highly appreciates banks that are less directly affected by tariff policies while benefiting from the recovery of the domestic real estate market with outstanding credit limits and NIM such as HDB, MBB, TCB, and VPB; or banks with good asset quality and motivated to boost profit growth by reducing credit costs and recovering resolved risky debts such as CTG; or banks with discounted valuations, approaching historical lows, while having equity issuance plans to improve CAR such as BID and VCB.

The Great Banking Shake-Up: A Necessary Evolution.

Amid the ongoing wave of job cuts across many banks, Dr. Chau Dinh Linh, a finance expert from Ho Chi Minh City University of Banking, shared his insights with the Bank Times correspondent. He asserted that this strategic move is a well-planned step for banks to realign their operations and meet the evolving demands of the new economic landscape.

The End of Easy Profits: What’s Next for Banks to Sustain Profitability?

In the first quarter, banks navigated a challenging environment marked by a continuing compression in net interest margins (NIM). Lending rates were lowered to support the economy, while funding costs remained relatively high to attract deposits. This squeeze on interest rate margins impacted the core income stream from credit activities, directly affecting the bottom line of banking institutions.

The Evolution of Banking Strategies: Insights from the 2025 Annual General Meetings

The past month has seen a series of annual general meetings (AGMs) held by banks, capturing the attention of investors and the market. With the need to boost credit growth this year to support the economy, the banking sector is expected to have multiple growth drivers. However, businesses still face numerous challenges, both internally and externally. Thus, each bank’s strategy will be a key differentiator.

The Surprising Secrets to Overcoming a Sharp Decline in Deferred Revenue

Deferred interest income plays a pivotal role in shaping a bank’s profit structure and can serve as a window into the bank’s asset quality. Moreover, it acts as a harbinger of profit quality. With the expiration of debt moratorium circulars, some banks have unveiled issues pertaining to this very item.

The Latest Credit Growth Figures: Unveiling the Banking System’s Performance

“The banking sector is off to a strong start this year, with credit growth outpacing that of the previous year. According to Vice Governor of the State Bank of Vietnam, Pham Thanh Ha, as of March 12, credit growth in the banking system had increased by 1.24% compared to the end of 2024, indicating a significant improvement.”