Vietnam’s Stock Market: A Tale of Volatility and Foreign Selling

VN-Index Falls as Foreigners Sell-Off: Vietnam’s stock market experienced a volatile start to the week, with the VN-Index closing 5.1 points lower at 1,296.29. HoSE witnessed low liquidity, with a modest transaction value of VND 19.6 trillion.

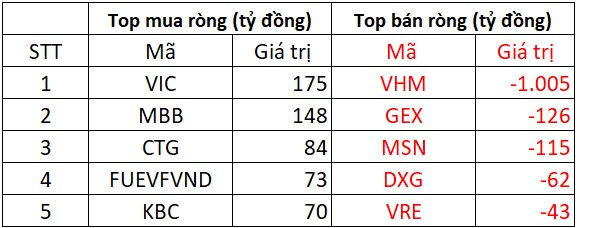

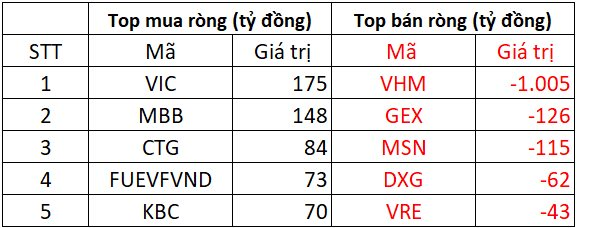

Foreign Sell-Off Continues: Foreign investors continued their selling spree, offloading over VND 540 billion across the market. On the HoSE, foreign investors sold a staggering VND 562 billion, with VHM bearing the brunt, followed by GEX and MSN. VIC and MBB emerged as the top buys, with CTG, FUEVFVND, and KBC also witnessing net buying.

HoSE witnesses foreign selling spree

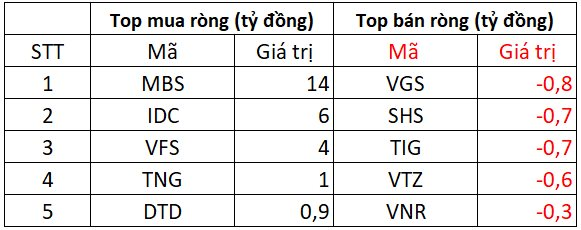

HNX and UPCOM Witness Foreign Buying: On the HNX, foreign investors turned net buyers, purchasing VND 20 billion worth of shares, with MBS leading the pack. Meanwhile, on the UPCOM, foreign investors bought a net of VND 1 billion, with SAS and MCH as the top picks.

HNX attracts foreign buyers

UPCOM’s Mixed Bag: While SAS and MCH attracted foreign investment on UPCOM, NTC witnessed a sell-off. Overall, the UPCOM witnessed modest foreign buying.

UPCOM’s foreign trading activities

“Capital Floods Blue-Chip Stocks as VN30-Index Soars to New Heights”

The HoSE matching liquidity slightly increased by 2.6% compared to the previous session, while the VN30 basket witnessed a more robust 10% surge. Trading of this blue-chip basket accounted for 62% of the entire exchange, with the VN30-Index climbing by 2.01% and setting a new peak since early May 2022.