Vietnam Industrial and Urban Construction Consulting Joint Stock Company (UPCoM: CCV) announced a cash dividend for 2024 with a ratio of 46.3%, equivalent to VND 4,630/share. The ex-dividend date is May 28, and the expected payment date is June 9.

This is the highest dividend payout in the company’s history. In previous years, the dividend ratio typically ranged from 8-33%.

With 1.8 million shares outstanding, CCV is estimated to pay out more than VND 8.3 billion in dividends for this period. CCV’s parent company, Vietnam Construction Consulting Corporation – JSC (UPCoM: VGV), which holds 51% of the charter capital, is expected to receive approximately VND 4.2 billion in dividends.

The company’s other two major individual shareholders, Mr. Nguyen Van Bang, a member of the Board of Directors (holding 6.82%), and Mr. Mai Doan, Deputy General Director (holding 6.25%), will receive VND 568 million and VND 520 million, respectively.

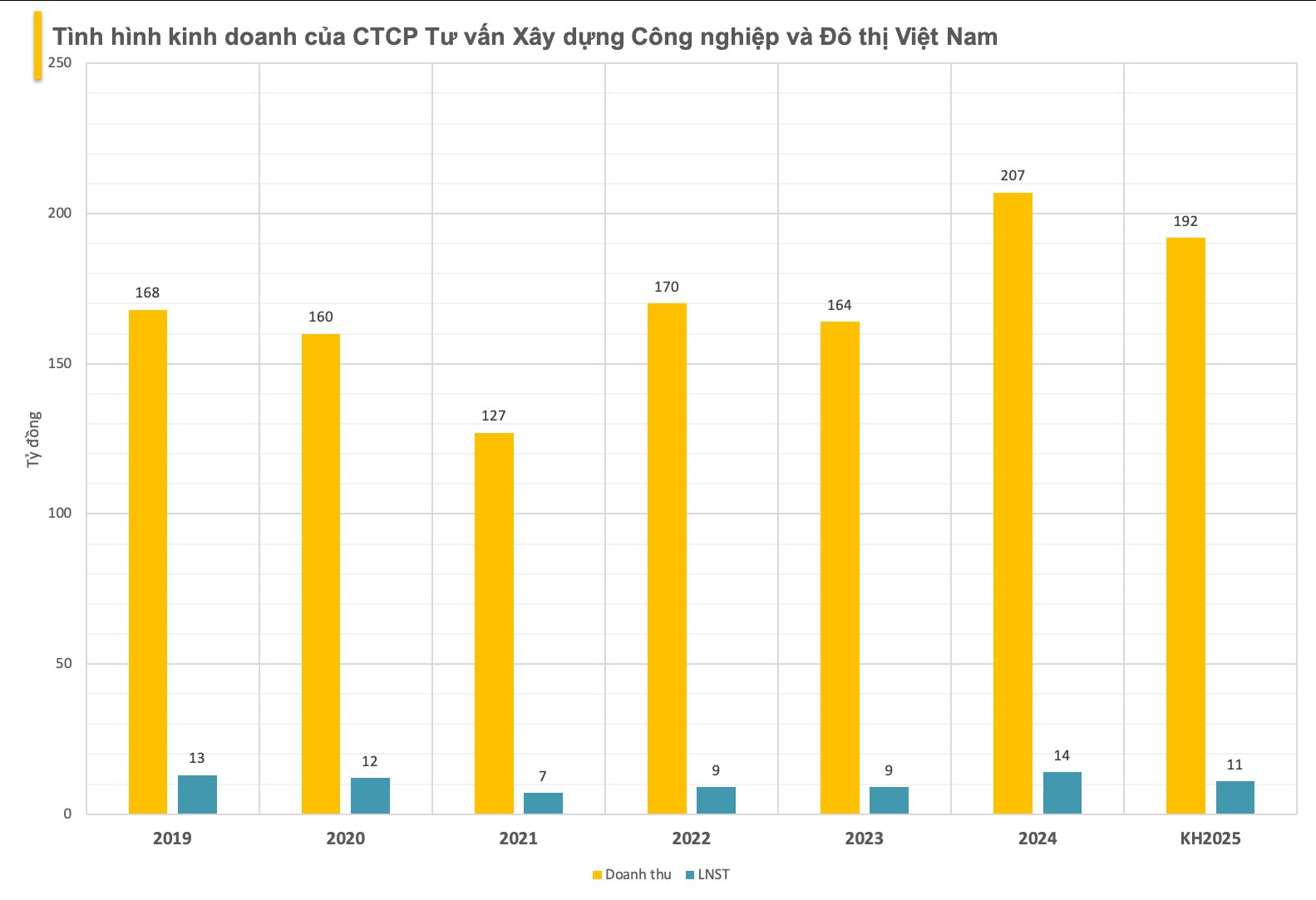

The high dividend payout is a result of CCV’s exceptional business performance in 2024. Specifically, net revenue for 2024 reached VND 208 billion, a 27% increase compared to the previous year. After-tax profit reached nearly VND 14 billion, a 56% growth compared to 2023, and set a new record since the company’s equitization.

For 2025, the company targets net revenue of nearly VND 192 billion and after-tax profit of approximately VND 11 billion, representing an 8% and 21% decrease, respectively, compared to the actual figures for 2024. CCV plans to maintain its high dividend policy, with a target of 65% of after-tax profit, equivalent to nearly VND 7 billion.

In the stock market, at the end of the trading session on May 19, CCV shares were priced at VND 34,000/share. The stock is considered illiquid due to a concentrated shareholder structure.

Vietnam Industrial and Urban Construction Consulting Joint Stock Company, formerly a state-owned enterprise under the Ministry of Construction, was equitized in 2007. Its main business is construction consulting, with two subsidiaries operating in the field of construction design consulting.

“Kido Aims for $80 Million Profit, Targets 12% Cash Dividend”

In 2024, KIDO had initially planned to distribute a 12% cash dividend to its shareholders, however, this plan did not come to fruition. Despite this setback, the company remains committed to providing value to its investors and has proposed a similar dividend payout for this year.

“Agriseco Prepares to Release Nearly 13 Million Shares as Dividends, Boosting Capital to Over VND 2,283 Billion”

AgriBank Securities Joint Stock Company (Agriseco, HOSE: AGR) is pleased to announce a dividend payout for the year 2024 in the form of a stock dividend. Over 12.9 million new shares will be issued, entitling shareholders to a dividend ratio of 100:6. This equates to a total value of over VND 129 billion. The ex-dividend date is set for June 2nd, 2024.

The Viconship Group Raises Stake to 11.6% in Hai An Port Handling

“A group of shareholders, Viconship, and two related legal entities have been steadily increasing their stake in Hai An Port Services. On May 13 and 14, they collectively purchased over 1 million additional HAH shares, bringing their total ownership to an impressive 11.6% of the company’s capital.”