Specifically, 18.2 million shares of AGM will resume trading on the UPCoM this Friday (May 23), with a reference price of VND 1,700 per share, and a market capitalization of nearly VND 31 billion.

Previously, AGM was delisted from the HOSE as of May 9 due to three consecutive years of losses, based on the audited consolidated financial statements for 2022-2024; accumulated losses exceeded paid-up capital; and negative equity.

AGM was once one of the stocks involved in the securities manipulation case of Do Thanh Nhan (former Chairman of Louis Holdings) and Do Duc Nam (Director of Tri Viet Securities) in 2021. After this incident, AGM’s business performance took a sharp downturn. In 2022, the company incurred a net loss of VND 234 billion, followed by a net loss of VND 215 billion in 2023, and a net loss of nearly VND 260 billion in 2024. Revenue also plummeted, dropping by 13% in 2022, and then by more than four times in 2023 (to VND 788 billion) and over three times in 2024 (to VND 241 billion).

| AGM’s Business Performance |

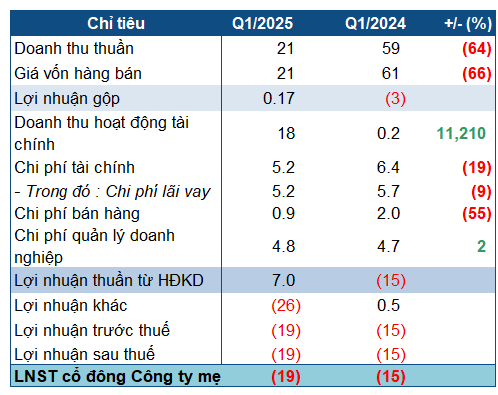

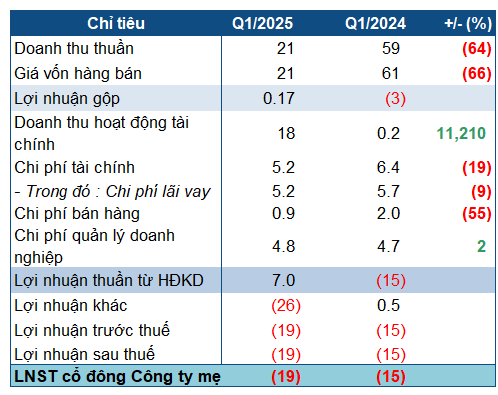

The first quarter of 2025 was another challenging period for AGM. Revenue stood at VND 21 billion, a 64% decrease year-on-year due to the absence of revenue from divested subsidiaries. However, the company managed to achieve a gross profit of approximately VND 170 million, compared to a gross loss of VND 3 billion in the same period last year, as it no longer operated at a loss-making level.

|

AGM’s Q1 2025 Results

Source: VietstockFinance

|

The decline in revenue from subsidiaries was offset by a significant increase in financial income, which surged to VND 18 billion (compared to just VND 200 million in the previous year) due to the disposal of investments. This resulted in a net profit of VND 7 billion, a substantial improvement from the net loss of VND 15 billion in the corresponding period. However, the company incurred a loss of nearly VND 26 billion from the disposal and sale of fixed assets, leading to an overall loss of over VND 26 billion (compared to a profit of VND 500 million in the same period last year). Ultimately, AGM posted a net loss of VND 19 billion for the quarter, compared to a net loss of VND 15 billion in the previous year.

As of the end of the first quarter, AGM’s total assets slightly decreased to over VND 997 billion, with only VND 189 billion in current assets (a 3% decline). Cash holdings stood at approximately VND 4.3 billion, a 25% reduction. Inventories amounted to just VND 169 million due to a provision for inventory devaluation of VND 6.8 billion.

On the liabilities side, short-term debt accounted for the majority of the company’s total liabilities, totaling over VND 1,230 billion, a slight decrease. Within this, borrowings amounted to VND 863 billion, an 8% decline.

AGM’s shareholder equity remained negative at over VND 247 billion, with accumulated losses surpassing VND 429 billion.

Chau An

– 1:00 PM, May 20, 2025