Threat to Vietnam’s Top Position in Coffee Exports

According to the General Department of Customs, in 2024, Vietnam exported approximately 1.32 million tons of coffee, achieving a record turnover of 5.48 billion USD. Despite a significant increase in the average export price to 4,151 USD/ton (a 56.9% surge compared to 2023) due to volatile global markets, the actual output decreased by 18.8%, reaching the lowest level in nine years.

As per the statistics from the Customs Department, by the end of April, Vietnam had exported over 660,000 tons of coffee, earning nearly 3.8 billion USD. Compared to the same period in 2024, the export volume decreased by 9.8%.

Mr. Nguyen Nam Hai, Chairman of the Vietnam Coffee – Cocoa Association (VICOFA), commented: “The consecutive decline in coffee production over the years is attributed to prolonged droughts and the severe impact of climate change. Additionally, many farmers have switched from coffee to more profitable crops like durian, avocado, and pepper, resulting in significant fluctuations in coffee cultivation area and output.”

Vietnam’s position as the world’s largest Robusta producer is under threat.

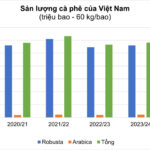

While Vietnam’s Robusta exports are stagnating, its biggest competitor, Brazil, is accelerating. According to the Brazilian National Supply Company (Conab), the country’s Robusta production for the 2025/2026 crop year is expected to reach 18.7 million bags (60 kg/bag), a 27.9% increase from the previous year. Safras & Mercado, a market analysis firm, forecasts an even higher output of 25-26 million bags due to expanded cultivation areas and modern farming techniques.

In contrast, Vietnam’s Robusta output for the 2024/2025 crop year is projected at around 26.5 million bags by the Ministry of Agriculture and Environment, and this downward trend may persist.

“If this situation continues, Brazil could overtake Vietnam in Robusta production within just 2-3 years,” warned Mr. Trinh Duc Minh, Chairman of the Buon Ma Thuot Coffee Association.

Strategies for Sustainable Coffee Development

While the export turnover has been consistently increasing annually, it is undeniable that Vietnam’s coffee output has been on a downward trajectory. To foster sustainable development in the industry, it is imperative to address the issue of maintaining and enhancing Vietnam’s coffee production.

As of the 2023-2024 crop year, Vietnam’s total coffee cultivation area was estimated to be over 709,040 hectares. However, some industry experts believe the actual area might be lower, around 600,000 hectares, due to farmers shifting to more economically viable crops.

According to VICOFA, to boost coffee production, priority should be given to replanting and varietal improvement, transitioning to high-yielding, disease-resistant coffee varieties that meet the standards of demanding international markets. This will not only increase output but also reduce input costs.

Coffee farmers are encouraged to adopt sustainable and organic farming practices, which contribute to long-term yield stability and command higher prices through international certifications. Integrating digital technologies, such as blockchain-based traceability, QR codes, and digital manuals for farmers, will enhance transparency and improve production management.

Vietnam possesses the resources and potential to maintain its leadership in the global coffee market, but it requires a comprehensive overhaul in mindset and strategies, involving farmers, businesses, and governing bodies alike. Otherwise, the crown of being the world’s leading Robusta producer, once a source of pride for Vietnamese agriculture, may slip from our grasp.

The Coffee Export Conundrum: Can We Still Hit the $7 Billion Mark in 2025?

In the coming months, Vietnam’s coffee exports to the US market are expected to face challenges due to tax policies favoring Brazilian coffee. However, industry experts predict that coffee exports for the full year of 2025 can still reach a record-breaking $7 billion.

The World’s Second Largest Coffee Exporter and Top Producer of Robusta Beans: Unraveling the Challenges Faced by Vietnam’s Coffee Industry

The Vietnamese coffee market is at a pivotal moment. With rising prices and declining production, the industry faces a unique set of challenges and opportunities. This dynamic situation demands a fresh perspective and a strategic approach to navigate the changing landscape.