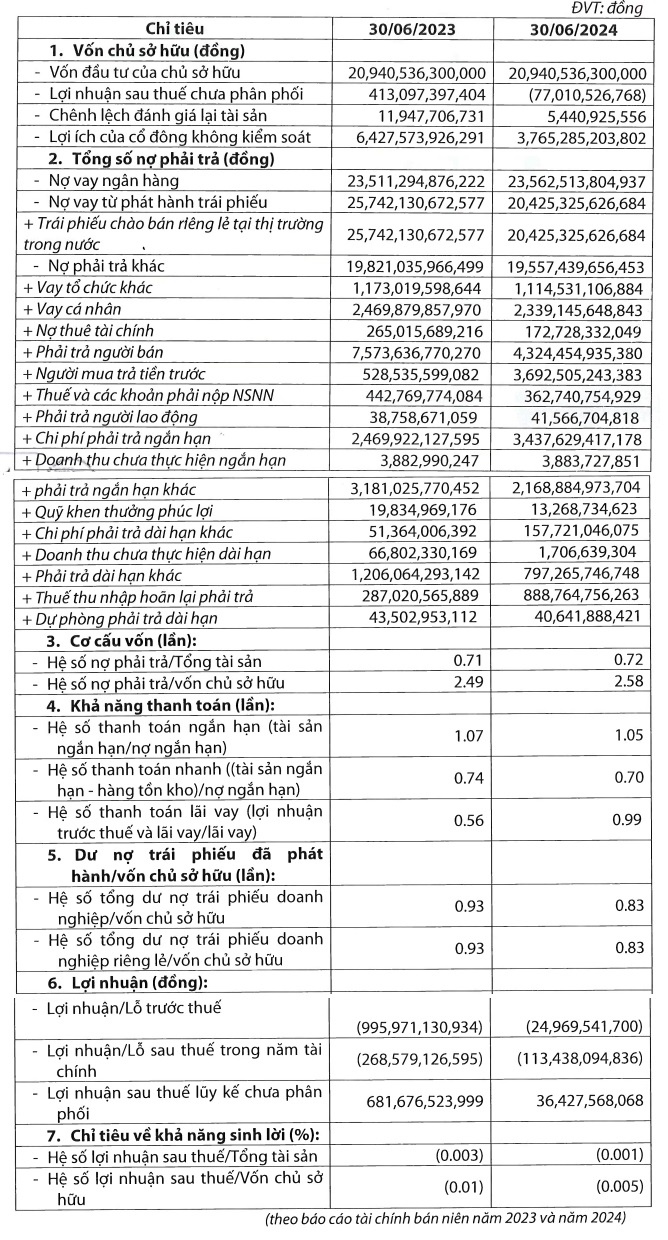

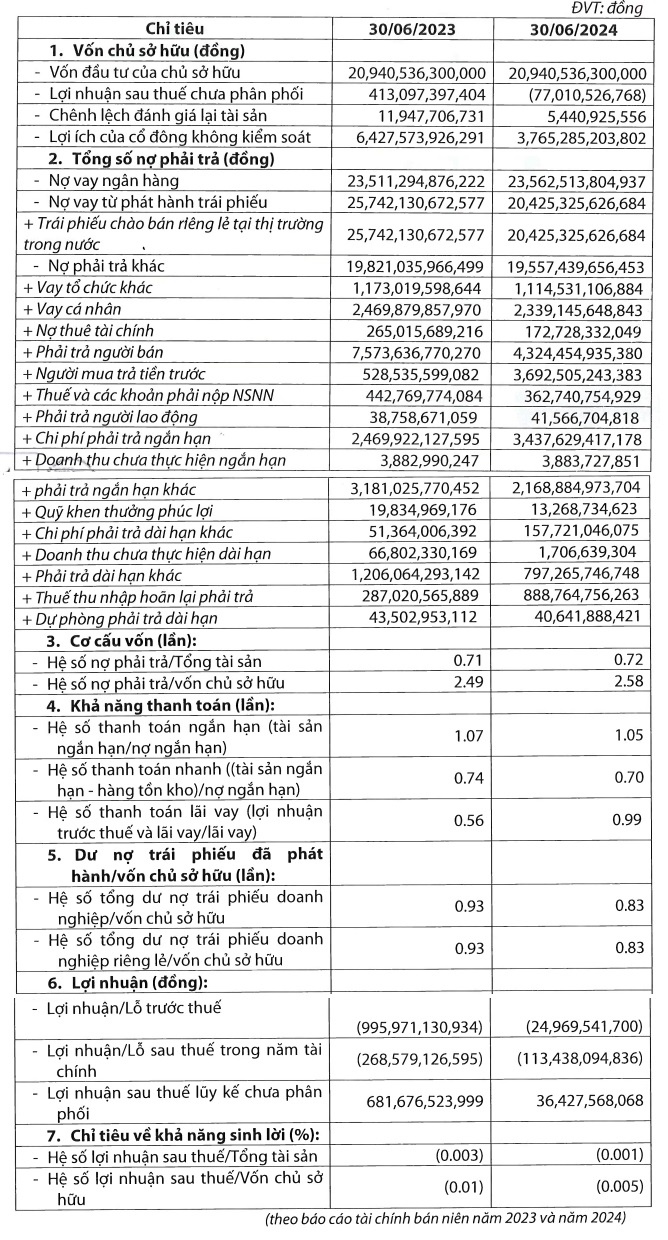

Specifically, in the first half of 2024, Trungnam Group posted a pre-tax loss of nearly VND 25 billion (compared to a loss of nearly VND 996 billion in the same period last year) and a post-tax loss of over VND 113 billion (compared to a loss of VND 269 billion in the same period).

However, as of June 30, 2024, the accumulated undistributed post-tax profit stood at only VND 36 billion (compared to VND 682 billion in the same period last year).

As of the second quarter of 2024, Trungnam Group had nearly VND 23.6 trillion in bank loans and over VND 20.4 trillion in bond debt, totaling approximately VND 44 trillion in debt, a 10% decrease compared to the previous year. In addition, other payables decreased slightly to VND 19.6 trillion.

The current ratio decreased slightly from 1.07 to 1.05, indicating that the company still maintains its debt repayment capacity. The quick ratio decreased from 0.74 to 0.7, suggesting that there are risks associated with maturing debts. However, the interest coverage ratio increased to 0.99, implying that the company can adequately manage its interest expenses.

Source: HNX

|

Established in November 2004, Trung Nam Group primarily engages in the construction of civil engineering works and is founded by brothers Nguyen Tam Thinh (born in 1973) and Nguyen Tam Tien (born in 1967). Mr. Thinh currently serves as the Chairman of the Board and legal representative of the company.

Over its 20 years of operations and transformations, Trung Nam Group has evolved into a diversified conglomerate with five core business segments: energy, infrastructure and construction, real estate, and industrial information electronics. Notably, the energy segment stands out with nine power projects totaling over 1,400 MW in capacity and nearly 4 billion kWh in annual output.

Some of Trung Nam Group’s most prominent projects include the Trung Nam Thuan Nam Solar Power Plant (450 MW, 1.2 billion kWh/year), Ea Nam Dak Lak Wind Power Plant (1.1 billion kWh/year), and several hydroelectric plants.

– 15:58 20/05/2025

The Perennial Borrower: Nhựa Việt Thành’s Spiraling Debt Saga

The Board of Directors of Vietnam Plastics Production and Trading Joint Stock Company (HNX: VTZ) has approved a resolution to secure a VND 100 billion working capital loan, including issuing guarantees and opening L/Cs for its business operations with SeABank – Thu Duc Branch.

The Woman in Debt: A Tale of Uncontrollable ‘Investment’ Addiction

The burden of her substantial debt fell heavily on her family. Her husband had no choice but to sell their home, forcing the family to relocate and start anew in their rural hometown. To aid their son-in-law, her parents sold their own land, sacrificing their assets to alleviate their child’s burden.

The Three Top Executives of Viettel Global Step Down

“Three individuals, united by a serendipitous twist of fate, found themselves entrusted with a new mission from the conglomerate. Their paths converged as they embarked on a journey to uncover the mysteries of their shared assignment. As they delved deeper, they discovered a web of intrigue, where their unique skills and perspectives became their greatest assets. With a collective determination, they set out to leave an indelible mark, driven by a passion to excel and a desire to unravel the unknown.”