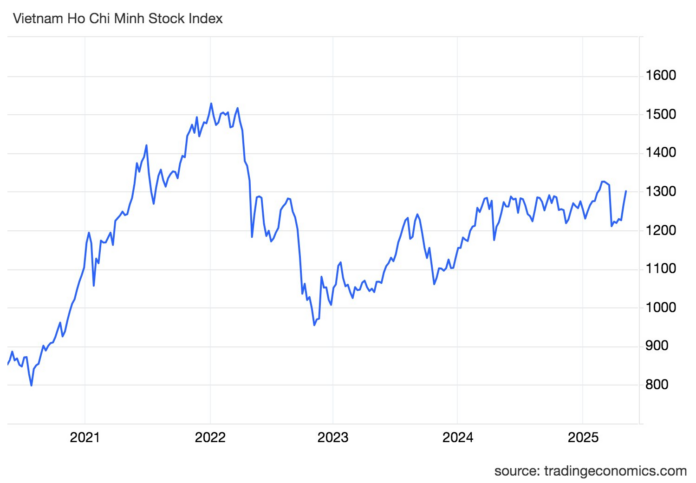

The Vietnamese stock market experienced a buoyant week of trading, with investors witnessing VN-Index surpass the 1,300 mark once again. VN-Index was upbeat in the first three sessions, pushing the main index from the 1,280 region past 1,310 before retreating in the final session of the week.

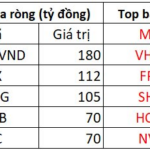

Overall, the VN-Index rose 34.09 points (+2.69%) from the previous week to 1,301.39. In terms of foreign investment, after five sessions, net foreign investors bought VND 2,871 billion in the entire market, marking the third week in 2025 that foreign investors have net purchased Vietnamese stocks.

As observed, the VN-Index has rebounded from the 1,080-1,130 region to the old peak region of 1,320-1,340. Many believe that unless there are significant changes in the overall situation, the VN-Index still lacks the crucial momentum to continue its short-term breakout.

“Note the possibility of VN-Index giving back points”

Vu Thi Quynh Trang, Pinetree Securities Analyst

According to Ms. Trang, the Vietnamese market experienced a rather positive trading week as the VN-Index officially closed the gap in the downward session on April 3, corresponding to the 1,278-1,317 region.

With improved market sentiment, the VN-Index once again surpassed the 1,300 mark, and the upward momentum was bolstered as the market mostly opened with upward gaps from the start of the morning sessions for four consecutive days. The news of the US and China officially agreeing to reduce retaliatory tariffs acted as a significant boost for global stock markets, including Vietnam.

The momentum of the VN-Index in the past week was largely driven by the Vingroup quartet, including VPL (Vinpearl), which was newly listed on Tuesday (May 13). Therefore, the nature of the market’s momentum in the past two weeks has been quite different from the previous phase of breaking the 1,300-point mark, as the market was highly polarized and focused only on pulling the Vingroup stocks.

“It can be said that the movement of this group will be the crucial factor determining the trend of the VN-Index in the near future“, Ms. Trang remarked.

Regarding the market trend for the following week , the Pinetree expert predicts that investors may not witness significant breakthroughs like the previous week, as there have not been any major changes in the macroeconomic landscape, and the only supportive information for the market at present stems from updates on Vietnam’s tariff negotiations.

The market will witness clearer differentiation, and even within the banking group, individual stocks exhibit contrasting performances as large banks take turns leading the sector, each with its unique story. This lack of consensus among the “king” stocks indicates that the VN-Index still lacks the crucial impetus to continue its upward trajectory in the coming week.

Importantly, in the event of a substantial correction in VIC, the VN-Index may have to give back points, and the market could retreat to the 1,270-1,277 region next week, corresponding to the critical support of the 100-day MA on the daily chart. Although this corrective phase may result in a loss of 20-30 points, investors need not be overly concerned, as the market’s breakout phase above 1,300 points in the previous week was accompanied by relatively low volume, averaging around 800-900 million shares per session.

Simultaneously, Ms. Trang noted that the market’s cup-and-handle pattern and decisive breakthrough above 1,300 present a significant opportunity for waiting demand at the 1,270 region. Furthermore, excluding the VIC group and some banks that are outperforming the overall market, numerous stocks have yet to fill the gap from the previous downward phase and still offer upside potential.

In a neutral scenario, the VN-Index is expected to fluctuate and consolidate around the 1,300 region next week. In a corrective scenario, after regaining balance around 1,270, the VN-Index will attempt to reconquer the 1,300 threshold.

“Not an attractive price region for further investment”

Securities Analysis of SHS

According to SHS Securities’ analysis team, the VN-Index had a positive start to May 2025, reclaiming the March 2025 peak. Last week, the VN-Index climbed for four consecutive sessions with rising trading volume. However, the index faced corrective pressure at a formidable resistance level during the final session.

By the week’s end, the VN-Index had surpassed the psychological threshold of 1,300, returning to the March 2025 peak before the steep decline triggered by US tariff announcements. Similarly, the VN30 rose 2.38% to 1,384.44, positively reclaiming the 1,400 region, the highest level in March 2025.

Market breadth continued to recover, with strong gains in electricity, electrical construction, and banking groups. There was also a robust recovery in industrial parks, retail, technology and telecommunications, and textiles. Meanwhile, real estate and insurance groups experienced corrective pressure and differentiation. Trading volume increased by 31.1% compared to the previous week, reflecting improved market sentiment and a resurgence of short-term cash flow.

Regarding the short-term trend, the SHS team anticipates that the VN-Index will resume its short-term upward trajectory above the nearest support region of 1,300. After surpassing the 1,300 resistance level, the VN-Index is expected to retest the March 2025 peak of 1,320-1,340. Market sentiment and trends remain positive under the beneficial influence of large-cap stocks in the VN30 group. The VN30 index, positively influenced by foreign investors, is returning to the March 2025 peak of around 1,400.

The market is recovering to pre-tariff announcement levels. However, regardless of the trade negotiation outcomes, tariffs will be imposed, impacting macroeconomic balances and business operations.

Currently, many stocks remain reasonably priced relative to their fundamentals. Nonetheless, the VN-Index has rebounded from the 1,080-1,130 region to the old peak region of 1,320-1,340. SHS assesses that this is not an attractive price region for further investment. Investors should carefully select stocks for portfolio expansion, considering growth prospects.

SHS also recommends that investors maintain a reasonable portfolio balance, focusing on stocks with solid fundamentals, industry leaders in strategic sectors, and exceptional growth potential.

“Vietstock Daily Recap: Selling Pressure Persists”

The VN-Index witnessed a consecutive decline for the second session, breaching the 1,300-point mark. If this trend persists in the upcoming sessions, the VN-Index could potentially retest the old peak formed in December 2024 (corresponding to the 1,270-1,280 point range). At present, the Stochastic Oscillator indicator has signaled a sell-off within the overbought zone. Investors are advised to exercise caution in the near term if the indicator falls out of this zone.

The Quiet Korean ‘Chaebol’ Makes a Move in Quang Nam

“In a significant move, one of the top 30 economic conglomerates in South Korea has chosen to adopt LNG as the energy source for its industrial complex in Quang Nam. This decision underscores the company’s commitment to sustainable practices and positions it at the forefront of Korea’s energy transition.”

The Foreign Sell-Off Continues: Nearly 900 Billion Dong Liquidated from Two Blue-Chip Stocks on May 20 Session.

As the VN-Index surges ahead, foreign transactions are a dampener, with a net sell-off of nearly VND 561 billion across the market.