On May 29, Vietnam Industrial and Urban Construction Consulting Joint Stock Company (UPCoM: CCV) will finalize its list of shareholders for a 46.3% cash dividend payout for the year 2024. This equates to a dividend of 4,630 VND per share, with the payment date expected to be June 9.

With 1.8 million shares in circulation, CCV will need to allocate over 8.3 billion VND for this dividend distribution. The company’s parent, Vietnam Construction Consulting Corporation – Joint Stock Company (VGV), which holds 51% of CCV’s capital, is set to receive more than 4 billion VND.

CCV, formerly a state-owned enterprise under the Ministry of Construction, underwent privatization in 2007. With a charter capital of 18 billion VND, the company primarily operates in the construction consulting sector.

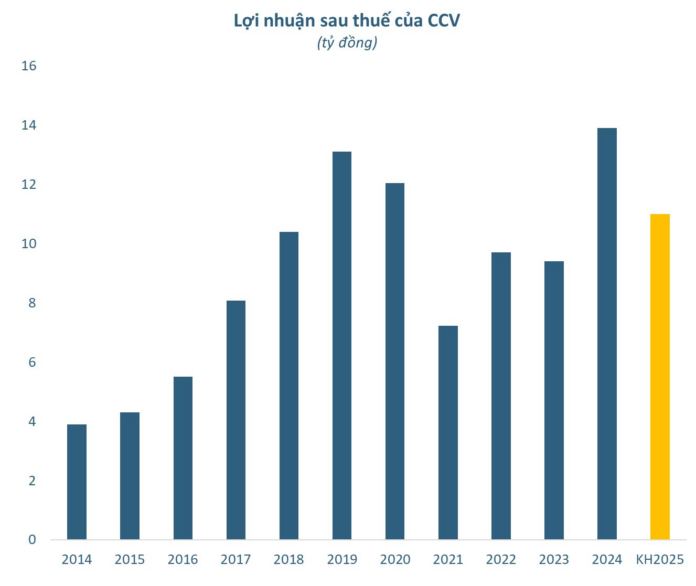

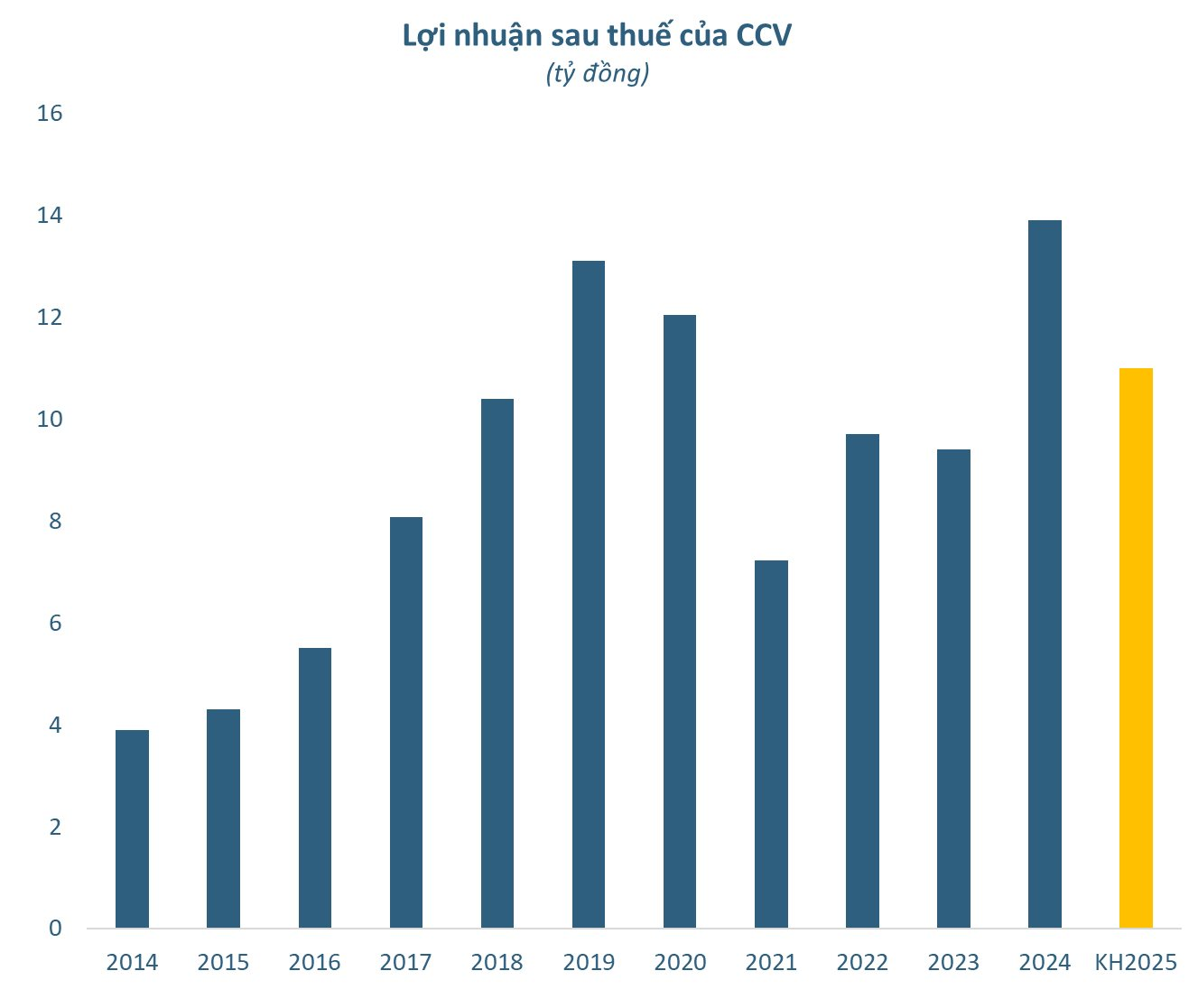

The dividend ratio of over 46% marks the highest level since CCV started paying dividends in 2016. The company’s strong performance in 2024 has resulted in substantial returns for its shareholders. CCV witnessed a 27% year-on-year surge in net revenue, reaching 208 billion VND. After accounting for expenses, the company posted a net profit of nearly 14 billion VND, reflecting a significant 56% increase and the highest profit in CCV’s operational history.

Looking ahead to 2025, CCV has set modest targets, with projected net revenue of nearly 192 billion VND and a net profit of approximately 11 billion VND. These figures represent an 8% and 21% decrease, respectively, compared to the 2024 performance. The company plans to distribute dividends at a rate of 65% of post-tax profits, amounting to roughly 7 billion VND (equivalent to a ratio of about 38%).

In the stock market, CCV shares are currently trading at 34,000 VND per share.

“SDA Stock Plunges Following Trading Restriction News”

“Shares of Simco Song Da Joint Stock Company (HNX: SDA) plummeted on May 19th, following an announcement by the Hanoi Stock Exchange. The exchange has decided to impose trading restrictions on the stock starting May 21st due to a delay in submitting its audited financial statements for the year 2024. With this development, traders are left wondering about the future performance of SDA and its ability to rebound from this setback.”

“Agriseco Prepares to Release Nearly 13 Million Shares as Dividends, Boosting Capital to Over VND 2,283 Billion”

AgriBank Securities Joint Stock Company (Agriseco, HOSE: AGR) is pleased to announce a dividend payout for the year 2024 in the form of a stock dividend. Over 12.9 million new shares will be issued, entitling shareholders to a dividend ratio of 100:6. This equates to a total value of over VND 129 billion. The ex-dividend date is set for June 2nd, 2024.