The Ho Chi Minh City office market witnessed a significant rise in Grade A office rental prices, reaching 46.5 USD/m2/month, an 11% increase compared to the previous year and 2.1% higher than the previous quarter, as per CBRE’s Q2 2025 report. This reflects a strong demand for prime locations and exceptional amenities, particularly in District 1 and Thu Duc City.

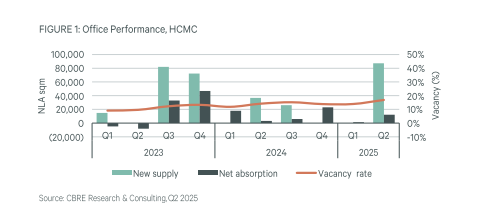

However, there’s a paradox as the average vacancy rate for Grade A offices remains at 22.8%, indicating that almost a quarter of the space is unoccupied. This is mainly due to the addition of new supply in Q2, including Marina Central Tower, Trec Tower, and Halo Signature Building, totaling over 87,000 m2. Newly completed projects usually take time to fill up, temporarily increasing the vacancy rate.

In contrast, Grade B offices have a more stable situation with an average rental price of 26.8 USD/m2/month, a slight increase of 0.7% from the previous quarter. The vacancy rate for Grade B offices is lower at 12.5%, indicating their continued popularity among tenants.

It’s noteworthy that the demand for office space remained steady during the first half of 2025, with over 13,000 m2 being occupied, mainly by businesses in the information technology, finance and banking, and manufacturing sectors. These enterprises tend to opt for offices outside the central area, where vacancy rates are lower and rental prices are more competitive.

Overall, the Ho Chi Minh City office market is experiencing a significant polarization: while new Grade A buildings drive up rental prices, they also contribute to higher vacancy rates; meanwhile, Grade B offices maintain stable occupancy levels and reasonable rental rates.

According to the Savills Impacts 2025 report, five key trends are shaping the global office market and are expected to continue influencing demand in the foreseeable future:

1. Wellbeing at Work: Tenants prioritize creating a work environment that promotes mental and physical health, recognizing its impact on productivity and employee retention.

2. Environmental Sustainability: Enterprises favor buildings with certifications for energy efficiency and sustainable development, aligning with their ESG goals.

3. Evolving Landlord-Tenant Relationships: Investors and tenants are collaborating more closely to optimize spaces and enhance the quality of the working environment.

4. Shift to Premium, Characterful Offices: There’s a growing demand for modern offices with a unique aesthetic and character, offering a range of amenities to provide a high-quality working experience.

5. Hybrid Working Models: Businesses embrace flexible policies, combining on-site and remote work, catering to diverse workforce preferences and geographical considerations.

The Grand Opening and Launch of Saigon Marina International Financial Centre Tower

On the morning of August 19, 2025, the grand opening and inauguration of the Saigon Marina International Financial Centre (Saigon Marina IFC) took place at 02 Ton Duc Thang, Saigon Ward, Ho Chi Minh City. The event was graced by the presence of esteemed leaders from the Communist Party of Vietnam, the Government, and the People’s Committee of Ho Chi Minh City, along with representatives from various central ministries and sectors. The ceremony was also attended by dignitaries from foreign consulates and international organizations, as well as high-ranking executives from numerous domestic and international corporations, financial institutions, and businesses.

The $73 Million CBD Deal: The Real Estate Giant’s Hunt for Prime Property in Ho Chi Minh City’s Core Amid Tech Titans

“The recent acquisition of 100% shares of VIAS Hong Ngoc Bao JSC by UOA Vietnam for a staggering 68 million USD (approximately 1,700 billion VND) has undoubtedly been one of the most notable real estate transactions in the first seven months of 2025, as observed by consulting firms.”