|

Mrs. Nguyen Thi Huong Giang steps down as CEO of Petrolimex Insurance after 3 years in the position

|

The Board of Directors of PGI has just announced the resignation of Mrs. Nguyen Thi Huong Giang from her role as CEO effective May 15th. Concurrently, Mr. Pham Thanh Hai, Chairman of the Board of Directors, has been appointed as the legal representative of the Corporation, replacing Mrs. Giang.

The Board also announced the resignation of Mr. Tran Hoai Nam from his role as Deputy General Director.

Currently, the position of CEO of PGI remains vacant, and no information about a successor has been released.

Mrs. Nguyen Thi Huong Giang (born in 1974) holds a Bachelor’s degree in Foreign Languages and a Master’s degree in Finance, Banking, and Insurance. She joined PGI in 1997 and is one of the long-serving employees of the Company.

She previously served as Deputy General Director from March 2020 and was appointed as CEO from March 1st, 2022, replacing Mr. Dao Nam Hai.

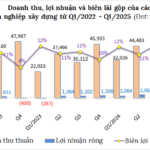

| PGI’s after-tax profit over the years |

|

|

In 2024, PGI recorded a 12% increase in gross profit from insurance activities and a 6% increase in financial activities compared to the previous year. However, due to a 16% surge in management expenses, reaching nearly VND 656 billion, the pre-tax profit only rose slightly by 3%, reaching over VND 291 billion. With these results, the Company achieved 101% of its profit plan.

According to the 2024 audited financial statements, Chairman Pham Thanh Hai and Mrs. Nguyen Thi Huong Giang were the two highest-paid employees at PGI, earning over VND 2.7 billion and VND 2.4 billion, respectively, in the past year.

For 2025, PGI sets its targets with original insurance revenue reaching VND 4,400 billion, equivalent to 2024; financial revenue of VND 220 billion. The pre-tax profit goal is VND 306 billion, a 5% increase compared to the previous year. The Company plans to pay a 12% cash dividend.

According to PGI, the plan for flat revenue is mainly due to the stagnation in growth forecasted for the marine insurance and health insurance segments.

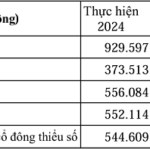

| PGI’s after-tax profit in Q1 over the years |

|

|

In the first quarter of 2025, PGI recorded insurance premium revenue of VND 1,186 billion, a slight increase of 3% compared to the same period last year. However, due to a 16% increase in reinsurance expenses, net revenue remained almost unchanged at VND 460 billion.

Thanks to a 10% decrease in compensation expenses, total insurance business expenses only rose slightly by 1%. As a result, the gross insurance profit reached VND 242 billion, a 2% decrease.

Financial income decreased by 31% to VND 18 billion, but a 5% reduction in management expenses helped PGI achieve a net profit of VND 71 billion in the first quarter, a 4% increase compared to the same period and equivalent to 29% of the yearly plan.

– 11:13, May 21, 2025

“City Auto’s Shareholder Meeting: Foraying into Electric Vehicles, Electing Chairman’s Son to the Board”

At the 2025 Annual General Meeting held on the morning of May 20, City Auto Joint Stock Company (HOSE: CTF) unveiled several new strategic orientations. Notably, the company announced its plans to expand into the electric vehicle sector and its ambition to move deeper into the automotive value chain, aiming to transcend its traditional role as a mere distributor.

The Construction Industry’s Profit Polarization: Weak Firms Stuck in a Spiraling Loss Crisis

The construction industry witnessed a stark contrast in fortunes in Q1 2025, with some businesses surging ahead with exponential profit growth while others remained mired in losses or experienced significant profit declines. A wave of public investment and key infrastructure projects offers a glimmer of hope for a sector-wide recovery in the coming months.

“SDA Stock Plunges Following Trading Restriction News”

“Shares of Simco Song Da Joint Stock Company (HNX: SDA) plummeted on May 19th, following an announcement by the Hanoi Stock Exchange. The exchange has decided to impose trading restrictions on the stock starting May 21st due to a delay in submitting its audited financial statements for the year 2024. With this development, traders are left wondering about the future performance of SDA and its ability to rebound from this setback.”