Source: VietstockFinance

|

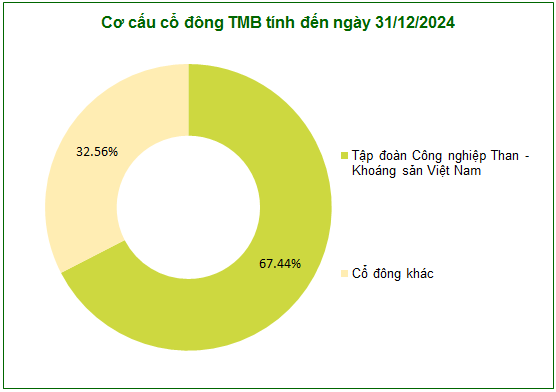

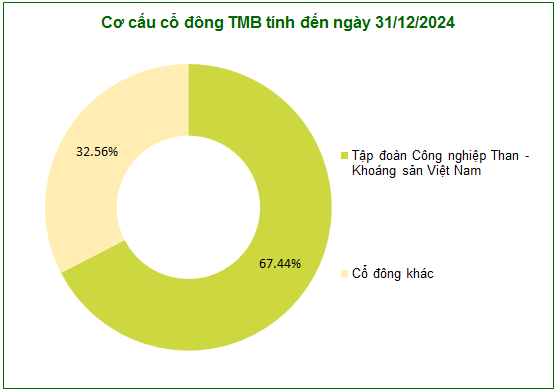

The largest shareholder, also the parent company, Vietnam National Coal-Mineral Industries Group (Vinacomin), which holds 67.44% of the capital, is expected to receive more than 20 billion VND.

Source: VietstockFinance

|

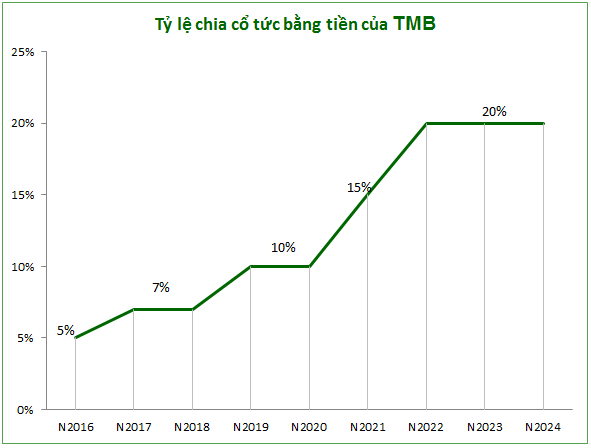

TMB started its cash dividend policy in 2016 with a ratio of 5%, gradually increasing over the years and stabilizing at 20% from 2022 onwards.

| TMB’s net profit over the years |

|

|

In terms of business results, TMB‘s net profit peaked at 332 billion VND in 2023, a 70% increase compared to the previous year. However, in 2024, profit dropped significantly to 200 billion VND, equivalent to a 40% decrease from the peak.

In 2025, the company plans to maintain revenue compared to the previous year at nearly 42,193 billion VND and reduce net profit by 35% to 130 billion VND.

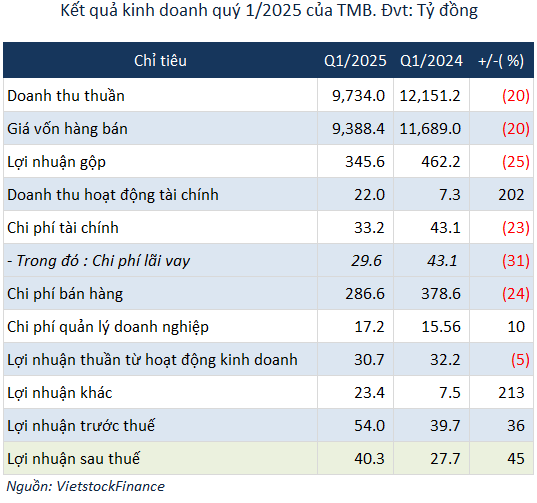

In the first quarter of 2025, despite a 20% decrease in net revenue compared to the same period last year to 9,734 billion VND, resulting in a 25% decrease in gross profit to 346 billion VND, TMB still made a net profit of more than 40 billion VND, an increase of 45%.

This result was achieved thanks to a threefold increase in financial revenue to 22 billion VND (mainly from exchange rate differences), a 24% decrease in selling expenses to 287 billion VND, and a significant increase in profit from other activities, tripling to more than 23 billion VND. The company has completed 31% of its annual profit plan after the first quarter.

– 13:57 22/05/2025

“SDA Stock Plunges Following Trading Restriction News”

“Shares of Simco Song Da Joint Stock Company (HNX: SDA) plummeted on May 19th, following an announcement by the Hanoi Stock Exchange. The exchange has decided to impose trading restrictions on the stock starting May 21st due to a delay in submitting its audited financial statements for the year 2024. With this development, traders are left wondering about the future performance of SDA and its ability to rebound from this setback.”

“Agriseco Prepares to Release Nearly 13 Million Shares as Dividends, Boosting Capital to Over VND 2,283 Billion”

AgriBank Securities Joint Stock Company (Agriseco, HOSE: AGR) is pleased to announce a dividend payout for the year 2024 in the form of a stock dividend. Over 12.9 million new shares will be issued, entitling shareholders to a dividend ratio of 100:6. This equates to a total value of over VND 129 billion. The ex-dividend date is set for June 2nd, 2024.