Currently, there are 154 million IMP shares in circulation on the market, with a share price of 50,600 VND/share, equivalent to a market capitalization of 7.8 trillion VND. Livzon’s repurchase value implies a valuation of approximately 8.8 trillion VND for IMP (approximately 57,400 VND/share), which is 13.4% higher than the current price, with a P/E ratio of 20 times.

| Price movement of IMP shares from the beginning of the year until now |

The transaction will be completed after complying with the regulations and procedures for public offering. The deal is carried out through Lian SGP Holding Pte. Ltd., an indirectly wholly-owned subsidiary of Livzon. As a result, Livzon becomes the indirect parent company of IMP with a holding ratio of 64.81%, and IMP‘s results will be consolidated into its financial statements. The second largest shareholder of IMP is Vietnam Pharmaceutical Corporation – JSC (Vinapharm, HOSE: DVN), holding 22.04% of the charter capital.

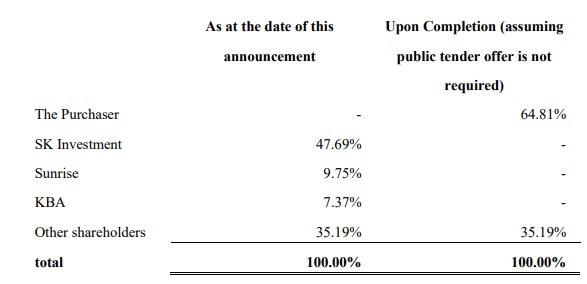

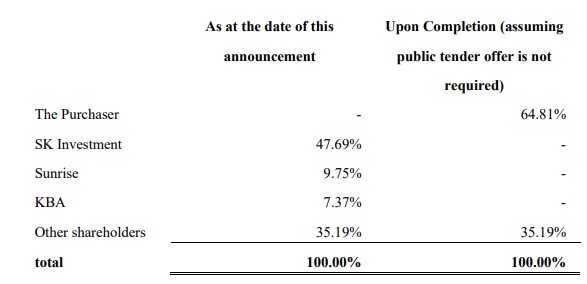

Based on the current shareholder structure, Livzon will purchase the above-mentioned shares from 3 shareholders, including SK Investment (holding nearly 73.5 million shares, equivalent to a holding ratio of 47.69%), Sunrise Investment Joint Stock Company (holding over 15 million shares, equivalent to 9.75%), and KBA Investment Joint Stock Company (holding nearly 11.4 million shares, equivalent to 7.37%).

|

Shareholder structure at IMP

Source: Livzon

|

In Livzon’s announcement, the above valuation is based on two criteria: the average market capitalization of IMP in the last 30 trading sessions on the HOSE (as of May 21, 2025) is about 269 million USD; and the control premium is assessed based on the consideration of the historical buy-backs of various companies on the HOSE in the period of 2011-2024, in which the average premium compared to the 1-month closing price is about 42%, and compared to the volume-weighted average price is 38.4%.

|

On June 10, IMP will finalize the list of shareholders to pay 2024 dividends in cash at a rate of 5% (VND 500/share), with the expected payment date on July 09, 2025. |

Livzon stated that this deal will lay a solid foundation for its long-term internationalization strategy and sustainable development of the pharmaceutical industry. The acquisition helps consolidate the Group’s presence in Vietnam and Southeast Asia by leveraging IMP‘s local strengths and networks.

In fact, the sale of IMP seemed to have been “hinted” by SK Group at the 2025 Annual General Meeting of Shareholders. Specifically, Mr. Sung Min Woo, Chairman of the Board of Directors of IMP and also the representative of SK Group, said that although they have not divested yet, “SK is currently restructuring its investment portfolio, including all of SK’s assets globally. Therefore, there may be a change in SK’s ownership rate at Imexpharm in the future” – quoted from the Chairman of IMP.

Mr. Sung Min Woo, Chairman of the Board of Directors of IMP and representative of SK Group at the 2025 Annual General Meeting of Shareholders

|

Livzon is a large pharmaceutical group in China, established in 1985, with a current charter capital of more than 935 million CNY. The Group specializes in researching, manufacturing, and developing pharmaceuticals, prescription drugs, traditional Chinese medicines, drug ingredients, etc., operating in more than 30 countries worldwide, including the US, EU, South Korea, Japan, Southeast Asia, etc. According to the 2024 Consolidated Financial Statements, the Group had a total revenue of more than 11.8 billion CNY (equivalent to more than 42.5 trillion VND), down 5% compared to the previous year; but net profit was more than 2.8 billion CNY (nearly 10.1 trillion VND), up 18%.

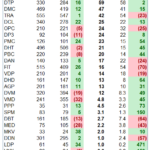

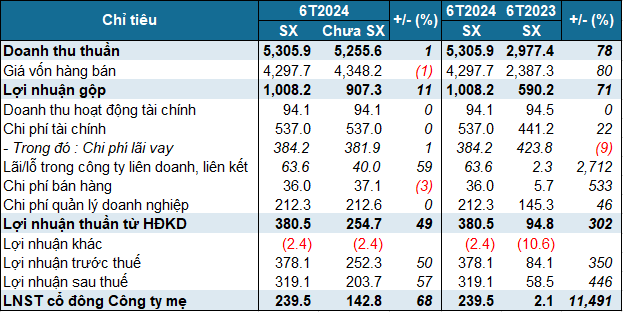

Regarding IMP, the Enterprise has just gone through 3 consecutive years of record profits. In 2024, IMP achieved revenue of more than 2,200 billion VND, up 10.5% over the previous year; profit after tax of 321 billion VND, up 7%. Not stopping there, IMP continues to set a record-breaking profit plan for 2025, with a revenue target of nearly VND 2,650 billion, up 20%; and a pre-tax profit plan of nearly VND 494 billion, up 22%.

The growth momentum continued in the first quarter of 2025, with revenue reaching VND 594 billion, up 21% over the same period; profit before and after tax reached VND 95 billion and VND 74 billion, respectively, up 23% and 20%. This result corresponds to 19% of the year’s profit plan.

| Business performance of IMP |

– 09:19 23/05/2025

Harvesting Gold: A Look at the Success of Industry Giants

The pharmaceutical industry witnessed a mixed performance in Q1 2025. While several industry giants thrived through continuous product restructuring and robust business promotions, numerous others experienced significant downturns due to diverse challenges.

The Ultimate Recession-Proof Industry: A $70 Billion Behemoth, with Retail Giants Scrambling to Open Stores in Rural and Urban Areas Alike

The pharmaceutical retail market is often deemed “recession-proof”, owing to the consistent demand for pharmaceuticals, which remains imperative despite macroeconomic fluctuations. In the context of Vietnam, with its aging population and growing middle class, the demand for healthcare, and by extension, the pharmaceutical industry, is experiencing unwavering growth, as highlighted by Vietdata, a prominent provider of reports on the Vietnamese economy.