On May 20, the Ho Chi Minh City Stock Exchange (HOSE) announced it had received an application from Truong Son Investment and Construction JSC to list 38.5 million TSA shares on HOSE, equivalent to a charter capital of VND 385 billion.

Established in 2002, Truong Son Investment and Construction JSC transitioned to a joint-stock company in 2019. The company primarily operates in the field of electrical construction, with its head office located in Chau Son Industrial Park, Chau Son Ward, Phu Ly City, Ha Nam Province.

Source: VietstockFinance

|

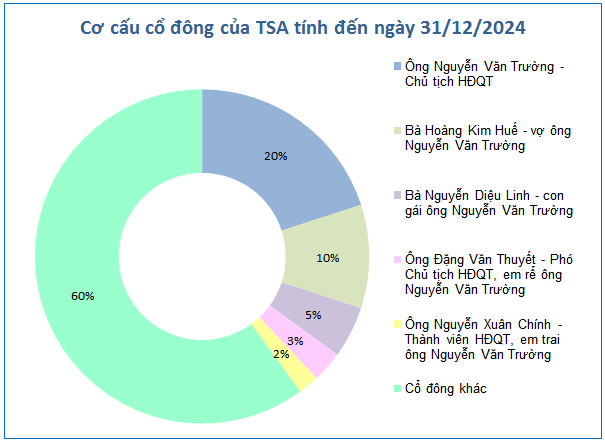

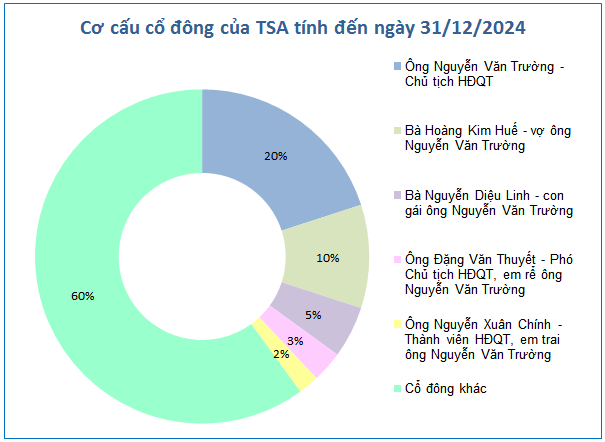

As of December 31, 2024, Mr. Nguyen Van Truong, Chairman of the Board of Directors of TSA, was also the largest shareholder of the company, with a 20% ownership stake. While still the largest shareholder, this percentage has decreased significantly from the 95% he held before TSA was listed on the UPCoM exchange.

In addition to Mr. Truong, the other two major shareholders of TSA are also members of his family. Specifically, Mrs. Hoang Kim Hue, Mr. Truong’s wife, holds 10% of the capital, while their daughter, Nguyen Dieu Linh, owns 5%.

Moreover, other senior leaders of TSA are also relatives of the Chairman. Mr. Dang Van Thuyet, Vice Chairman of the Board of Directors and Mr. Truong’s brother-in-law, holds 3% of the capital. Mr. Nguyen Xuan Chinh, a member of the Board of Directors and Mr. Truong’s brother, owns 2%.

In total, Chairman Nguyen Van Truong and related individuals hold approximately 40% of TSA’s charter capital.

| Price movement of TSA shares since listing on UPCoM |

TSA began trading on the UPCoM exchange on June 25, 2024, with a reference price of VND 10,600 per share. On the first day, TSA shares surged to the maximum daily limit and continued to rise sharply in the second session (June 26), reaching a peak of VND 15,200 per share.

However, after hitting this high, the share price quickly corrected and fluctuated around the range of VND 11,000-12,200 per share for most of the remaining year. In early January 2025, TSA hit a short-term low of VND 10,800 per share before showing signs of a mild recovery, but it failed to break out of the VND 12,000 range – a level also observed in 2024.

| TSA’s financial performance over the years |

In 2024, TSA recorded net revenue of nearly VND 653 billion, a 77% increase compared to the previous year. Net profit reached nearly VND 24 billion, 2.4 times higher than in 2023. These figures represent the highest revenue and profit levels since the company began disclosing its financial results.

For 2025, TSA set a target of VND 690 billion in revenue and VND 26.5 billion in net profit, an increase of 6% and 13%, respectively, compared to 2024. The company plans to pay dividends at a rate of 10%.

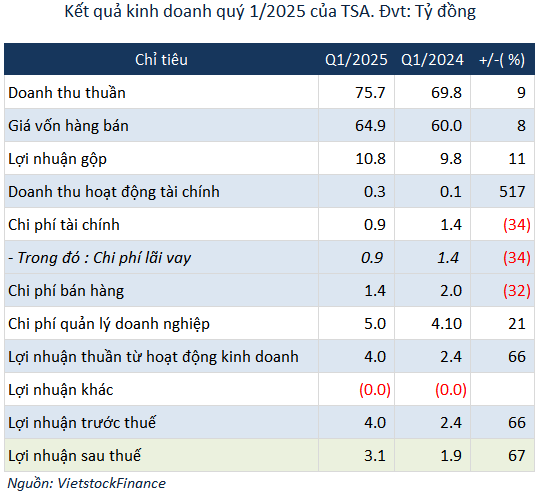

In the first quarter of 2025, TSA achieved net revenue of nearly VND 76 billion, a 9% increase compared to the same period last year. Thanks to a 34% reduction in interest expenses and a 32% decrease in selling expenses, net profit for the quarter rose by 67%, reaching over VND 3 billion, completing 12% of the annual plan.

As of the end of the first quarter of 2025, TSA’s total assets decreased by 6% compared to the beginning of the year, amounting to over VND 604 billion. Within this, cash decreased sharply by 71% to over VND 36 billion, while short-term receivables declined by 13% to nearly VND 204 billion. Conversely, inventory increased by 85%, reaching nearly VND 160 billion.

In terms of capital structure, total liabilities at the end of the first quarter stood at over VND 170 billion, a 31% decrease from the beginning of the year. This reduction was mainly due to a decrease in short-term payables to suppliers and short-term borrowings, which fell by 41% and 44%, respectively, to VND 75 billion and VND 43 billion.

– 15:04 21/05/2025

“A Securities Firm Suspended from Making Payments and Trading Private Bonds for One Week”

On May 20th, HD Securities JSC (HDS) announced that it had received a decision from the Vietnam Securities Depository and Settlement Corporation (VSDC) and the Vietnam Stock Exchange (VNX) to suspend the company’s settlement operations and activities in the private corporate bond market from May 20th to May 26th.

“Haxaco Seeks Buyer for Prime 6,200 sqm Land Plot, Asking Price: VND 1,130 Billion and Up”

Haxaco is seeking shareholder approval to sell a 6,282.6 sqm land plot on Vo Van Kiet Street, with an expected transaction value of at least VND 1,130.8 billion.

“A Bright Start: PJICO’s Impressive Performance in Q1”

In the recently released Q1 2025 financial report, Petrolimex Insurance Joint-Stock Corporation (PJICO, code: PGI) recorded a total revenue of VND 1,343 billion, a 3.3% increase, amounting to 26% of the yearly plan. The original insurance revenue reached VND 1,114 billion, a slight 1.3% uptick compared to the same period in 2024.

The Great Mid-Year Sale: Slashing Prices, Not Quality

The financial report submitted to the Hanoi Stock Exchange reveals an interesting development. Trungnam Group, a construction and investment company, reported a pre-tax loss of VND 25 billion for the first half of 2024, a significant improvement from the VND 1 trillion loss in the same period last year. Despite a post-tax loss of VND 113 billion, the company is showing signs of a robust recovery.