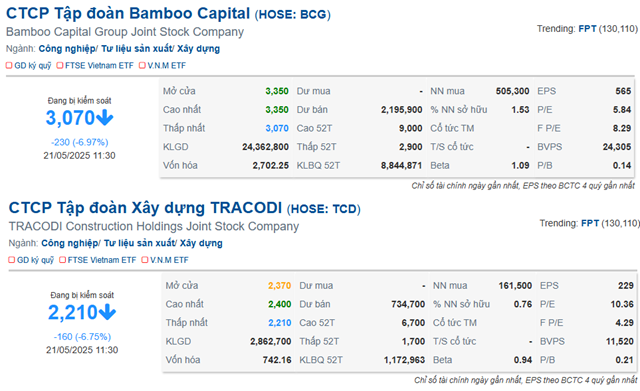

Previously, due to delays in submitting the 2024 audited financial statements, the stocks of Bamboo Capital Joint Stock Company (HOSE: BCG) and Tracodi Construction Group Joint Stock Company (HOSE: TCD) were placed under warning from April 23, and then shifted to the controlled category from May 13, due to submissions being over 30 days late.

More notably, on May 14, both BCG and TCD were again reminded for the second time regarding their delayed submission of separate and consolidated financial statements for the first quarter of 2025.

The situation of these two stocks in the securities market is extremely challenging, following the prosecution of several leaders at the end of February 2025. The stocks continuously fell to the floor price, triggering margin cuts by securities companies, followed by a series of forced sales.

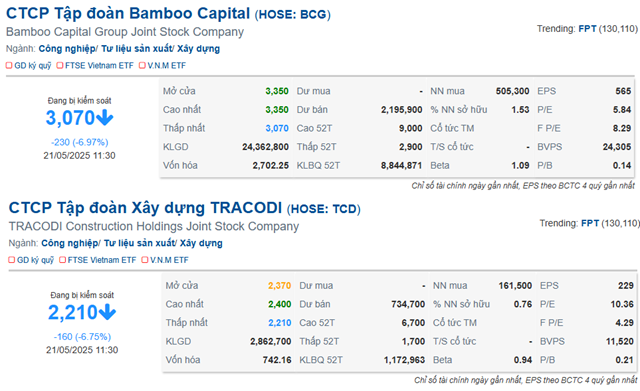

By the end of the morning session on May 21, after a series of unfavorable information, both BCG and TCD hit the floor price with respective selling volumes of over 2.1 million shares and nearly 735,000 shares.

Source: VietstockFinance

|

In reality, BCG has provided explanations and solutions for the delay on May 9. In the document, the Company stated that there had been numerous changes related to major shareholders and personnel, which interrupted the reporting process due to the need for investigation.

The letter also clarified that only 4 out of 45 subsidiaries and associated companies had completed their reporting, hence the inability to issue consolidated audited financial statements within the prescribed time frame. The Company also anticipated the completion of the audit reports of the member units by August 2025, with the consolidated audited financial statements of BCG to be released in early September 2025.

Regarding TCD, on May 8, the Company also explained the delay in submitting its report, citing significant pressure amidst economic challenges and fluctuations in the Company’s operations, along with an ongoing comprehensive restructuring to stabilize its business in the new context.

TCD also mentioned that the new personnel were still familiarizing themselves with the work and needed additional time to coordinate and reconcile data with the auditing firm.

A leadership team that has never been stable

Recently, on May 19, the TCD Board of Directors received resignation letters from Mr. Nguyen Van Bac and Mr. Tomas Sven Jaehnig, who wished to step down from their positions for the 2022-2027 term. The Board of Directors will propose to the shareholders to approve the dismissal of these two members at the upcoming General Meeting of Shareholders.

In the announcement on the same day, Tracodi’s leaders stated that they would elect three new members to the Board of Directors, including one independent member, in addition to electing two new members to the Supervisory Board. The Company plans to collect shareholder opinions in writing regarding the personnel changes in the Board of Directors and the Supervisory Board.

At BCG, on May 12, the Board of Directors decided to appoint Mr. Pham Huu Quoc as the new CEO, replacing Mr. Ho Viet Thuy, who had resigned. BCG has changed its CEO twice in just over two months, since Mr. Ho Viet Thuy replaced Mr. Nguyen Tung Lam in early March. Previously, on March 17, the Chairman of the Board of Directors of Bamboo Capital, Mr. Kou Kok Yiow (Chris), suddenly passed away. Simultaneously, two members of the Board of Directors also withdrew for personal reasons and other assignments.

– 13:58 21/05/2025

“Veteran Textile Manufacturer Suspends Operations After Six Years of Consecutive Losses and Depleting Capital”

Legamex is one of the businesses that has suffered at the hands of the Amazon giant. Similar to Garmex Saigon, LGM faced disruptions in their garment orders from Gilimex starting in late 2022.