I. MARKET ANALYSIS OF STOCKS AS OF MAY 21, 2025

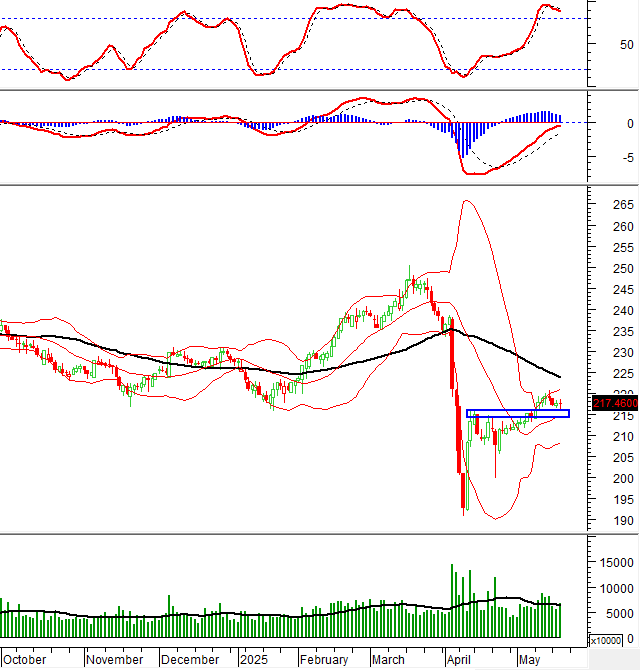

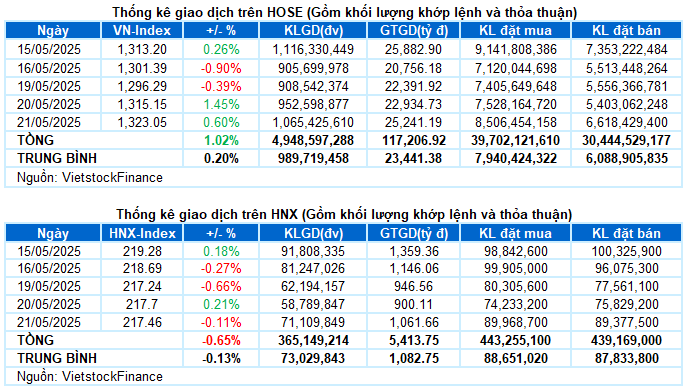

– The main indices showed mixed performance during the May 21 trading session. The VN-Index rose by 0.6%, reaching 1,323.05 points. Conversely, the HNX-Index failed to maintain its positive momentum, closing at 217.46 points, a slight decrease of 0.11%.

– The matched order volume on the HOSE increased by 15.5%, reaching nearly 990 million units. The HNX recorded a volume of over 68 million units, a 20.4% increase compared to the previous session.

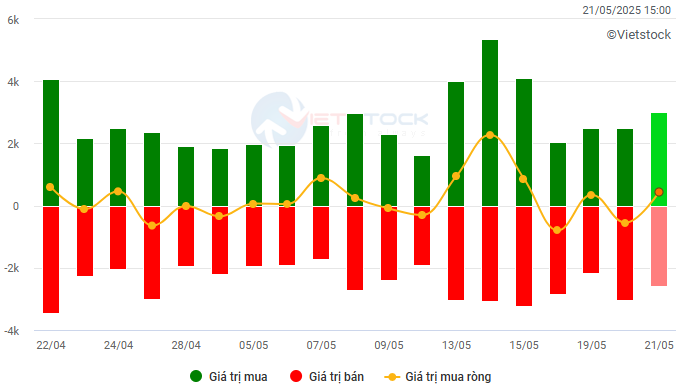

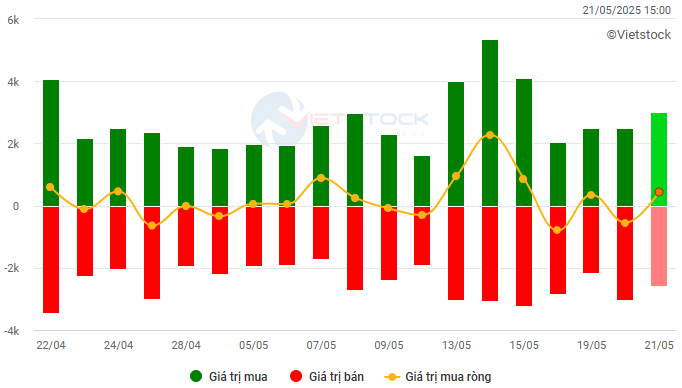

– Foreign investors recorded net buying with a value of more than VND 467 billion on the HOSE and net selling of over VND 51 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM. Unit: VND billion

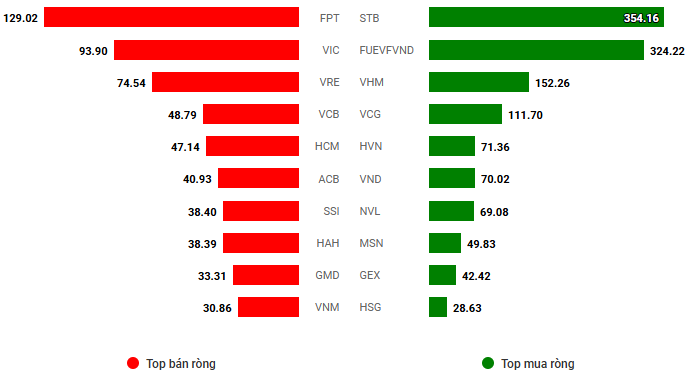

Net trading value by stock code. Unit: VND billion

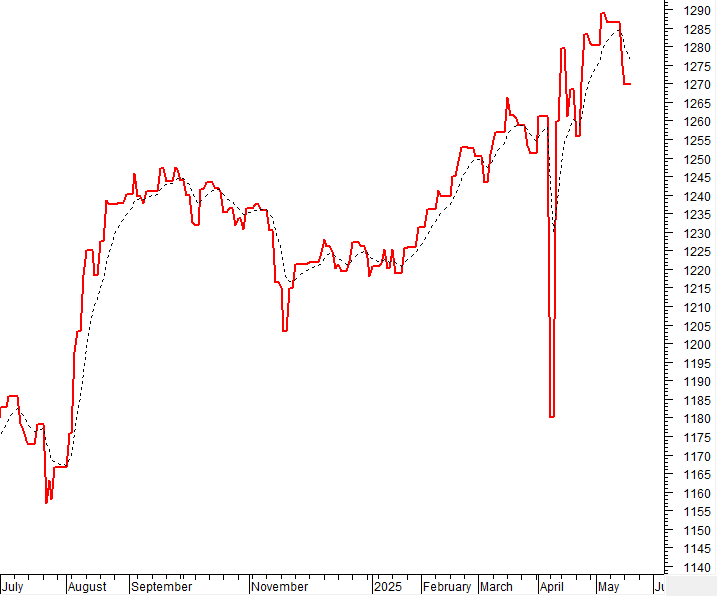

– The market started the May 21 session on a positive note, with the VN-Index opening nearly 10 points higher, led by large-cap stocks. However, profit-taking pressure quickly emerged after half an hour of trading, causing the index to narrow its gains and even approach the reference level by the end of the morning session. Nonetheless, buying demand showed signs of improvement in the afternoon session, helping the market regain its upward momentum. The VN-Index closed at 1,323.05 points, a 7.9-point (+0.6%) increase compared to the previous session.

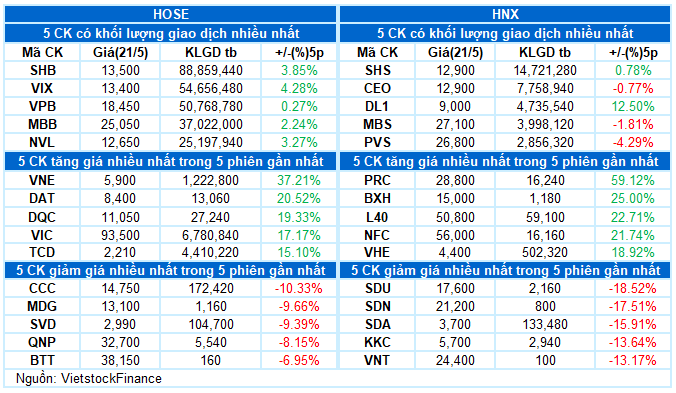

– In terms of impact, the duo of VHM and VIC continued to play a leading role, along with HVN and STB, contributing a total of 8.5 points to the VN-Index. On the other hand, the notable negative influences were VPL and GVR, which took away nearly 1 point from the overall index.

– The VN30-Index rose by 0.84%, reaching 1,419.36 points. The basket showed a somewhat mixed performance, with 13 gainers, 12 losers, and 5 stocks remaining unchanged. VHM topped the chart with a strong gain, followed by STB and VIC, which increased by 5.8% and 2.2%, respectively. On the losing side, GVR and LPB faced significant selling pressure, falling by over 1%.

Sectors exhibited a rather mixed performance. On the positive side, real estate stocks continued to lead the market, surging by 2.35%, driven by the explosive performance of VHM and NVL, which hit the daily limit-up, along with gains in VIC (+2.19%), DXG (+1.2%), HDG (+3.27%), and NLG (+1.03%). However, red hues were also scattered within the sector, with several stocks experiencing strong profit-taking, such as SIP (-2.22%), KBC (-1.67%), IDC (-1.21%), SZC (-1.8%), SJS (-1.52%), and QCG (-2.07%).

Industrial stocks also made a strong impression in the afternoon session, with numerous stocks surging to their daily limit-up prices, including VCG, HAH, CII, HVN, and VNE. Additionally, DPG (+3.57%), ACV (+2.67%), C4G (+4.11%), HHV (+2.89%), FCN (+3.16%), VSC (+1.77%), and others also attracted robust buying interest.

On the other hand, the telecommunications and energy sectors lost over 1% due to notable declines in VGI (-1.71%), FOC (-2.17%), YEG (-1.22%), TTN (-1.14%); BSR (-1.43%), PVS (-111%), and AAH (-2.38%).

The VN-Index continued its upward trajectory while retesting the old peak formed in March 2025 (corresponding to the 1,320-1,340 range). Moreover, the trading volume remained above the 20-day average, indicating positive signs of capital participation. However, in the upcoming sessions, the VN-Index is likely to experience volatility as it tests this range. Currently, the MACD indicator is maintaining a buy signal since the end of April 2025. If this status is sustained in the coming period, the short-term outlook for the index remains optimistic.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Retesting the March 2025 peak

The VN-Index continued its upward trajectory while retesting the old peak formed in March 2025 (corresponding to the 1,320-1,340 range). Moreover, the trading volume remained above the 20-day average, indicating positive signs of capital participation. However, in the upcoming sessions, the VN-Index is likely to experience volatility as it tests and consolidates within this range.

Currently, the MACD indicator is maintaining a buy signal, which has been in place since the end of April 2025. If this positive status is sustained in the coming period, the short-term outlook for the index remains optimistic.

HNX-Index – MACD indicator likely to cross above the 0 threshold

The HNX-Index witnessed a slight decline, forming a High Wave Candle pattern, indicating investors’ indecision. If this trend persists, the index is likely to retest the old peak formed in April 2025 (corresponding to the 214-216 range).

However, the MACD indicator remains in buy signal territory and is likely to cross above the 0 threshold in the upcoming sessions. Should this scenario unfold, short-term risks will be mitigated.

Analysis of Capital Flows

Fluctuations in Smart Money Flows: The Negative Volume Index indicator of the VN-Index dropped below the EMA 20-day moving average. If this status persists in the next session, the risk of an unexpected downturn (thrust down) will increase.

Fluctuations in Foreign Capital Flows: Foreign investors returned to net buying during the trading session on May 21, 2025. If foreign investors maintain this stance in the coming sessions, the situation will become even more optimistic.

III. MARKET STATISTICS AS OF MAY 21, 2025

Economic and Market Strategy Analysis Department, Vietstock Consulting

– 17:13 21/05/2025

Stock Market Update for Week of May 19-23, 2025: Navigating Volatility Around the 1,300-Point Mark

The VN-Index demonstrated resilience by rebounding above the reference level following an extended period of volatility and below-average trading volume. This recovery indicates a cautious sentiment among investors. However, the resumption of net selling by foreign investors has introduced challenges, causing fluctuations around the 1,300-point mark and presenting obstacles to sustaining the upward momentum in the near term.

What are the Strongest Stocks on the VN-Index?

As of late May 2025, the VN-Index has climbed approximately 4.44% since the start of the year, weathering the April slump triggered by tariff headlines. Yet, not all investors’ portfolios are in the green.

Market Beat: VN-Index Holds on to Green, VHM Soars to New Heights

The market closed with the VN-Index up 7.9 points (+0.6%), reaching 1,323.05; while the HNX-Index fell 0.24 points (-0.11%) to 217.46. The market breadth tilted towards decliners, with 397 losers and 337 gainers. The VN30 basket saw a relatively balanced performance, as 13 stocks added value, 12 declined, and 5 remained unchanged.